Nvidia, decisive chip test

25 August 2025 _ News

Today, we want to take stock of some of the issues that are driving the markets at this mid-year stage. We will start with Powell's comments and their implications for future rate cuts. We will then move on to the earnings season and whether or not US retailers are suffering from inflation. We will then focus on market valuations and, finally, we will talk about some of the excesses — both positive and negative — that we are seeing emerge. Because, as Mr. Market always reminds us, excesses never last forever: sooner or later, they tend to come back down.

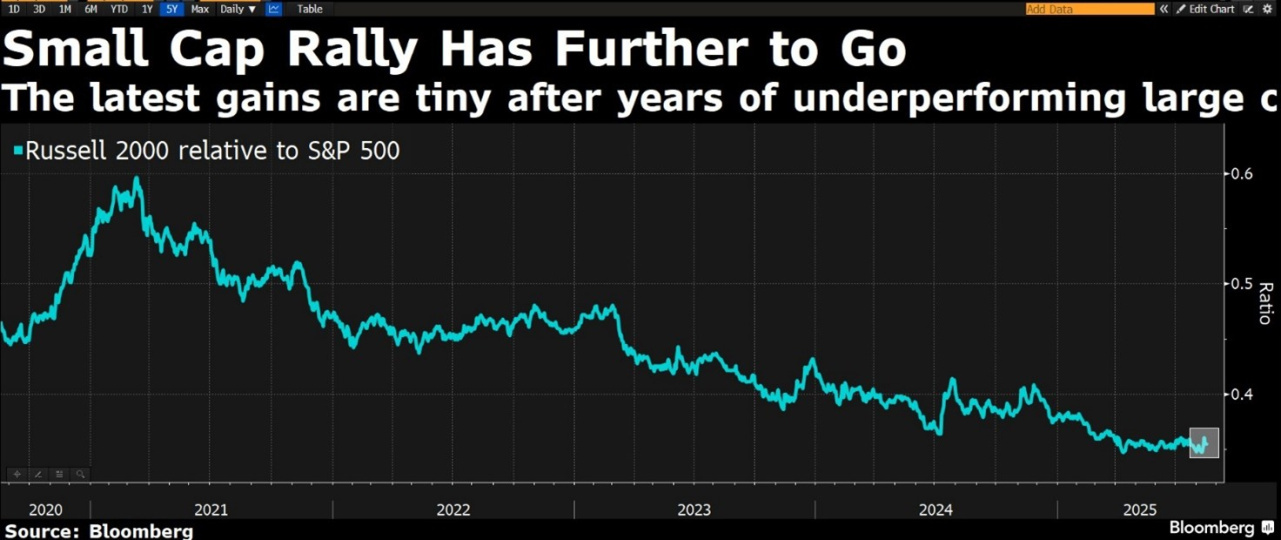

Last week, global stock markets closed slightly higher, boosted by Powell's comments on Friday. Once again, small caps led the way, an area we continue to believe is rich in opportunities.

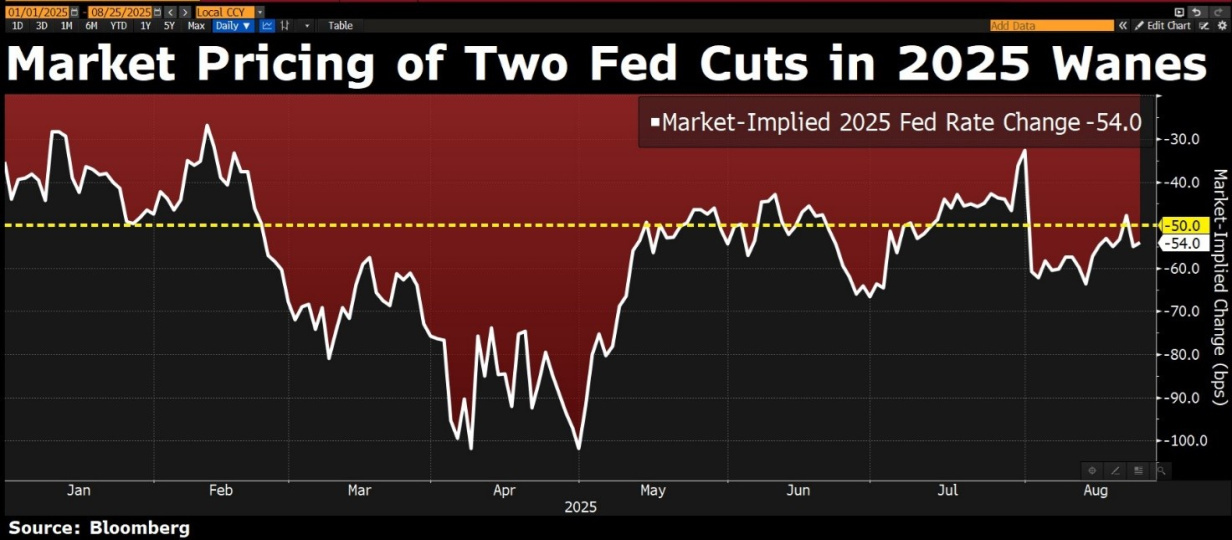

Let's start with Jackson Hole. In his speech, Jerome Powell effectively opened the door to a rate cut as early as September. The reason lies in the labor market: today it appears to be “in balance,” but it is a fragile balance, with a simultaneous decline in both labor supply and demand. On the price front, Powell acknowledges that the effect of tariffs is now visible, but he sees it primarily as a one-off shock, more temporary than persistent. At the same time, he updated the monetary policy framework: gone is the reference to average inflation at 2% and the focus is now on anchoring long-term expectations; furthermore, it is acknowledged that the economy can move beyond the theoretical level of “maximum employment” without this automatically implying inflationary risks. Translated: more discretion and a more forward-looking approach when the dual mandate objectives come into tension. With US growth slowing to 1.2% in the first half of the year and rates about 100 basis points closer to neutral than a year ago, the message is clear: there is no need to wait too long to ease restrictions. The market is currently pricing in two cuts by the end of the year and five by September 2026.

Let's move on to the retailers' reporting season.

Walmart closed its second fiscal quarter of 2026 with comparable US sales up 4.6%, driven by more transactions and higher average receipts. Earnings are under pressure, but guidance is improving: sales are expected to be up 3.75%/4.75% and EPS slightly above previous estimates. The strategy of competitive pricing, a global supplier network, and strong e-commerce growth (+25% in the quarter) is enabling the company to capture customers across all income brackets, even in a context of inflation and interest rates that are curbing discretionary spending. Tariffs and extraordinary costs are weighing on margins, but Walmart remains a key barometer of US consumer health; omnichannel retailing and supply chain automation should strengthen its positioning.

Home Depot closed the quarter with a 4.9% increase in sales, supported by the acquisition of SRS Distribution and a 1% increase in like-for-like sales. Despite a still weak real estate market, it is gaining market share in a sector that is down 1%. With expectations of more favorable mortgage rates, comparable sales could accelerate. The acquisition of GMS (to be completed by the end of the fiscal year) will expand its customer base, sales force, and distribution network, with approximately .5 billion in additional revenue in 2026.

So the message from retailers is that inflation will somehow make itself felt. Therefore, as always, pay attention to the safety margin.

On the valuation front, we remain cautious on big names: multiples are stretched and we see less margin for safety. The situation is different for small caps, which have been underperforming over the long term: that is where we continue to see the best opportunities.

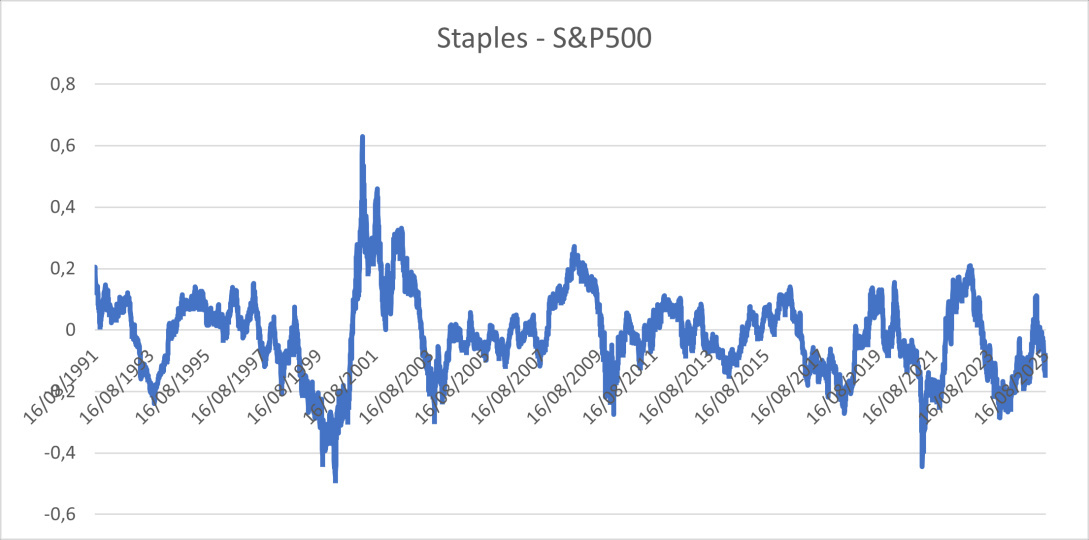

There are also opportunities in defensive sectors—healthcare and consumer staples—with the latter coming off a significant underperformance relative to the S&P 500 over the long term: a correction of excesses could favor outperformance in the coming months. As Mr. Market reminds us, excesses eventually correct themselves.

In summary: the second half of the year will be marked by interest rate cuts on the one hand and possible temporary price spikes on the other. Discipline and a solid safety margin will be needed to cope with the volatility that is likely to arise.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.