Value returns to markets

02 November 2023 _ News

Recent pleasant surprises from profits and corrections bring value back to the main stock markets.

Earnings season

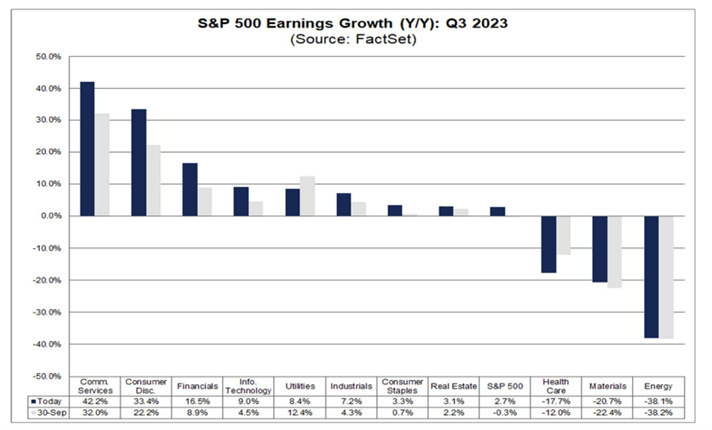

The US earnings season has seen around half of companies on the S&P 500 report their results for Q3 2023. Of these, around 80% reported results that were approximately 7.7% higher than forecasts. The growth in earnings for Q3 is now 2.7% (see graph below), compared to a -0.3% drop in earnings at the end of Q3. While 2.7% is the actual growth rate for the quarter, it will be the first quarter of year-on-year earnings growth reported by the index since Q3 2022.

Earnings season has given us some insight.

- Starting with tech, which reported nicely on average, including Microsoft, but positive performance was not enough because expectations were a little too high. Take Alphabet, for example, which reached the highest levels of the period. Excellent reporting with numbers that were generally better than expectations was not enough. The market focused solely on the cloud, which was a source of mild disappointment and drove the company to correct by around 10% in the week.

- Now for the companies hit hardest by the rate hikes. One company that rates US lenders (right graph) corrected by around 30%, showing how the mortgage market is falling sharply, by around 34% in 2023, as a result of excessively high rates. How the rates are slowing down the economy has also been highlighted by one of the leading US commercial real estate firms, which anticipated a cut in earnings of more than 30% for 2023.

- As for European consumer non-discretionaries, where a great deal of value was created, Campari and Remy Cointreau showed a weaker outlook due to a strong slowdown in European demand, and became very attractive in terms of value.

- Lastly, the slowdown is also evident in the automotive sector. Tesla, Mercedes and Ford revised their margins down due to the future drop in prices that car manufacturers must adopt for two reasons: to respond to the sharp increase they had carried out and the drop in demand driven by the rise in lending rates for vehicle purchases.

Value

Excellent business results combined with price corrections have brought value back to the markets. The recent correction brought the S&P 500 below the average valuation. In particular, we find the equal-weight S&P 500 (see first graph below), at 14x P/E, at the lowest levels of the last decade, and Europe, at 11x P/E (see second graph below), almost at the lowest levels of the last decade:

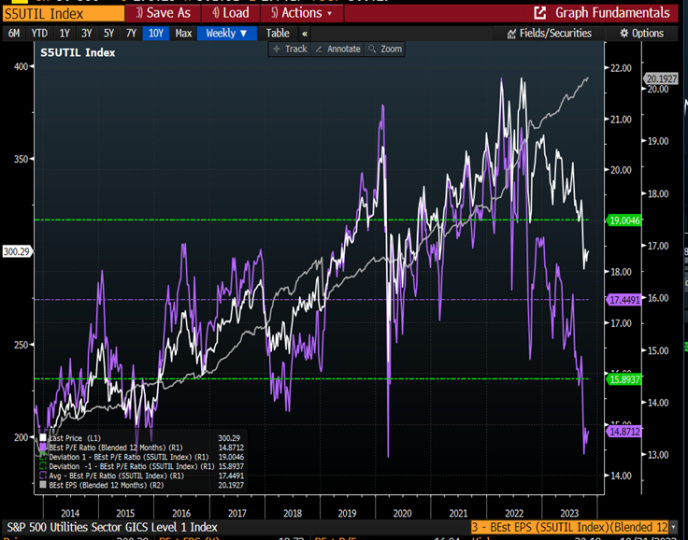

At sector level, we continue to opt for defensive: utilities (see graph below), health care and consumer non-discretionaries. In particular, as shown in the graph to the right, utilities present a P/E (purple line) at its lowest levels in the last decade, and earnings (grey line) are expanding rapidly.

These are joined by financials, where prices are already slowing sharply. Mid-caps are preferred to large caps.

Conclusion

In conclusion, value has finally returned to the main markets.

How should we interpret the price corrections in equities and the strong earnings season? Like always, equities look ahead while analysts adjust earnings afterwards. This year, consumption fuelled economic growth and company profits, but the return to more normal saving rates combined with high interest rates, more restrictive lending conditions, pressure on the margins and weakening in demand indicate a normal slowdown. We are also seeing a shift in the priorities of the central banks from inflation to growth. Referring again to the value of equities, indications show a market that, in general, has become interesting once more, where we continue to opt for defensive sectors and financials. Following value at this moment in time leads to portfolios that allow investors to invest in simple businesses and obtain flows in terms of coupons and dividends over 4%.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.