Macro Data: Slowdown swept under the rug

07 September 2023 _ News

Macroeconomic data from the United States last week showed a clear slowdown.

Let's take a look at the main points:

-

GDP last Wednesday showed how US economic growth was solid but had been revised downward, with 2.1% annualised growth in GDP in the last quarter, lower than the expected 2.4%. This finding was curious for economists, who expected that the GDP for the second quarter would not be revised downward, and, despite the negative surprise, they still raised their growth forecasts for the third quarter to 5.9%. This shows us that economists continue to see positive momentum for growth.

-

The second figure released last week was the FED’s preferred measure of inflation, the PCE, which was in line with expectations at 3.3%, with core at 4.2%, the latter down on the previous figure.

-

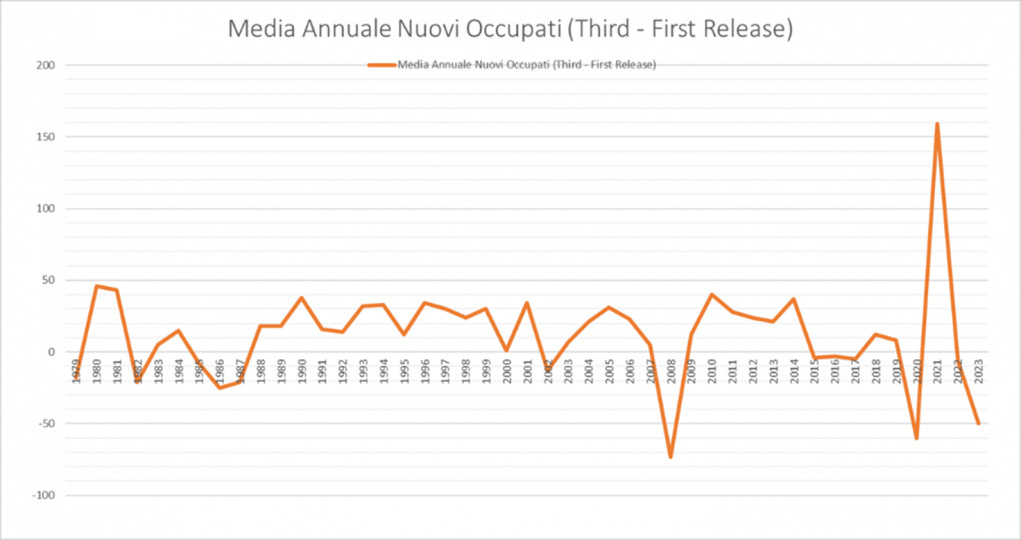

The third macroeconomic figure last week was employment. The labour market was also weaker than expected, still showing moderate energy, but growth in employment is slowing and salary growth is cooling. New employees, nonfarm payroll, grew by 187,000 jobs, slightly above the estimated consensus of 170,000 jobs. However, it is necessary to highlight how these employment data are not overly reliable because they were strongly revised downward over the course of the year. In 2023, this figure was revised downward on average by approximately 50,000 jobs. A revision of this nature has only been seen twice since 1979, in 2020 and 2008. This leads us to believe that the labour market is experiencing a slowdown and that this slowdown is little perceived by market operators.

As for Europe, inflation data (CPI) showed an improvement in core inflation from 5.5% last month to 5.3% this month, underlining, however, the strong disparity between various countries in Europe. On one hand, there is Spain with inflation at 2.4%. On the other hand, there is Germany with 6.4% inflation.

This lack of uniformity accompanied by weaker economic growth is leading ECB members to adopt less aggressive views on rate increases. Interesting statements came from one of the most prominent members of the ECB, Isabel Schnabel, who has claimed that, considering the economic slowdown, rates could very well be maintained at these levels, with no further increases.

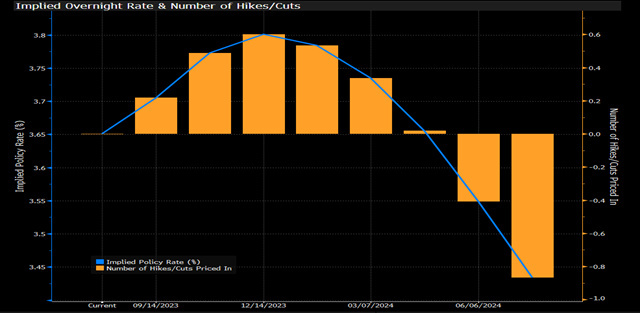

So what will the ECB do in 10 days? For now, market expectations for an increase in rates have fallen from 55% to under 25%. In our opinion, it is important to highlight that, to manage this inflation disparity, the ECB may not be enough, and fiscal policies are required, which we expect to see this autumn from the various governments, and this could lead the ECB to opt for a pause.

With GDP data solid but slowing down, excess savings of American consumers all but gone, inflation in line, a labour market that is slowing, and mortgage rates at historical highs (which led to the highest rates of missed car loan and credit card payments since 2009), we believe that we are now beginning to feel the effect of the rates on the economy and the FED will probably not raise rates in 15 days.

One question springs to mind. What should investors do in this complicated environment?

Investors should continue to maintain composure and look closely at the value that remains in the equity of sectors that were left behind. These sectors are also the most defensive ones, those that benefit most from the scenario of economic slowdown that we deem likely. This slowdown should also help bond performance, which remains the great straggler of the year.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.