Profits at the Top, Duties at the Gates: Who Wins?

14 July 2025 _ News

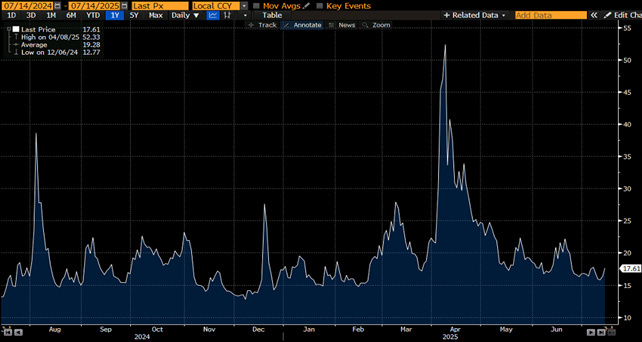

As we approach the heart of summer, financial markets seem to have found a new, fragile stability. But behind the calm surface, the forces at play remain anything but calm. In the most recent FOMC minutes, the words “uncertain” and “uncertainty” appeared no fewer than 28 times, and Powell, in the subsequent press conference alone, uttered them 19 times. A clear sign that the dominant element in this market phase is not growth, nor inflation, but unpredictability.

This uncertainty focuses on one specific point: tariff turmoil related to Donald Trump's trade policies.

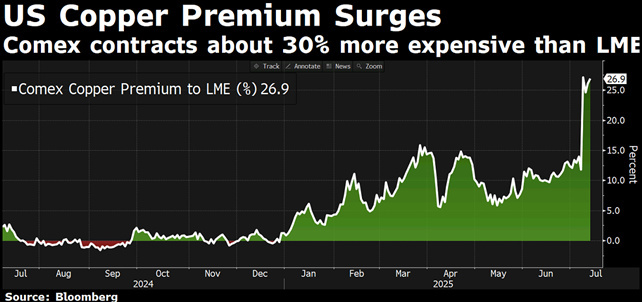

Starting August 1, Trump will impose reciprocal tariffs on nations that have not successfully negotiated an agreement with the United States. On that date, copper will be subject to a 50 percent tariff.

Trump is threatening to impose tariffs of 35% and 50% on Canada and Brazil respectively on August 1. On Saturday he announced that a 30 percent tariff will go into effect on goods from the European Union and Mexico on August 1. Trump is also threatening to impose a 200 percent tariff on pharmaceuticals, although it may not go into effect immediately.

This is a threat that is as real as it is volatile, which the market now treats in TACO mode, that is, convinced that Trump will then step back. The president huffs, he threatens new tariffs, but the markets' reaction has been flat for now. Literally. Stocks, bonds, oil and the dollar have moved little or nothing. This is not summer low volumes, but it is experience. It is a market that has learned to distinguish noise from signal.

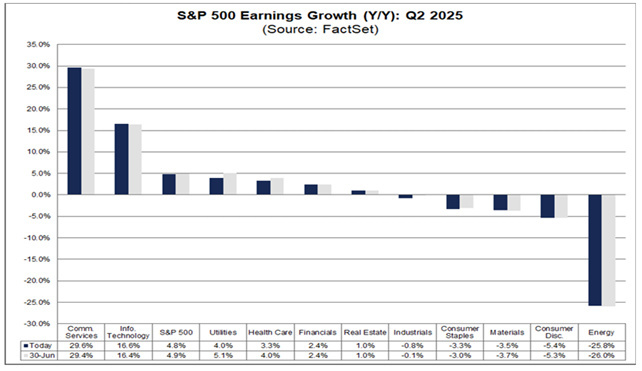

And the sign today is that corporate earnings are surprisingly beating expectations, despite everything. In the first quarter, EPS for the S&P 500 grew 11.5 percent year-on-year, almost double expectations. For the second quarter, which will officially start next week, estimates have been revised downward and earnings growth expectations are now 5%, but we would not be surprised by another positive surprise thanks mainly to the big banks from which solid results are expected thanks mainly to the brilliant performance of the trading division.

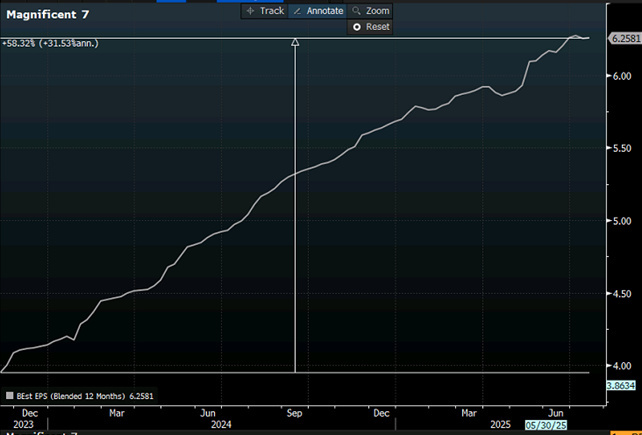

Meanwhile, the market is responding accordingly, since April 8 the S&P 500 has risen strongly, and many fear-again-that the rebound was led by a few names. But the data tell a different story. Sure, the magnificent seven are back to lead performance, with Nvidia nearing a trillion market cap, but the rest of the market has also shown solid double-digit gains, with surprising breadth. The only real laggard is the healthcare sector and some areas of consumer staples. Against this backdrop, the “golden crosses”-that is, the bullish cross between the 50-day and 200-day moving averages-are multiplying. This is an important technical signal that has historically accompanied phases of sustained expansion.

We had started this podcast by talking about “uncertainty,” and not by accident. For it is precisely its gradual reduction that is fueling the market's new bullish leg. Indeed, the main factors of concern-from tariffs to economic growth, inflation to data center spending, and tensions in the Middle East-have partially subsided.

And as the uncertainties dissipate, what is surprising is the resilience of the real economy. Despite a global pandemic, the invasion of Ukraine, aggressive monetary tightening, reignited conflicts in the Middle East, and tariff volatility, U.S. real GDP has never entered a recession since the 2020 lockdown. Six consecutive years of expansion in an environment that could easily have generated a crisis.

Sure, consumer and business confidence does not seem particularly exuberant. But the markets tell a different story. The Buffett Ratio -- that is, the ratio of stock market capitalization to nominal GDP -- is back near all-time highs. Another proxy for this index, the S&P 500 ratio to sales, touched 3.03, the same level reached just before the correction that began last February.

The reason multiples are returning to high levels is simple: confidence in the duration of the economic expansion is growing. The longer the economy is expected to grow, the longer investors will be willing to pay high multiples for future earnings. This also explains the persistent outperformance of the Magnificent-7: they are the locomotives of this new phase of global growth.

So is the stock market irrationally exuberant and headed for a correction or even a bear market? Corrections occur when recession fears depress the valuation multiple, which then rebounds when a recession does not occur. Bear markets, on the other hand, occur when recession fears accurately anticipate an economic downturn. In this scenario, both the valuation multiple and earnings decline. Unfortunately, it is still too early to say whether we are in one or the other case. What is certain is that a cautious attitude near market highs in a complexly read scenario seems the most rational one.

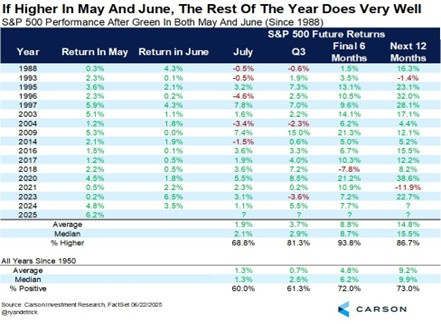

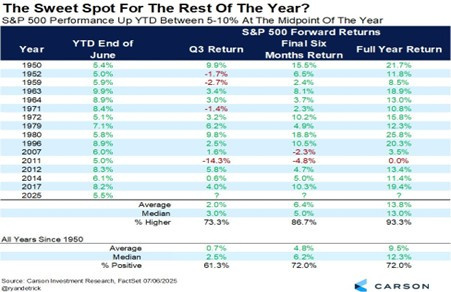

The statistics continue to be favorable, When the S&P 500 gains between 5 and 10 percent by the middle of the year, historically the market has closed up 13 more times out of 15. And when May and June-usually weak months-both close positive, as they did this year, the second half has been positive in 15 out of 16 years.

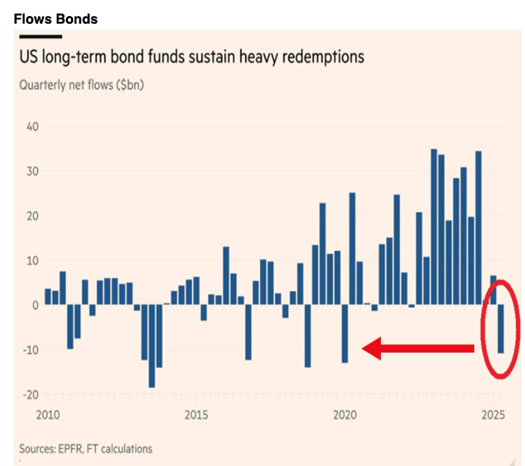

However, all that glitters is not gold. Massive fiscal and monetary stimulus globally is driving up the money supply to record levels. Central banks are still a long way from reaching the 2 percent inflation target. And meanwhile, U.S. long-term bond funds are experiencing outflows not seen since COVID, with rising buying flows to equity markets calling from a contrarian perspective for healthy caution, pending the theme that we have repeatedly anticipated as one that should please the markets very much-that of deregulation, which will begin to be discussed in the later part of the year.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.