Difensivi come áncora di stabilità per i portafogli

18 August 2025 _ News

Today, we want to take stock of some of the issues that are driving the markets at this mid-year stage. We will start with US inflation, trying to understand what consequences it could have on the Federal Reserve's upcoming decisions. We will then move on to consumption, taking a close look at household spending, a key indicator of the health of the economy. We will then focus on market valuations and, finally, we will discuss some of the excesses—both positive and negative—that we are seeing emerge. Because, as Mr. Market always reminds us, excesses never last forever: sooner or later, they tend to come back down.

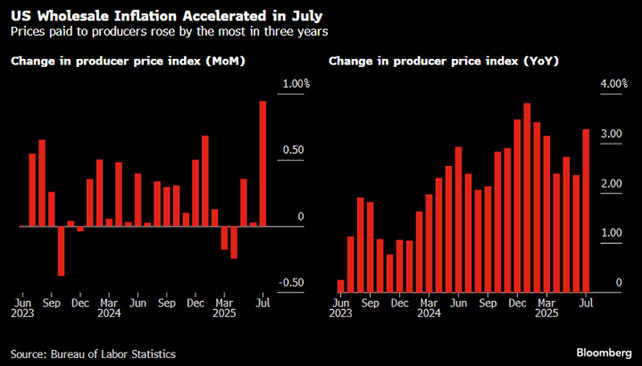

Let's start with US inflation. Consumer price data came in better than expected, but what really surprised the markets was the producer price index, which jumped 0.9% month-on-month, well above the 0.2% forecast. Why this surge? Probably because of tariffs, which have pushed up production costs. According to a Goldman study, about two-thirds of tariffs are initially absorbed by companies, but about two-thirds will ultimately be passed on to consumers. Now the question is: will companies be able to pass these price increases on to consumers, thereby pushing up consumer inflation, or will they not, thereby squeezing their margins?

We may begin to see some answers on the consumption front as early as this week. Retail sales have shown positive data so far, and attention is now shifting to this week's quarterly reports from giants such as Home Depot, Target, and Walmart, which will help us better understand the health of consumers. For now, the latest consumer confidence data already reflects these concerns. It will be interesting to see the market's reaction to Walmart, which is reporting with a PE ratio of 36 times, compared to its average PE ratio of less than 20. In 2025, it surpassed Amazon's PE ratio for the first time.

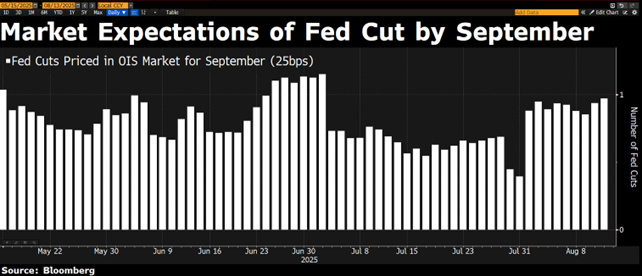

With these figures, this weekend's Jackson Hole symposium becomes even more interesting. It will be an opportunity to see whether the rate cut expected in September will be confirmed and how the new Fed members intend to tackle the inflationary scenario.

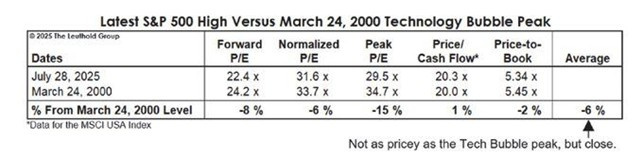

Passando alle valutazioni: l'indice S&P 500 è attualmente scambiato a un rapporto prezzo/utili che rimane elevato, ma è ancora inferiore di circa l'8% rispetto ai picchi registrati nel 2000, grazie principalmente alla ponderazione delle società di grandi dimensioni e di alta qualità.

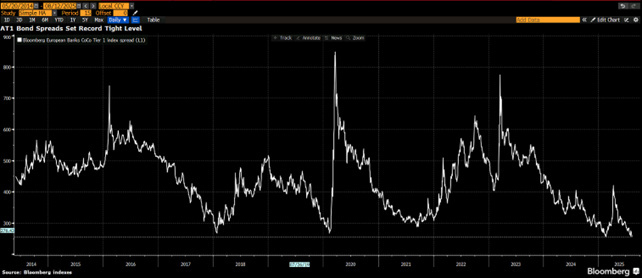

Another excess can be seen in AT1 spreads, which are now at their lowest level in ten years.

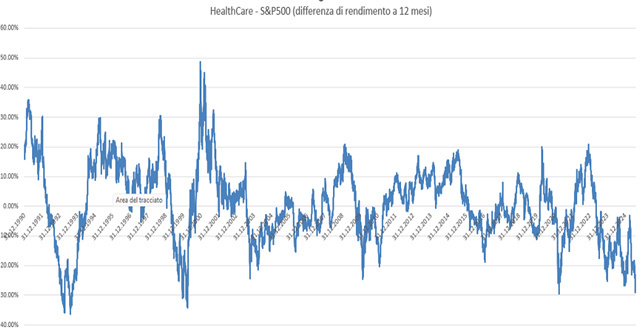

Where do we see opportunities? In the healthcare sector, which has been underperforming the S&P 500 for twelve months in a way that has rarely been seen since 1990. There are several interesting themes here: health insurance, pharmaceuticals, and medical devices.

Opportunities are also emerging in non-discretionary consumption, particularly among small and mid caps, from beverages to chocolate. More generally, small cap value stocks are trading at multiples rarely seen in history.

Our positive view on Chinese equities also remains valid: over the past year, the market has gained around 32%, reaching a ten-year high. Once again, Mr. Market reminds us that the best opportunities often arise in times of greatest negativity.

In summary, we believe that the second half of the year may still offer opportunities, but a more selective approach will be essential. Focusing on assets that are temporarily neglected by investors can in fact offer a useful margin of safety to face the inevitable shocks that the market cyclically presents us with more solidly.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.