Price or value ? A narrative question

13 July 2020 _ News

Looking at the history of financial markets, even only the track record of last ten years, it is clear that there is a discrepancy between the price of financial instruments and their implicit value. Therefore, the markets are by their nature “pricing” mechanisms and not “valorization” mechanisms.

As acknowledged by Profesor Aswath Damodaran - lecturer at Stern Business School of New York University, where he teaches Corporate Finance & Equity Valuation, often the financial marketsalmost always escape the strict control of micro and macroeconomic rules. As a result, price and value remain different criterias and follow different rules.

In particular, since the price is determined by the meeting point of supply and demand, theoretically there is no limit to the price’s variation up or down, and therefore, it can strech from zero to infinity linked to market feeling. On the contrary, the value has its minimum and maximum,identified according to the estimations of cash flows, growth rates of turnover etc. We may disagree on where to establish such low or high limits, but their existence is certain.

Moreover, information is a key element on market movements and it impacts differently in the establishment process of price or value. From a price point of view, the information that may seem insignificant at first, may result in large price fluctuations . A stock in positive trend can go up after good news, even if caracterised by a little weight in numerical (e.g. turnover ) and vice versa. Therefore, the price is reactive by nature.

Value cannot be influenced by the news and it is therefore necessary to determine whether this will have an impact on the measurable variables, such as cash flows, and if yes its weight. In other terms, the value is proactive. This principle means that, mostly in tumultuos times on financial markets, it is extremely difficult and counterproductive to try to find explanations on price variations with a typical “value approach”.

Finally, it is important to remember that the price of shares may never converge to match their value.

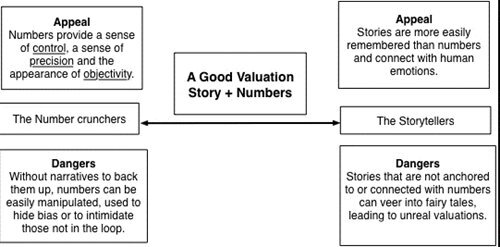

If valuing a company simply meant attributing an intrinsic determined value, for example on price-to-profit or price-to-cash ratios or even using a method that discounts future cash flows, financial markets would not exist and it would be impossible to lose or earn money on the stock exchange. Numbers, of course, play an important role in investors’ trust and without positive financial results, a company could destroy the value for long-term shareholders.

However, at the same time, not paying attention to a company’s history could lead investors to miss out on great opportunities or invest in assets with no positive perspective. The story behing a company could often describe price variation that seem irrational from the standpoint of financial performance.

There is in fact a simple reason why future persepective matters in evaluating a company and should be sought in behavioural finance. Although the calculation of the instrinsic value is based on budgets and fundamentals, making the investments more technical. In reality, emotions play a determinant role in upwards and downwards stock flactuations. Disregarding this fact could become an obstacle in constantly generating alpha returns.

Attention should be paid in order not to fall into the opposite extreme, which would be only relying on story telling, since one would risk investing into financial chimeras. The combination of numbers and good historical background of the company is the right guide in the selection of investments. In this regard, the Professor introduced an evaluation process which consists of 5 phases, taking into account both the narrative and the numbers:

- Develop a narrative for the company that is being evaluated for the investments

- Test the storytelling vs the history, experience and common sense

- Convert key parts of fiction into value factors

- Link value drivers to an evaluation

- Keep the feedback loop open

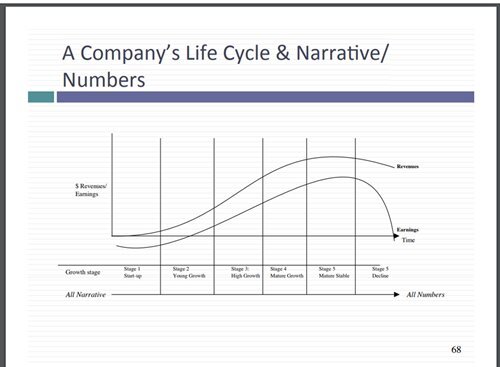

Before proceeding, we need to take in consideration that finding a balance does not necessarly mean equating the two factors. Rather, their weights should be adapted to represent the economic reality of society. For example, a small company operating in a fast-growing industry will probably be driven by storytelling in the early stages. Therefore, assigning a higher weight to the history seems to be a prudent decision. Once the industry matures, the numbers are likely to dominate the market trend. Amazon and Netflix are two typical examples of companies that initially presented a prevalence of history with scarce numbers. Progressively the numbers and evaluations have improved.

After finding the right foundation, companies are divided into 4 categories and are researched for criteries that enter the third and fourth categories, which represent the ones more likely to reward investors positively in the future:

1. Narrative-based companies that have yet to confirm their ability to generate earnings (e.g. Tesla)

2. Number-driven companies with no storytelling (e.g. Bank of America and Kraft Heinz)

3. Narrive-based companies that are already generating revenues and profits (Netflix and Uber)

4. Number-driven companies with an interesting storytelling (Starbucks)

Us, Pharus, share the inspiration of Professor Damodaran to combine the “pure numerical evaluation aspect” and also all the aspects related to the narrative and the storytelling; those are intangible elements essential in the assessment made by our management team.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.