The unsurprising possible rise in inflation in August

19 July 2023 _ News

Last week the major inflation indexes confirmed how the deflation process that began last year is continuing in line with the FED's expectations.

The CPI came out Wednesday up 0.2% month-on-month and up 3.0%, year-on-year, better than the consensus, which expected a monthly change of 0.3% and an annual change of 3.1%.

Core inflation came out at +4.8%, below expectations of 5%.

The producer price index also came out better than expected at +0.1%, expected at +0.2%.

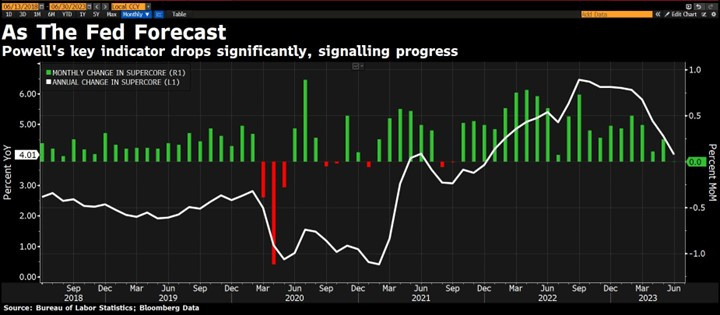

Powell's preferred inflation measure, i.e., the monthly change in super core inflation, varied by 0% month-on-month.

This reduction in the CPI is mainly due to three aspects.

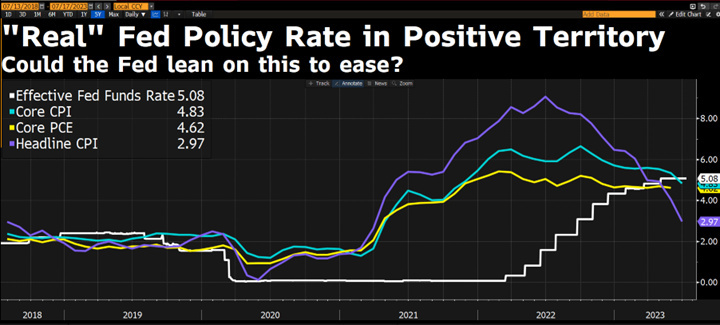

First, the return of the inflation imbalance favored by the high level of interest rates. Indeed, the FED rate is at a higher level than both the traditional and Core CPI.

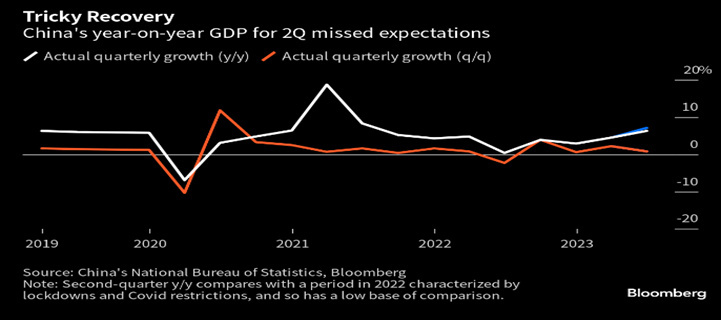

A second aspect that is helping deflation is the slowdown in China's economic growth. Indeed, data released this week showed that China is growing more slowly than expected, both on GDP and consumer spending.

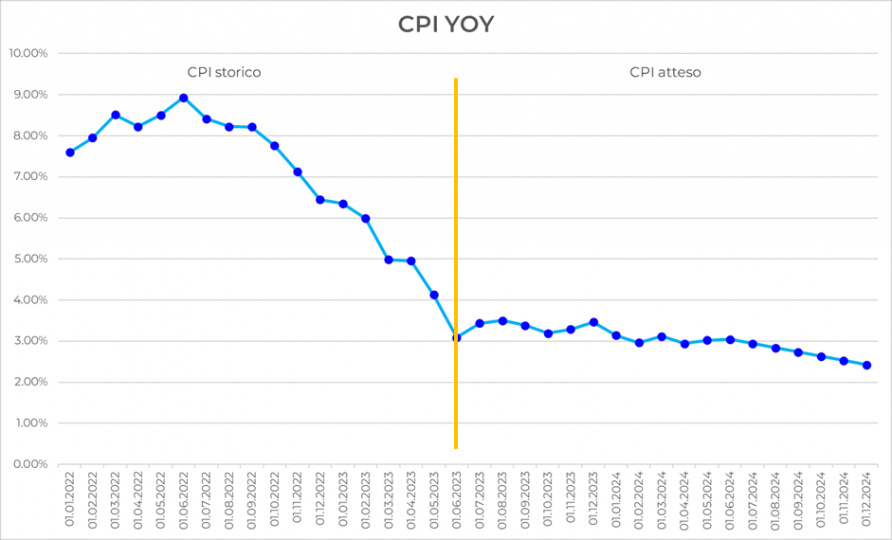

A third aid to deflation came from the base effect, that is, the comparison between today's figure and that of a year ago, where inflation had peaked. From next month this comparison effect should drop, and according to our simulations this should lead to a rise in inflation from the current 3 percent to 3.5 percent. To get to these values we assumed a very conservative base scenario. The scenario assumes an average monthly increase in inflation of 0.3 percent, a value higher than the historical average, until it reaches 3.5 percent in August, which is expected to hold until the end of the year. By 2024, on the other hand, with the lagged effect of monetary policy starting to work and the natural economic slowdown, we expect inflation to be around 2.5 percent, which is in line with the FED's target.

Based on these scenarios, we expect that the FED may raise rates by 0.25 percent, just to send a signal to the market by anticipating the August inflation figure, which is expected to be up.

However, our view is that it would be better to stop the hikes and let the current level of rates work, in order to focus efforts on preserving economic growth. In fact, we believe there is too much focus on the inflation issue, and there is little memory of how inflation has evolved over the past 15 years.

First of all, for the past 15 years the FED and ECB have been trying to raise inflation to stimulate growth without succeeding, and now that the trend suggests a return to 2-3% it seems to us that inflation, in addition to returning to normal, has finally achieved this goal. Second, if we go to average inflation from 2009 to 2023, which includes upward and downward excesses, we get an average inflation of 2.3%, and thus all in line with the targets.

This excessive focus on inflation stems from the fear highlighted by many that inflation is very difficult to manage and that it is possible that there could be further episodes. Although our simulations show that there may be an upturn next month, this does not change our view: the deflationary trend is now defined and the FED and ECB are working very well, it is enough to consider the fact that inflation expectations remain anchored. They will not make the past mistakes that then led to higher inflation.

In conclusion, the next inflation figure may rise, due to a base effect, although this should not surprise the investor because the level of interest rates is still acting on the economy.

In this scenario we continue to overweight the sectors where market expectations are lower, health care and financials, which can best deal with the turbulence of the reporting season.

On the bond side, we continue to believe that it is necessary to increase duration. First, because inflation goes down, which leads to repricing of bonds. Second, because if the economic slowdown is harsher than expected, this would have a very important effect in lowering rates.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.