The relationship between macro data, earnings expectations and the stock market

03 May 2023 _ News

The stock market always tends to anticipate both macro data and analysts' earnings expectations. This implies that when there are sharp corrections in stock prices, valuation multiples (Price over Earnings, the so-called PE) tend to decline to anticipate the future slowdown that will be seen in both macro data and earnings expectations.

Putting these principles in context to the current situation, we note that since the 2022 correction, the market has moved far ahead by revising downward expectations for economic and earnings growth.

Therefore, we should not be surprised if we see worse macro data and shrinking earnings in the coming months with a U.S. stock market that may have already discounted them and converged toward its intrinsic value, which as of today we estimate to be around 00.

What macro data tell us

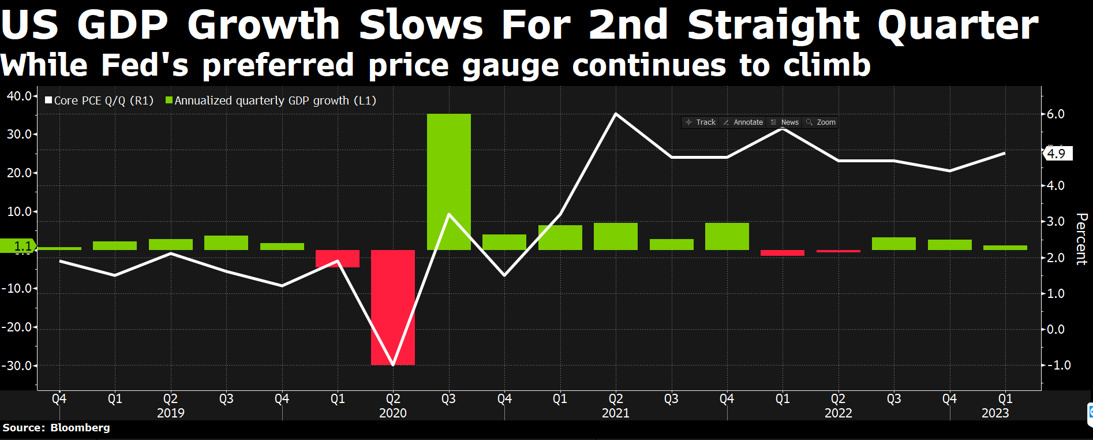

Macroeconomic data coming out in recent weeks show a slowing U.S. economy but without exceeding negativity. Thus, the so-called soft landing is materializing. Thursday's U.S. GDP at +1.1 percent compared to expectations of +1.9 percent, although influenced by the normalization of inventories, shows us that the first quarter of 2023 was below expectations.

Analyzing the 2022 U.S. GDP data we can see how the slowdown has already been experienced in Q1 and Q2 2022.

In addition to past data, key economic forecasters are also beginning to show a clear slowdown.

First, the LEI Index, an index of leading economic indicators, reached its lowest level since November 2020. Second, business economic expectations for April, released in the Philadelphia Fed survey, were particularly negative, with values rarely seen since the 1970s. In contrast, PMI indices showed an improvement in economic conditions.

What companies tell us

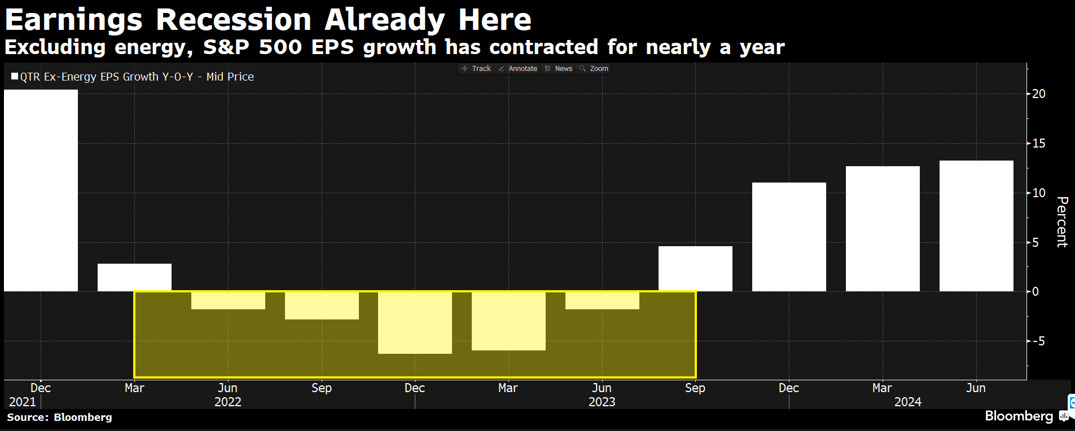

We have entered the heart of the corporate earnings season, which is proving to be significantly better than those of the past two quarters. In fact, about 50 percent of companies have reported results, and of these about 80 percent have reported earnings that are higher than expected by about +6.9 percent, resulting in an improvement in expectations for the quarter from -6.7 percent a few weeks ago to -3.7 percent. For 2023, analysts expect earnings to grow by +1.2%, resulting in a mild slowdown in the economy, the so-called soft landing. The reporting season also confirms that we are experiencing what can be called a rolling recession, that is, a recession that hits different economic sectors at different times, as also evidenced by the numbers on quarterly earnings that contracted for several months in 2022.

What the stock market thinks

Macroeconomic data belatedly discount the restrictive monetary policies of central banks, which is why slowdown data now are normal. The stock market on the contrary looks ahead, at least 12 months, and always anticipates. And historical data confirm this. In fact, 3-, 6-, and 12-month stock returns following macroeconomic slowdown data historically tend to be positive, precisely because the market had already discounted what there was to discount.

Same for earnings. Indeed, history teaches us that during a market correction, the valuation multiple (Price over Earnings, PE) tends to decline, driven by the market price correction, thus anticipating the future earnings cut. In the months following the stock correction, analysts will adjust the downward earnings estimate by inflating the valuation multiple (PE) by 20 percent on average. This implies that the stock market corrects before earnings fall and then tends to recover even with falling earnings.

An example is represented by consumer discretionary, which experienced a recession in 2022 with stock corrections of about -40%, but beat analysts' earnings expectations by about 19%. In fact, it is one of the sectors that is showing the highest stock performance ytd. Another example is the financial sector, which in March had experienced a sharp correction, almost a recession, led by the banking crisis. In fact, the sector was able to soothe investors with earnings growths of +5.4% compared to the expected +2.9%. JPMorgan raised guidance by more than expected, and Citigroup and Wells Fargo showed very solid and encouraging results. This allowed the U.S. financial sector to outperform the market over the past month.

Finally, Health Care also deserves mention. Due to the recession experienced in the first quarter of 2023 they are experiencing a -20% drop in earnings. They are therefore a very good sector to look at, even because market expectations are virtually reset.

Conclusion

In conclusion, the stock market always anticipates both macro data and analysts' earnings expectations. To deal with this situation, we believe it is essential to continue to look for value, building positions on sectors and companies that have already experienced a recession, and taking profits where valuations begin to be higher and thus where market expectations are too high.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.