Race for a vaccine

23 November 2020 _ News

The race for the COVID-19 vaccine has officially entered its final lap. On 9 November, Pfizer and BioNtech announced very good results, with an efficacy rate of around 90%, significantly better than analysts’ estimates. A week later, on 16 November, Moderna demonstrated even better results with an efficacy rate of 94.5%. Then, on 18 November, Pfizer updated its results, increasing the efficacy rate from 90% to 95%. On 19 November, AstraZeneca and the Univeristy of Oxford also demonstrated excellent results. And then there is China, where spokesperson Zhao Lijian confirmed that the Chinese Government has adopted five different technological approaches for the development of COVID-19 vaccines and that these five vaccines are currently undergoing advanced-phase trials.

So there are currently 12 candidates undergoing advanced-phase trials and given the state of emergency, both the US regulator, the Food and Drug Administration, and the European regulator, the European Medicines Agency, are able to authorize the provisional use of the vaccine prior to obtaining official approval. Emergency use actually requires an efficacy rate of over 50% and currently the various candidates in the race for the vaccine have recorded rates far beyond the threshold set by law. And just think – for a seasonal flu vaccine to be approved, efficacy rates of over 70% are sufficient.

It is therefore expected, given the large number of companies in phase 3 trials and considering the results that have emerged so far, that final approval will be given by the end of 2020 or the beginning of 2021 and that it will be possible to vaccinate a significant proportion of the world’s population by the end of next year.

But what are the implications for the financial markets?

Risk Aversion

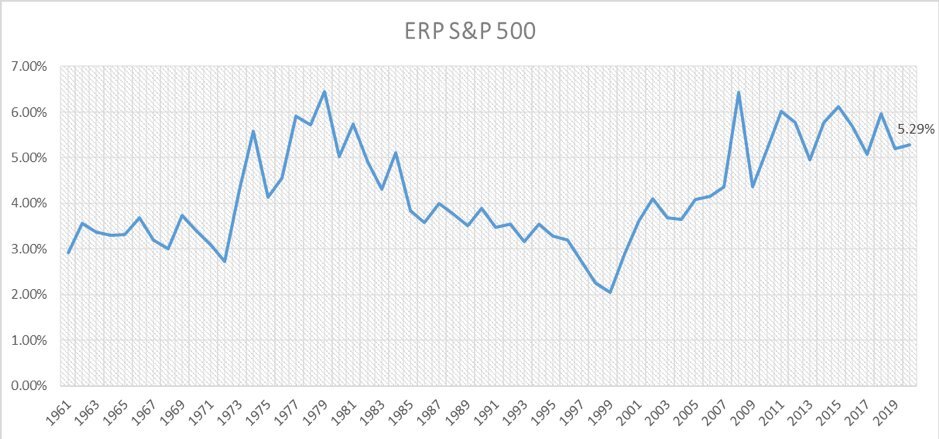

The main effect of news such as the discovery of a vaccine during a pandemic is to radically alter operators' sentiment, resulting in changes to one of the key variables that is part of every evaluation process: the risk premium.

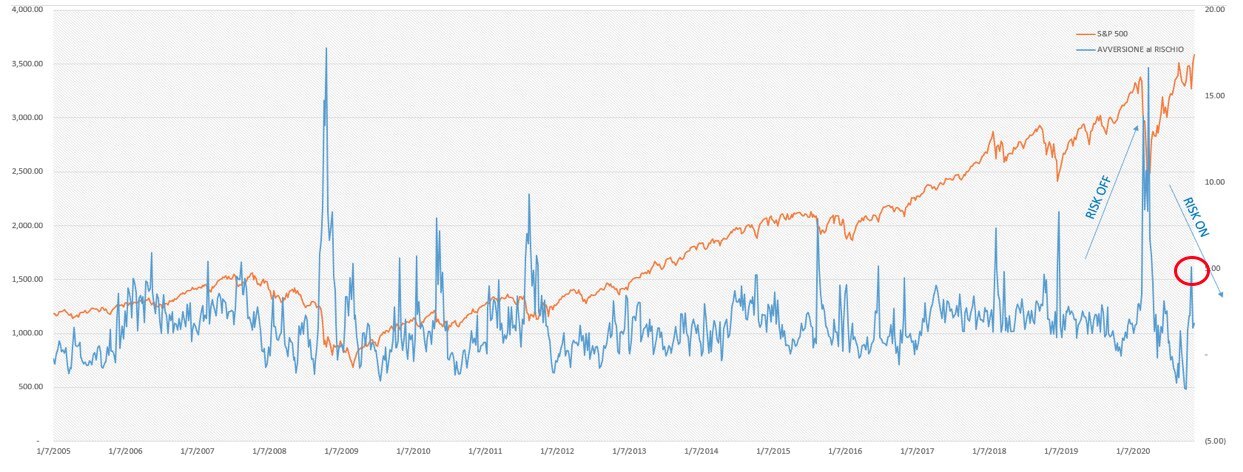

In order to understand the implications of these dynamics on the market, it is necessary to analyse movements in operators’ attitudes to risk aversion. One indicator that we use to estimate risk aversion among investors is the differential betwen the implied volatility of options at one month and at three months on the U.S. stock market. A rise in this value signifies a reversal in the volatility curve, with one-month volatility overtaking three-month volatility, and this implies an increased risk aversion on the market. Given that volatility is the best proxy of how the options market, used by operators to hedge their portfolios, is evaluating the market risk, the increase in risk aversion means that investors pay more to cover themselves at one month than at three months.

The graphic below shows that when risk aversion (blue line) rises above certain threshhold levels, the U.S. stock market (orange) adjusts. It can also be seen how positive news on the vaccine front has reduced risk aversion among investors in recent weeks (the red circle).

Conclusion: Equity Risk Premium

We believe that all subsequent positive newsflows regarding the approval of a vaccine will help to further reduce risk aversion among investors with the effect of compressing the equity risk premium (the premium required by operators to select shares rather than bonds), thus helping to sustain the growth of risky assets and stock markets in particular.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.