What impact will inflation have on corporate earnings?

23 September 2021 _ News

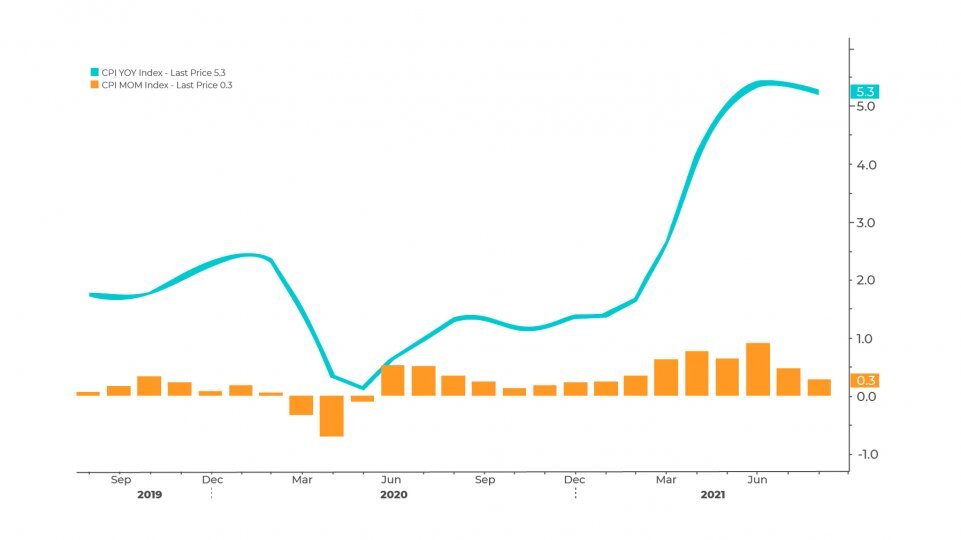

US inflation data for August confirmed the presence of two opposing forces, which contributed to the smallest monthly change in the consumer price index since last January.

- On one hand, the fall in certain prices that have risen sharply in the recent months, notably the price of second-hand cars, which fell by -1.5% in August compared to July, and the travel sector, notably the price of airline tickets, with a fall of -9.1% compared to the previous month.

- On the other hand, the steady rise in rental prices (which account for 30% of the index), whichhave increased by 2.8% compared to last year, combined with other expenses, such as the price of new cars.

Consumer prices in August thus recorded a variation of +5.3% compared to the previous year, against expectations of +5.4%.

Production prices, meanwhile, rose by 8.3% in August, the largest year-over-year increase since 2010, when the US Bureau of Labor Statistics began conducting surveys.

A change in producer prices above that of consumer prices is an early signal of possible pressure on corporate margins.

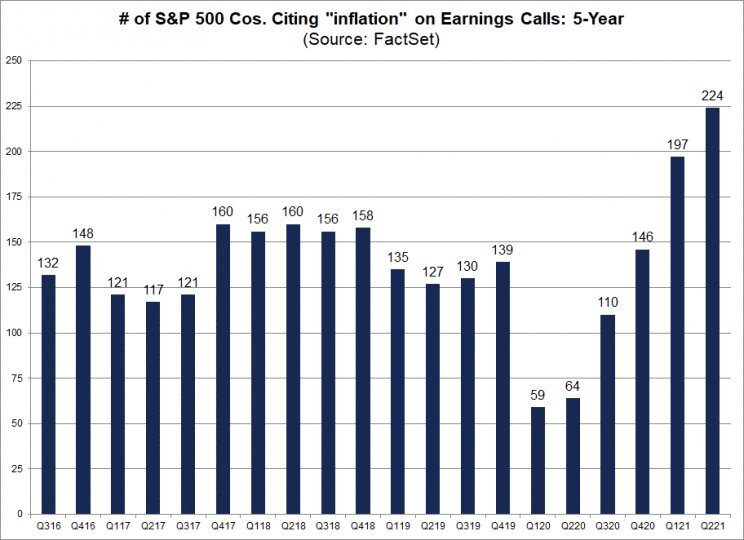

In the last Reporting Season, the number of companies citing “inflation” during the quarterly commentaries increased significantly: 224 companies in the S&P500, the highest number since 2010.

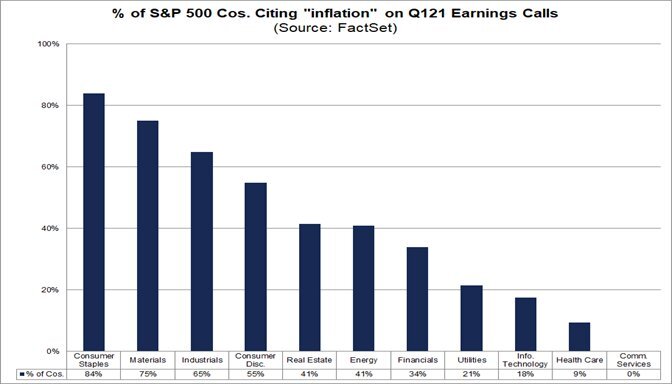

Among the secotrs, the ones that most frequently cited the term “inflation” were Consumer Staples (87%), Materials (75%) and Industrial (68%).

Given the high number of companies within the S&P500 citing inflation during the Reporting Season, is a negative impact on expected earnings and profit margins possible?

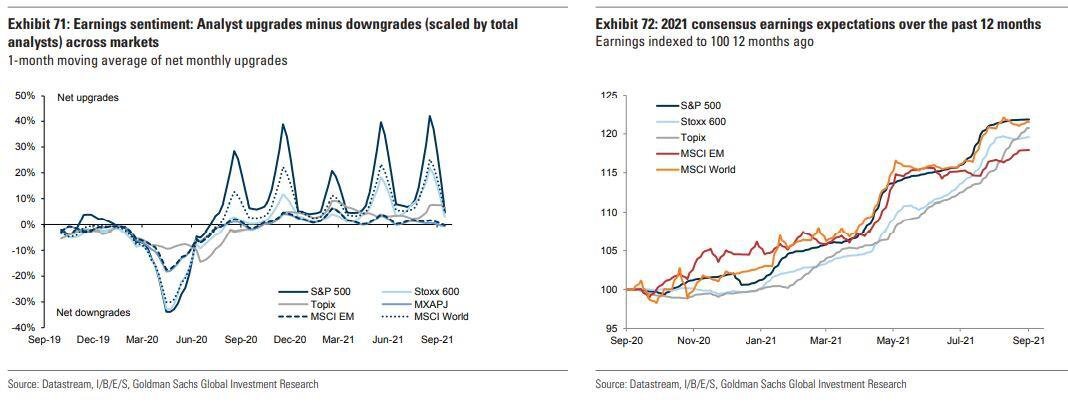

The answer, so far, seems to be a no.

After a period of upward revision (+20% since the beginning of the year), earnings are now lateralizing, but with an estimated growth rate for the end of 2021 of +42.6%, and net profit margins at +12.4%, values that remain above June expectations.

We therefore expect inflation to have a limited impact on earnings at least in 2021. In the longer term, the pricing power, i.e. the ability of companies to pass on higher production costs to consumer prices, will play a key role.

Being invested in companies that are leaders in their sector and with a consolidated competitive advantage is therefore the best strategy for dealig with uncertain market times such as these.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.