Market highs and liquidity lows: beware of excesses.

24 July 2025 _ News

In mid-July, we find ourselves at a crucial point in the year: the economy continues to surprise with its resilience, and markets are back at their highs despite facing new political, inflationary and positioning uncertainties.

In this context, the second quarter reporting season takes on particular importance for the markets because it provides a crucial update on the health of companies in a rapidly changing macroeconomic environment. Corporate results will provide concrete data on margin stability, revenue trends and companies' forward-looking visibility, which are key elements for validating – or revising – current market valuations. Furthermore, as this is the quarter that fully incorporates the effects of tariff policies and wage dynamics, it will be crucial to understand how much of the optimism expected by investors is actually supported by fundamentals.

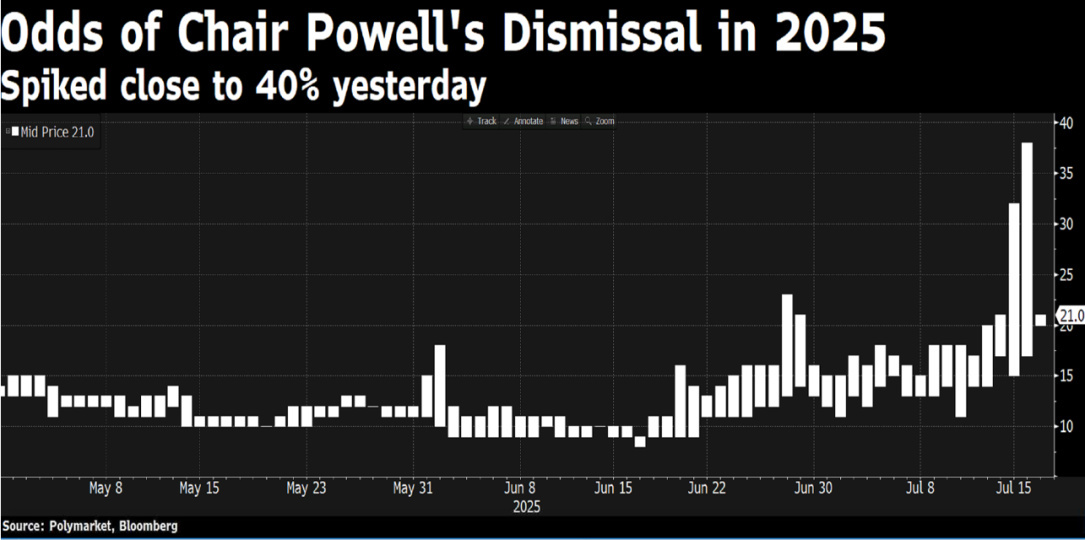

Meanwhile, Trump's tariff aggression has returned to the forefront, but this time with a much more serious threat: to replace Powell as head of the Federal Reserve before his term expires in 2026, with the explicit aim of reducing rates to 1%. These statements have been tempered in recent days by saying that nothing is ruled out, but that the possibility is highly unlikely unless he is forced to leave for reasons related to fraud.

While 2-year rates are falling, in line with expectations of an imminent cut by the Fed, 30-year yields are rising again, approaching 5% once more — a level that the market considers a warning sign. It is the market itself that suggests that a return to 2% inflation is by no means guaranteed, and that the current combination of growing deficits and new tariff barriers is incompatible with structurally low real rates in the long term.

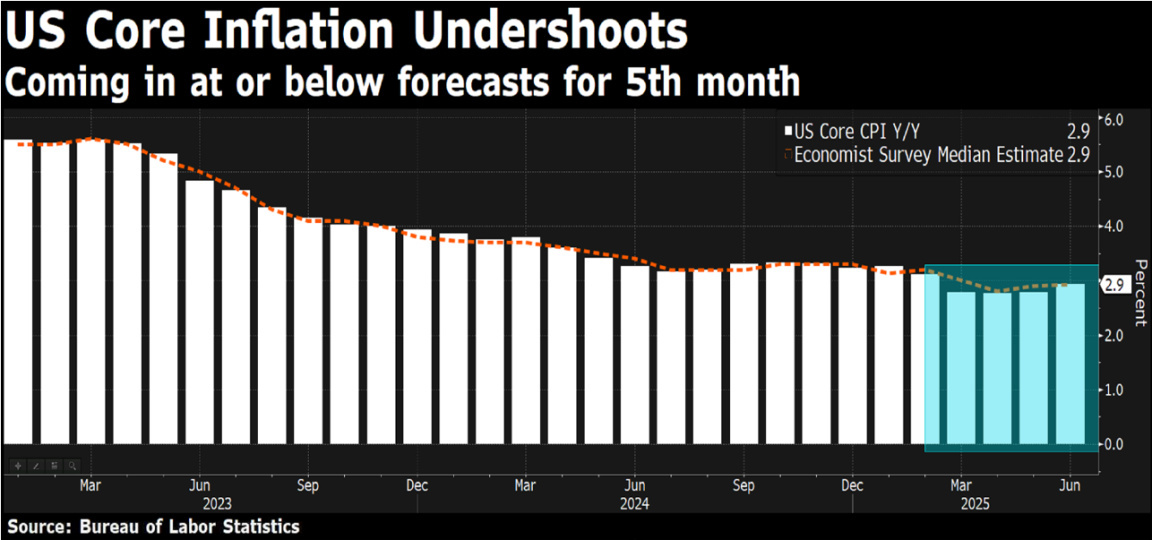

Just this week, we received important confirmation on the inflation front, with June CPI data showing a rise to 2.7%, higher than the previous month and slightly above consensus expectations. At the same time, the PPI – an indicator of inflation from the production cost side – was weaker than expected, offering temporary relief to the markets. But we should not be under any illusions: the PPI does not include imports, whereas actual consumer inflation, which is what the Fed focuses on, does include them. And the measure most closely followed by the central bank, the core PCE, has remained stuck at 2.7% since May, with no signs of cooling.

Essentially, it seems that Trump's tariffs, while not yet inflationary in the short term, may have halted disinflation. The now obvious risk is that core inflation will remain “stuck” at around 3%, an uncomfortable level for the Fed, too high to cut rates with conviction, too low to react forcefully.

In this context, conventional monetary policy becomes less effective. And political pressure to “do something” increases. Hence the increasingly insistent rumours of a change at the helm of the Fed and a possible explicit alignment of the central bank with the executive's fiscal and political objectives. A prospect that, if realised, would alter the balance of global markets.

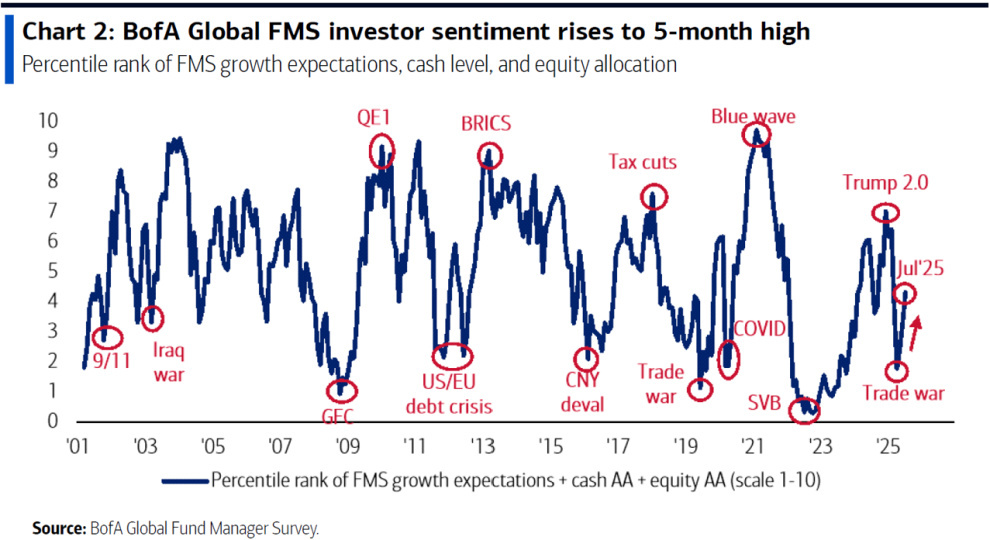

In the meantime, however, the stock market does not seem overly concerned, as demonstrated not only by the indices at their highs and valuations that are certainly not cheap, but also by the sentiment indicators emerging from the latest fund management survey for July released this week by Bank of America. To highlight the importance of this survey, it is worth noting that 211 management companies with assets under management of 4 billion participated in the July survey, which we can certainly say is a good benchmark for the market, providing valuable insights, including from a strategic perspective, and often to be read from a contrarian perspective. The survey results show market sentiment at its highest since February.

There has been a marked improvement in economic growth expectations and a reduction in portfolio liquidity levels to below 4%, a threshold that has historically triggered a technical ‘sell signal’. It is a bit like saying that today investors' portfolios are almost fully invested and therefore the markets lack the marginal liquidity needed to find new growth opportunities.

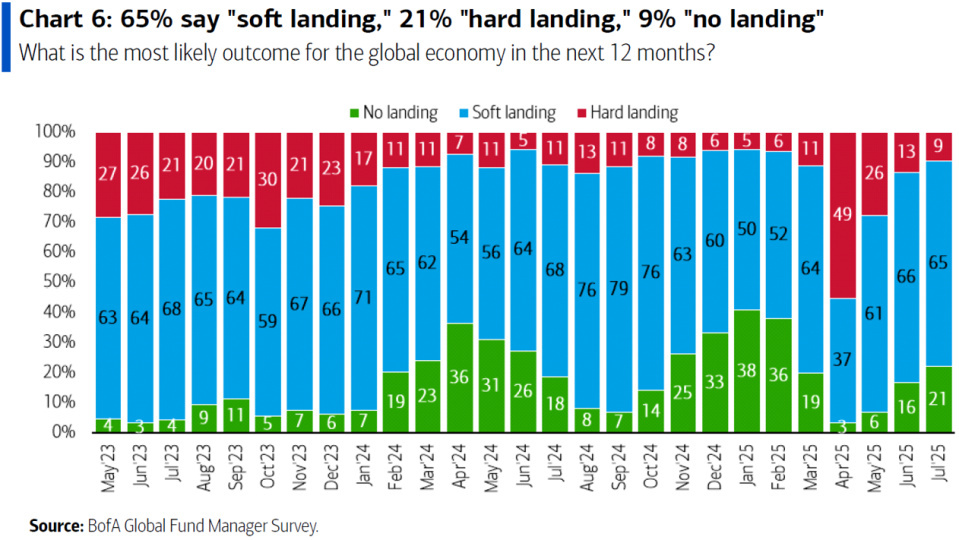

Furthermore, although not yet at extreme levels, the allocation to equities remains high and risk appetite has strengthened for the third consecutive month, while recession expectations have fallen to their lowest level since the beginning of the year, with 65% of managers expecting a soft landing for the economy and only 9% expecting a full-blown recession.

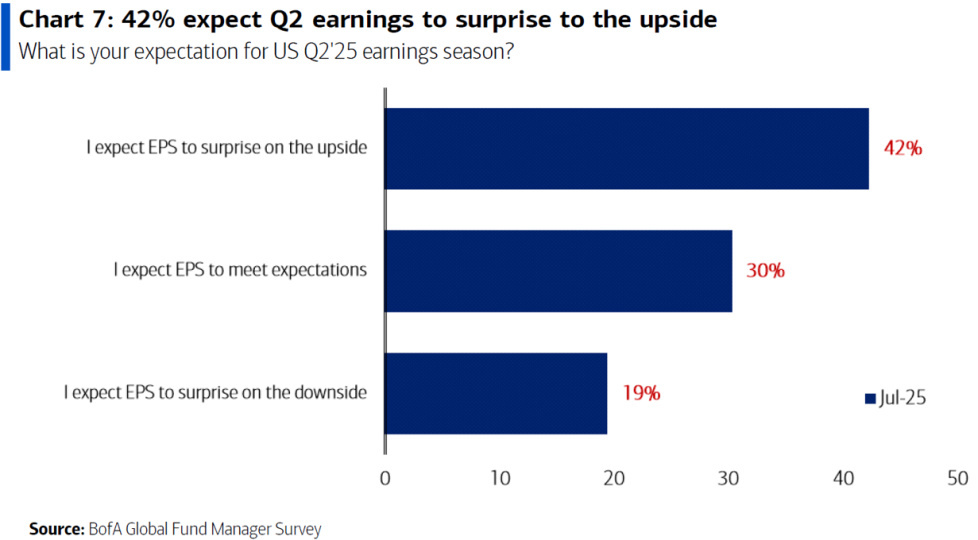

There is also optimism about the current earnings season, with 42% of institutional investors expecting higher-than-expected earnings for the second quarter, particularly in the banking sector and in defence and AI-related industrial sectors.

Essentially, there is an optimistic market consensus, but the positive thing is that there are no excesses at the moment, leaving room for further increases in the absence of exogenous shocks.

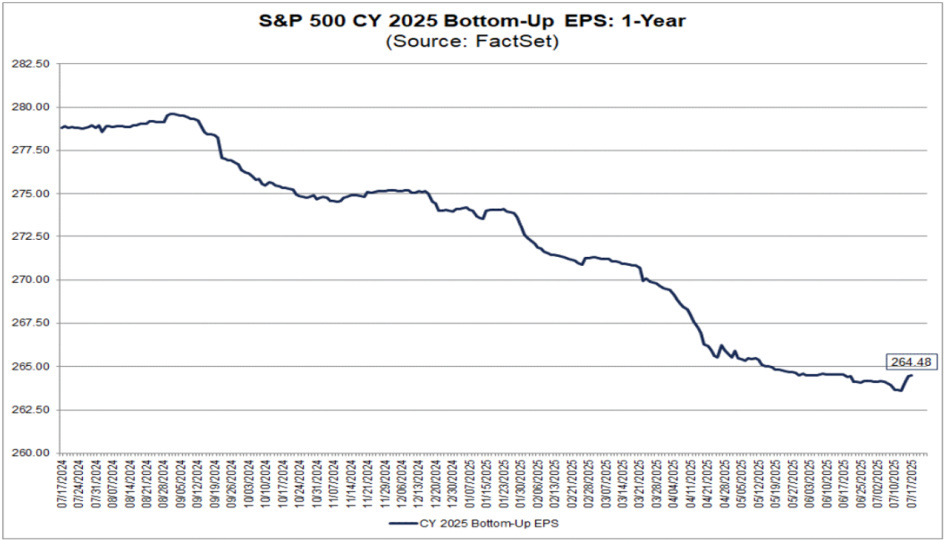

It is also plausible to expect a season of positive surprises in terms of earnings: in recent weeks, the consensus has lowered its estimates more sharply than the historical average, creating a favourable environment for many companies to exceed expectations.

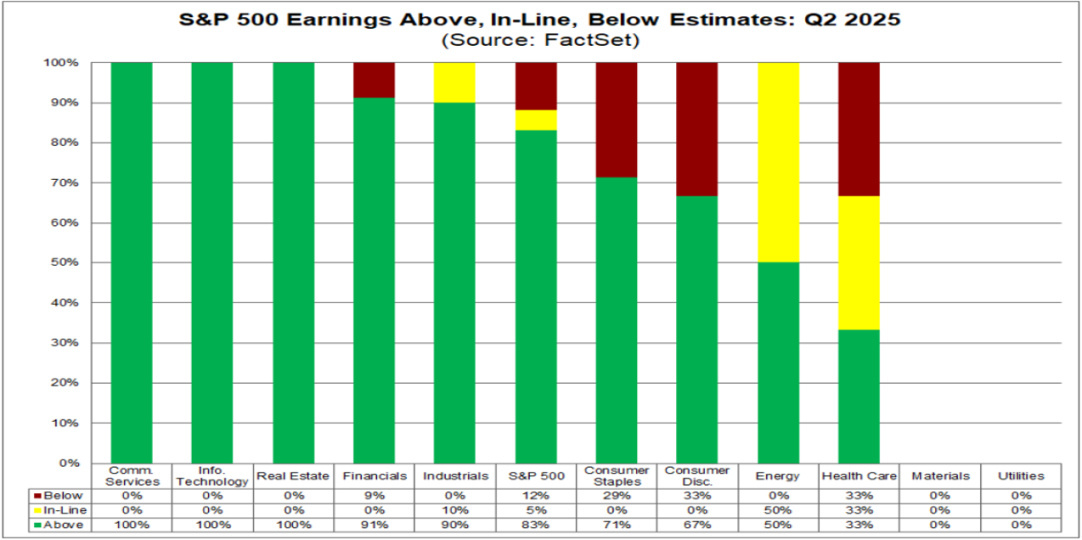

So far, the start has been characterised by mixed but overall encouraging signs, with 12% of S&P 500 companies having reported so far, recording positive surprises in 83% of cases.

Goldman Sachs and Bank of America performed well, while Morgan Stanley was weaker. In Europe, the spotlight was on ASML, which, despite posting solid results, was penalised with a 10% decline the following day due to management's decision not to provide guidance for 2026, citing high uncertainty related to tariffs and the macroeconomic scenario. Also from the Old Continent came Renault's profit warning, which revised its forecasts for 2025 downwards, further dragging down the automotive sector. The coming days will be crucial for assessing the resilience of margins in various sectors and the actual impact of the new macroeconomic conditions on business dynamics.

In this context, it is essential to remember the importance of the contrarian approach. When positioning becomes excessively unbalanced in one direction, the risk of asymmetric shocks increases, the margin for disappointment widens, while the protection inherent in valuations (the so-called margin of safety) is reduced.

It is precisely in these phases that a contrarian approach is not an ideological imposition, but a structural element of a solid investment process, capable of recognising phases of excess and allocating capital in a selective, rational and disciplined manner.

The market is not immune to excesses, and widespread optimism, in the absence of adequate risk remuneration, requires greater attention to asset quality, the sustainability of earnings revisions and consistency between valuations and fundamentals. This type of analysis, typical of long-term investing, is what should guide investors today.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.