Historical Maxims, But at What Price?

07 July 2025 _ News

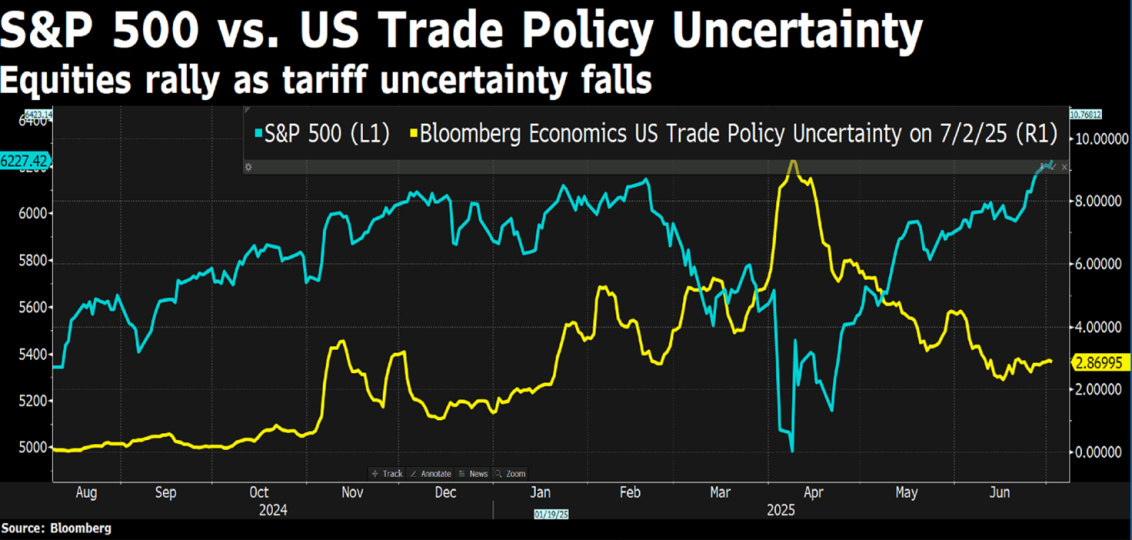

We entered the third quarter of the year with global equity markets (expressed in local currencies) at all-time highs, but with increasingly mixed signals on the macroeconomic and sectoral fronts.

June was a very positive month for U.S. equities, with double-digit performance for the Nasdaq ending the month up 6.5 percent, with the S&P 500 also gaining +5 percent. The U.S. indices are now at all-time highs, but if we look at the entire six-month period, the rise is just over 5 percent, a sign that much of the performance has been concentrated in the last two months, following the low reached in April. The story changes dramatically if the same performance is measured in euros instead of dollars. Over the past few months, the U.S. dollar has in fact lost well over 10 percent against major currencies, and the performance since the beginning of the year of the S&P 500 measured in euros would be -6.5 percent.

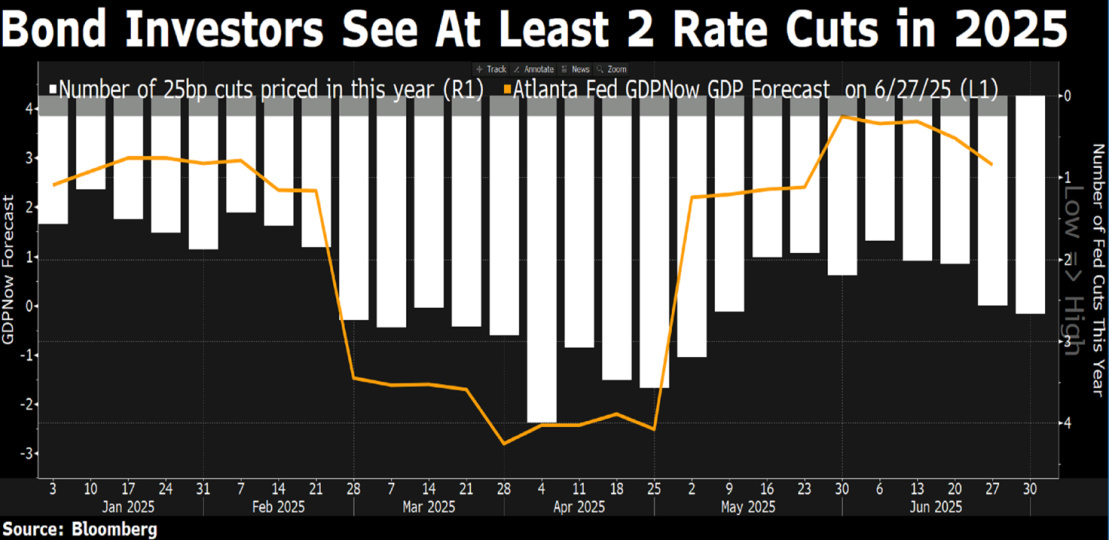

The depreciation of the dollar, one of the Trump administration's stated goals, has also been pursued through pressure on Powell to lower rates by ventilating the possibility of an early choice of the next Fed chair who may already influence rate expectations before the start of his term in May 2026. The euro/dollar exchange rate returned to virtually its 25-year average today, but the speed of its movement surprised many.

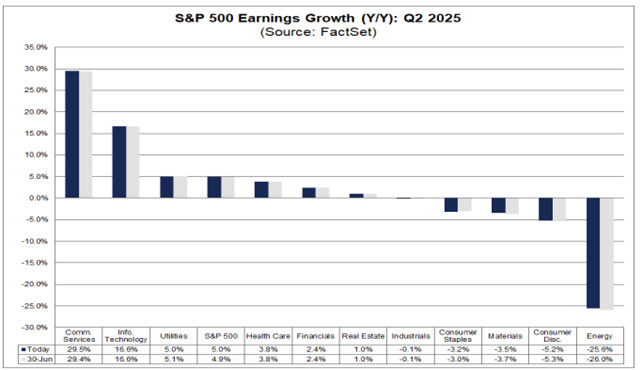

And it is precisely the weakening of the currency that helps in part to explain the outperformance of U.S. indices and in particular the NASDAQ in recent months. In fact, the weakening of the dollar has a significant impact on the profits of U.S. multinationals, particularly the technology sector, which generates more than 55 percent of profits abroad. A weaker dollar, in addition to increasing the competitiveness of U.S. companies, is automatically reflected in nominally higher profits, when expressed in dollars, even with the same real sales. Because of the transactional effect, if a U.S. multinational has subsidiaries in Europe that generate profits in euros, a weaker dollar will mean that, when these profits are converted into USD, the result will appear higher in consolidated financial statements.

It is the same principle, but in reverse, that has hurt German companies: an overly strong EUR has reduced competitiveness and lowered local currency earnings estimates. In an increasingly globalized world, currencies have returned to center stage and are likely to remain a key driver of equity returns in the coming quarters.

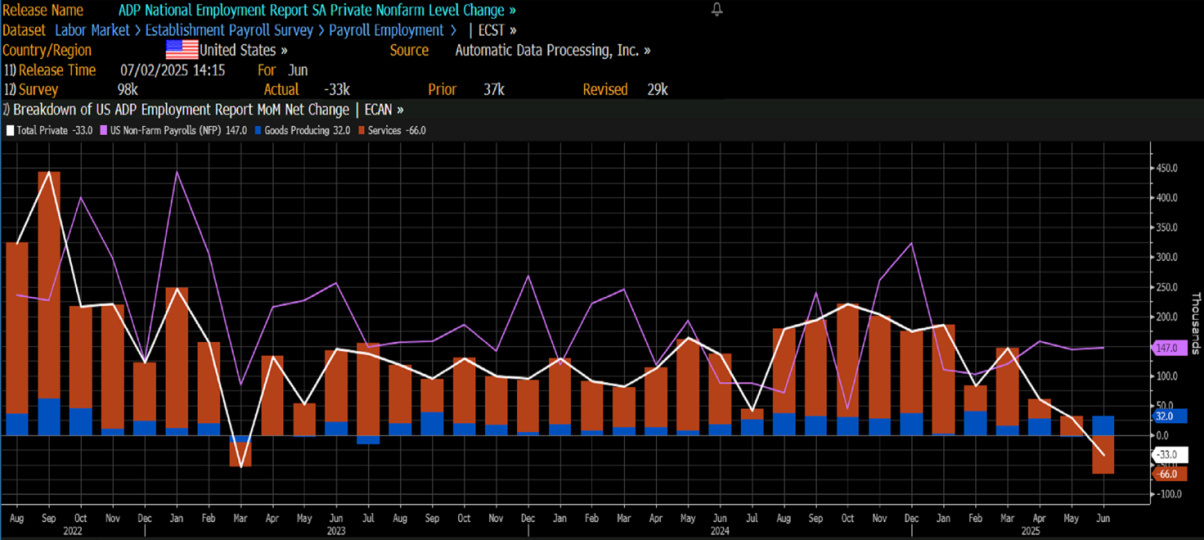

Turning now to macro data, the most recent readings appear mixed. The ADP employment report disappointed heavily with a net loss of 33,000 private sector jobs, against expectations of +100,000, with the May figure also being revised downward.

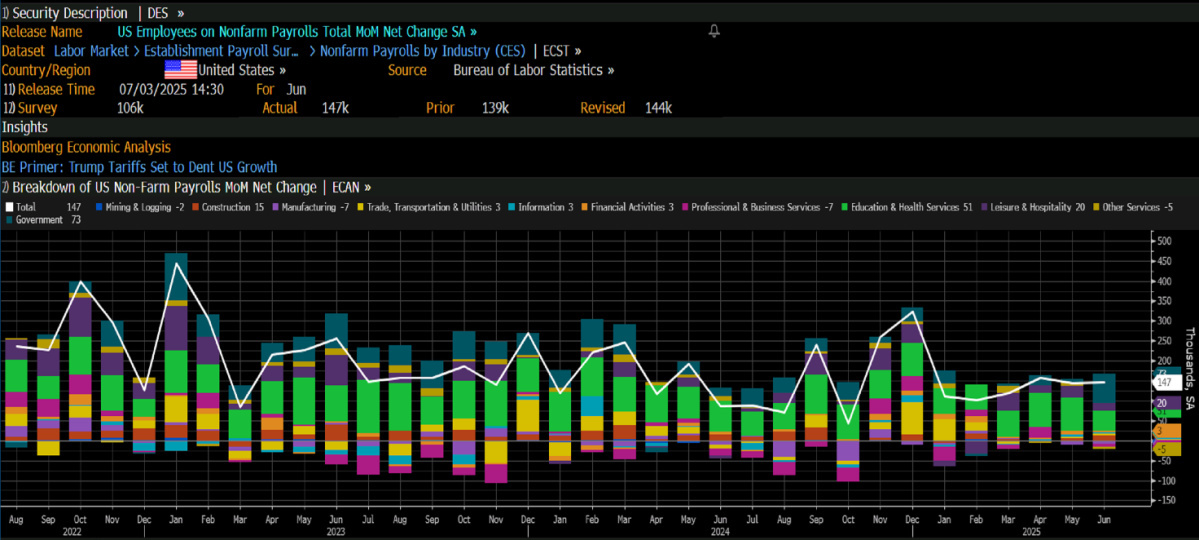

However, payroll data for the nonfarm sector turned the picture around, coming out significantly above expectations, showing a stronger-than-expected labor market.

And signs of strength further came from the lower-than-expected unemployment figure and a stronger-than-expected ISM in services.

The odds of a July rate cut by the Fed thus plummeted from 25 percent to 5 percent, the dollar rose, Treasuries saw rising yields, and Wall Street reacted enthusiastically.

But beneath the surface, the picture is less bright. Job growth is driven by health care and the local public sector, while the federal sector continues to decline. The American economy thus appears divided: few layoffs but also few new hires. A strong but static labor market, whose apparent vigor hides a structural fragility.

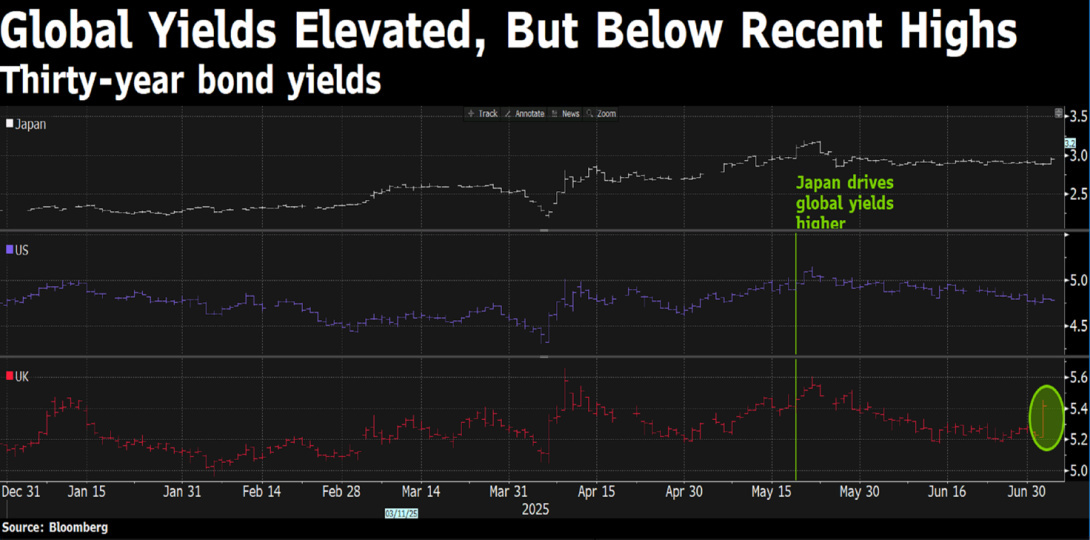

On the bond front, Treasury yields thus rose, with The bond market choosing to ignore the rise in continuing unemployment claims, and also ignored the weaker-than-expected ADP payrolls report, a sign that investors are temporarily reducing exposure to safe-haven assets, probably in favor of equities, and as is often the case this is done when the market is at highs.

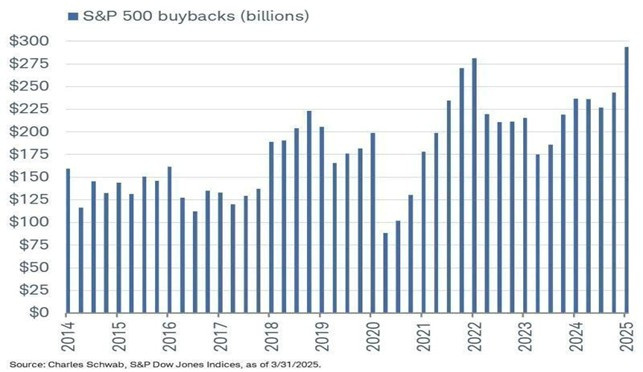

The other record this year, which is certainly helping the rise of equities, concerns buy backs by U.S. companies, probably also due to the fact that many companies faced with a scenario of increased uncertainty related to tariffs have preferred to make more targeted capital allocation choices toward share buy backs also taking advantage of the price drop between February and early April.

We are in a rather rare phase for the markets: in American history, when the first quarter was negative and the second closed with a rise of more than 10 percent, subsequent quarters have always been positive, with returns above the historical average.

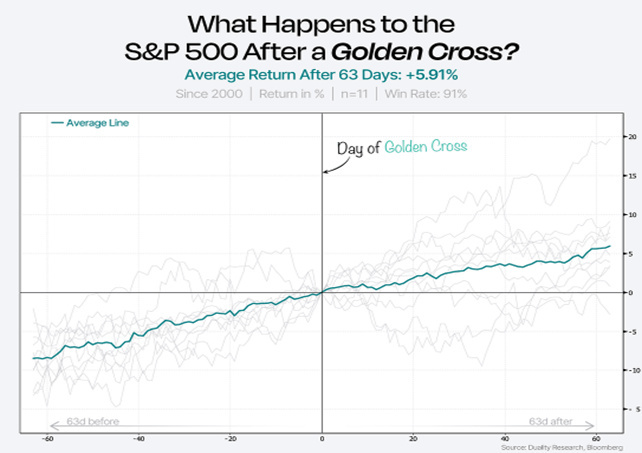

This pattern also aligns with other statistics that show how the breaking of new highs by indices often tends to generate further uptrends, confirming the saying “new highs call for new highs,” or the statistics that see the continuation of the bullish market following the so-called golden cross, one of the most closely followed moving average crosses in the market that just occurred on the S&P500.

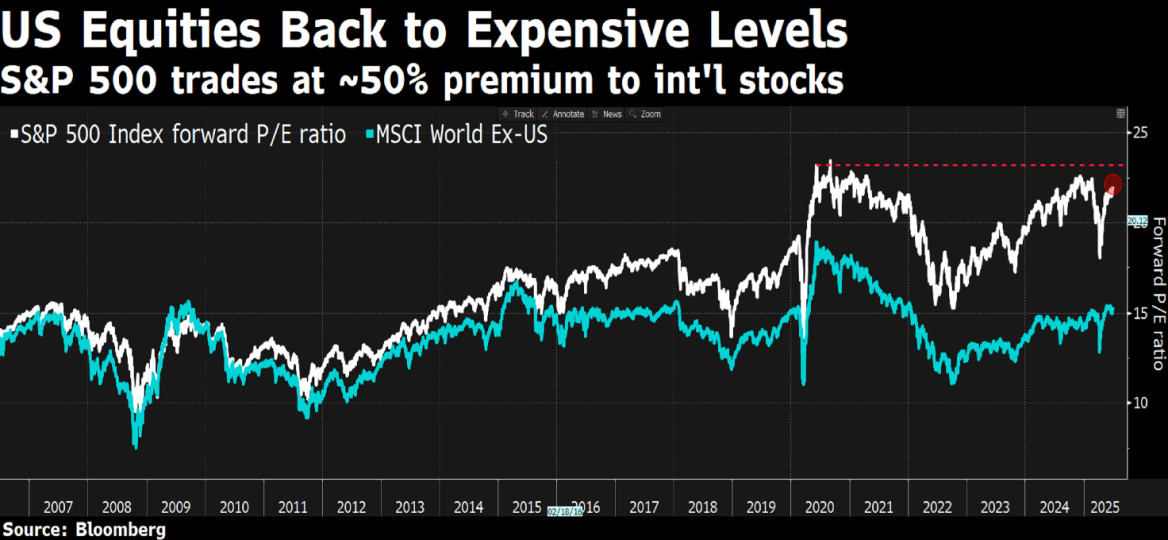

The current market phase is therefore particularly delicate: on the one hand, short-term statistics continue to show decidedly bullish signals; on the other, valuations have returned to historically high levels. For investors, it therefore becomes essential to strike a balance between these two elements, adopting a careful and rational approach.

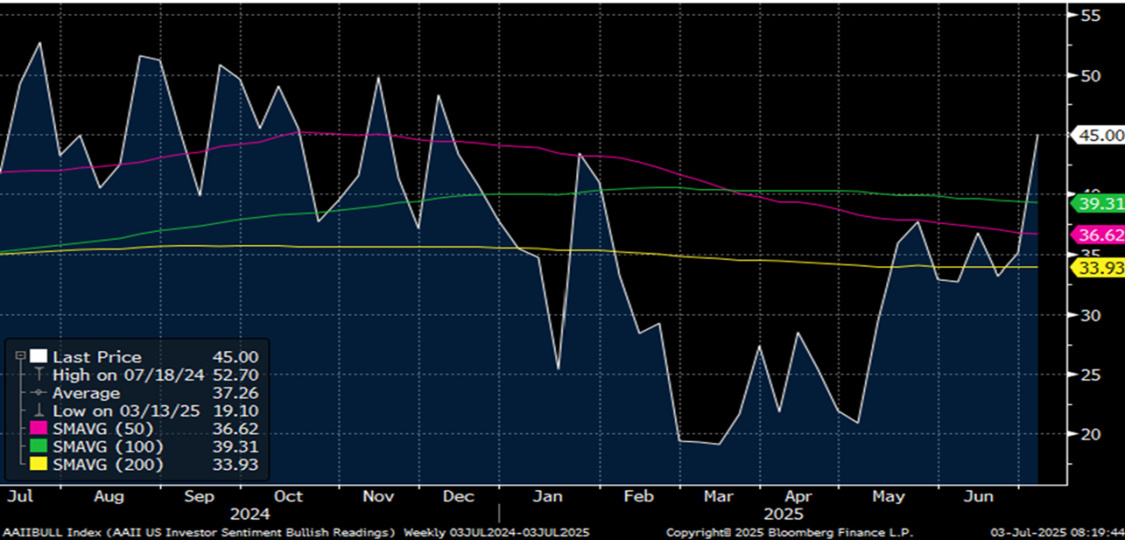

The fact that the market is at the highs does not automatically imply an imminent correction, just as we cannot rule out the possibility that valuations could go even higher. However, it is appropriate to gradually increase the level of caution as the environment becomes more euphoric, while recognizing that, at the moment, we are not yet in a phase of overt excess. If we take, for example, the bull/bear ratio as an indicator of sentiment, bullish sentiment is up today and is at the year`s highs at 45 percent from the previous 35 percent, but we are not yet in areas of over-optimism.

In addition, the new earnings season will kick off shortly-a crucial step, which on the one hand may offer more clarity on the impact of macro dynamics on individual companies, but on the other hand may also introduce an additional dose of volatility in the short term.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.