Fundamentals, confidence, liquidity: the real drivers of the market

10 June 2025 _ News

Against a backdrop of markets increasingly dominated by background noise and shouted narratives, the fact that the S&P 500 is targeting mid-February highs before the introduction of tariffs is an interesting sign.

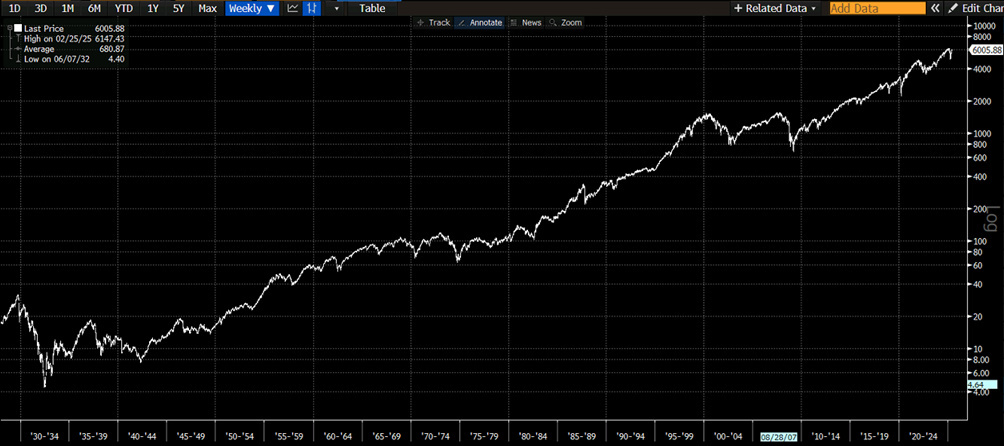

The impression is that the stock market could now move sideways for a while, and a consolidation would not be a bad thing after two years of gains of more than 20 percent for the S&P 500 over the past two years in an uptrend driven by a large expansion in multiples. And it is from the multiples that comes the biggest element of attention with the 12-month price-earnings ratio back, following the recent uptrend, in the 22 area and not far from the high of 23 considered by much of the market (and by us as well) as not particularly attractive.

Those of us who look for deeper signals beneath the surface will find that many indicators are telling a somewhat different story than the negative one we read in the headlines, but the impression is that we are still navigating a very uncertain environment with mixed signals.

Credit spreads, for example, have almost fully recovered from the widening related to the tariff crisis. And if, as is often the case and as the British would say, the credit analysts are the smartest people in the room, perhaps they would be worth listening to.

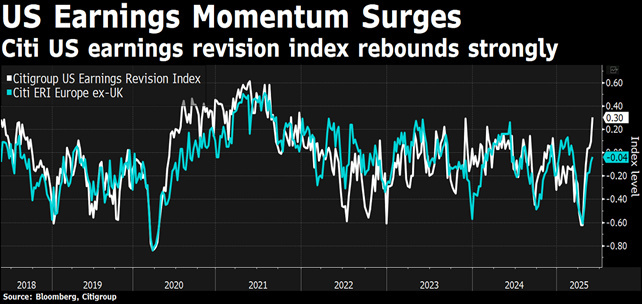

Earnings expectations, now scaled back to growth more in line with historical averages, may have finished their cutting path, and this would obviously be a crucial point: while it is true that markets feed on fundamentals, confidence, and liquidity, at this time none of the three pillars really appear to be faltering, not even that of confidence put to the test by Trump but now understood and digested by markets.

Speaking of liquidity, the global money supply continues to increase, with a growth rate of 8 percent per year. This flow is supporting global markets and has already taken the MSCI ACWI index to new highs.

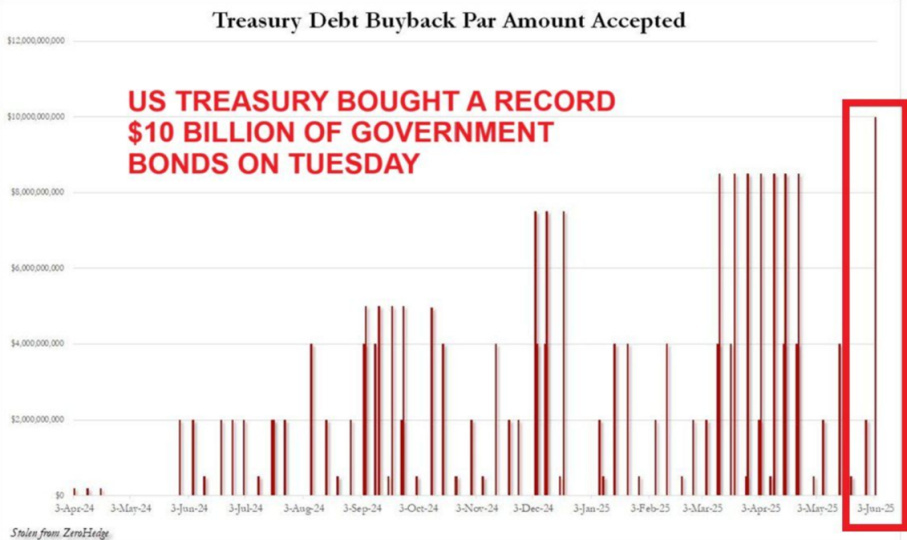

Also speaking of liquidity, the U.S. Treasury on Tuesday alone intervened to support the bond market by buying billion of its debt, and in recent months treasury repurchases have been trending strongly upward in a kind of curve-control intervention.

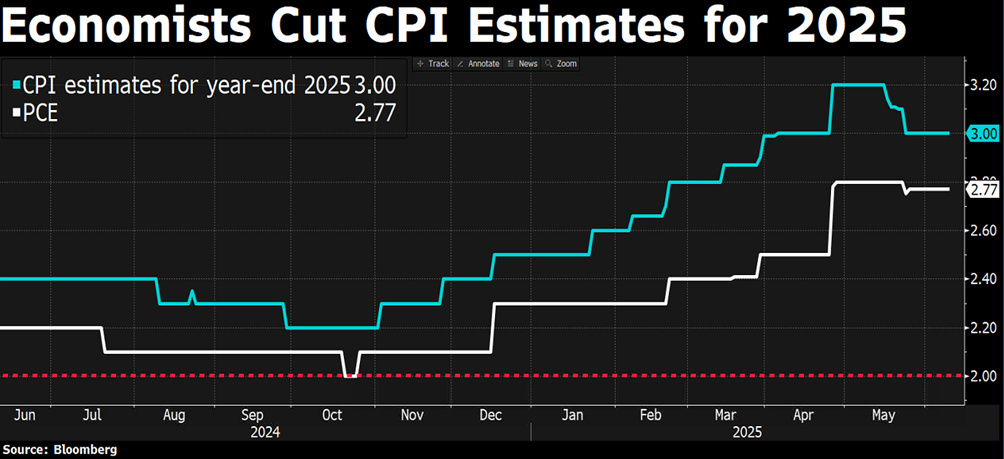

The yield on the 10-year Treasury thus fell to 4.35 percent, also aided by a series of weaker-than-expected macroeconomic data with the indices si economic surprises back below zero. Data leading to greater likelihood of rate cuts by the Fed, whose stance, let's not forget, remains one of cautious openness to future normalization, especially with core inflation falling to 2.5 percent.

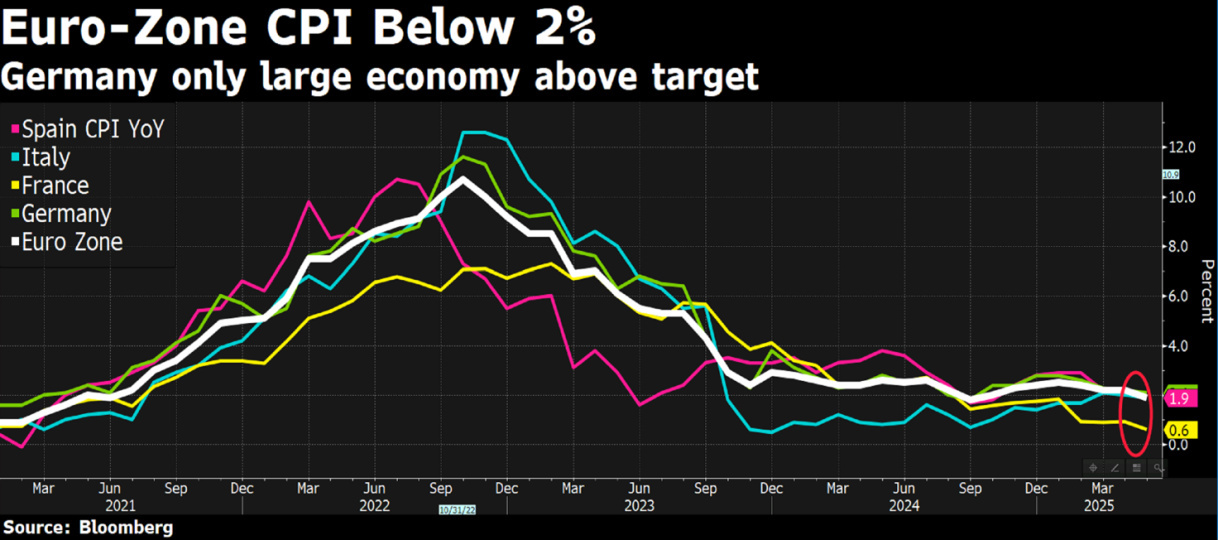

The other central bank, on the other hand, the European central bank, as widely expected, cut rates by 25 basis points, but Lagarde's words made the cut perceived as hawkish prompting markets to sell bonds. The reaction was mainly related to Lagarde's words about the fact that we have now reached the end of the cut cycle and the possibility of upward revision of growth estimates this year with particular reference to the first quarter. Traders were caught off guard in that they were predisposed to check the possible opening toward two more cuts this year and were forced to scale back by instead pricing in a single cut not before September despite a favorable inflationary scenario.

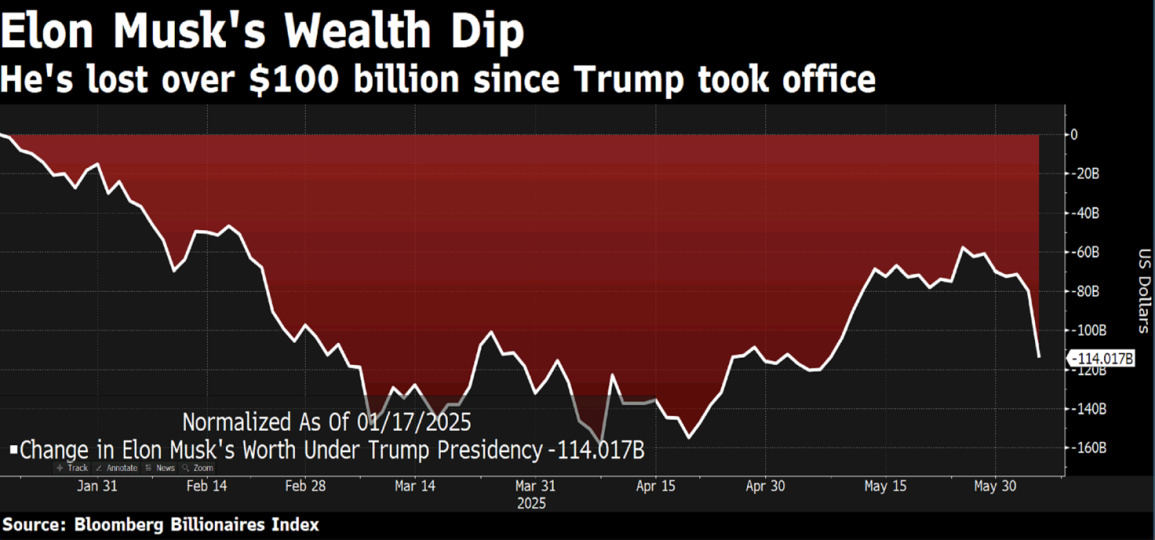

Back to the stock markets, which showed no concern even in the face of the unprecedented clash between Donald Trump and Elon Musk. The rift broke out over Trump's strongly-worded budget bill, which the Tesla founder says would risk driving America into bankruptcy. The confrontation between the two occurred during a meeting at the White House that lasted a couple of hours, and then continued on social media, where Trump claimed that the easiest way to save “billions and billions of dollars” would be to revoke government funding for electric cars and government contracts with Musk's companies. The tycoon's response was not long in coming: again via social media, Musk announced the suspension of operations of SpaceX's Dragon spacecraft. The situation definitely escalated when Musk declared himself in favor of impeachment, prompting Trump to publicly express his “deep disappointment” with the evolution of their relationship.

Markets also remained unmoved by what was described by Trump as a “very good talk” with the Chinese president, which lasted an hour and a half and focused mainly on trade, at the end of which the two also agreed to visit each other.

Meanwhile, the dominant narrative remains somber. One need only type “interest rates” into Google to find oneself overwhelmed by headlines evoking collapse, crisis and impending disaster. It is a deep reflection of our human nature: we look for patterns, explain what is happening through coherent stories, and prefer - by evolutionary instinct - negative ones. Because threat activates us more than hope.

Our need for narrative exposes us to a constant bombardment of bearish opinions that play on our loss aversion. It is a well-known phenomenon in behavioral finance: we fear a loss much more than we fear seizing an opportunity. And so, whenever the market retraces or rates go up, we are quick to look for “the reason” and believe it, even if the next day the narrative changes and even if we only have to look at a chart of the stock market over the long term to see what would be the right choice to make.

Deficits, government spending, tariffs, geopolitics: these are all real issues, of course, but their interpretation in public debate is often excessive, and sometimes misleading. Take the case of public debt: for years Ray Dalio has been announcing an impending crisis. However, those who had followed those signals would have missed one of the biggest rallies in the history of U.S. equities. And let's not forget that historically, a rise in federal debt has often been followed by a drop in rates, not a blowout.

In this sea of opinion we must navigate using method, discipline and a long-term perspective. The current environment is not without its unknowns, indeed, the fundamental data are beginning to be mixed, but it is still early to define the direction, liquidity remains abundant, however, and the narrative, once again, seems perhaps darker than the reality. In times like these, more than ever, it is important to be able to separate the signal from the noise, and at the moment the signal indicates neutrality.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.