And if current levels of inflation really are just temporary?

23 November 2023 _ News

The Fund Manager Survey, carried out monthly by the Bank of America with participation of 265 fund-management companies, with a total of 0 billion in managed assets, shows that whilst negative sentiment persists in November, things have improved significantly.

There have been a series of events over the last week guiding this improvement in sentiment, all viewed positively by investors: signs of easing tensions in the geopolitical sphere, combined with American treasury issues that where lighter than expected, but above all encouraging data on inflation and signs of a soft landing for the economy.

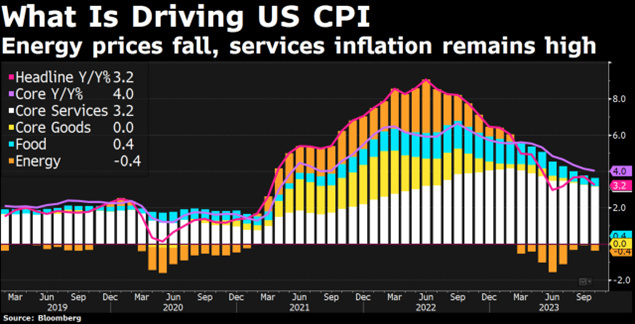

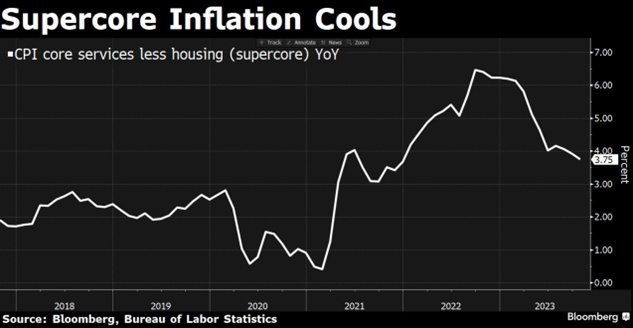

The most keenly awaited macro figure for the week was certainly Tuesday’s announcement of 3.2% US inflation for the month of October. This shows further cooling compared to the expected 3.3%, with the monthly variation at 0%, confirming the gradual approach of price increases towards the Fed target. There was also a decrease in core inflation, which excludes the more volatile energy and food components, which came out at 4% compared to the expected 4.1% and also supercore inflation, at 3.75%, confirming its downward trend.

One could object that overall inflation is not far below expectations, but the bond-market rally, with the ten-year rate down twenty cents on the day of publication of inflation data, and the 70 cents of recent peaks at the end of October, suggest that investors are increasingly aware of the shift in macro trends.

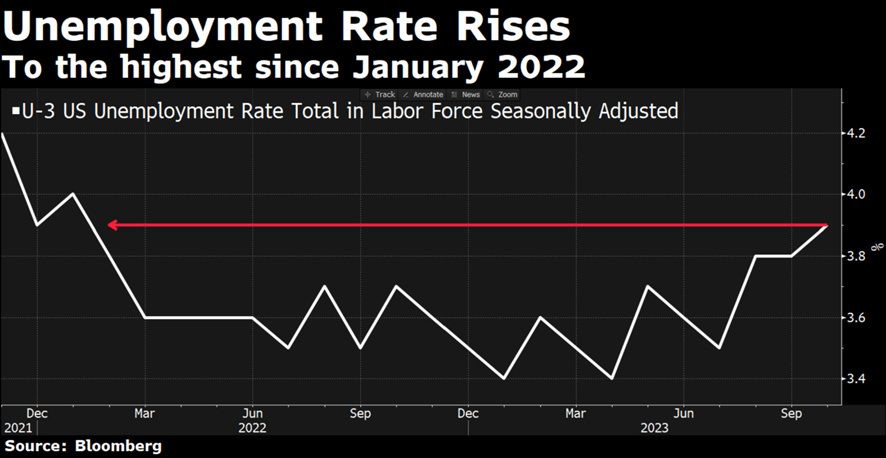

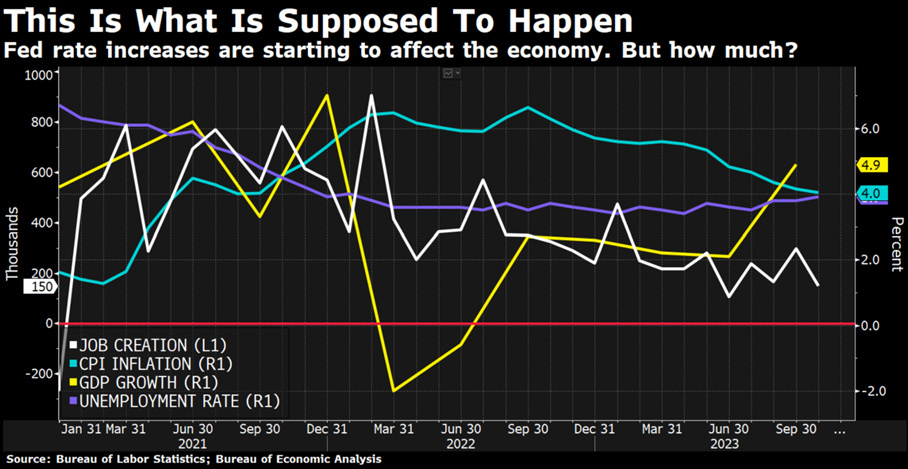

Other macro-economic data well-received by the bond market was that showing a cooling labour market, with unemployment above the expected figure by 11,000 units, along with lower-than-expected figures for industrial production, indicating a slowing economy. This was also good news for the Fed, which can now feel more relaxed about the prolonged interest-rate pause announced.

All of this data has contributed to investors taking into consideration expectations of an American economy that is passing from overheating to tepid, confirming a stop in interest-rate hikes by the Fed, and an economy that is on the right path for a soft landing, the so-called Goldilocks scenario. On the basis of this belief, equities have also seen a third consecutive week of gains, although it is acknowledged that in the event of a recession, high-quality bonds would obviously have better chances of performing well.

Signs of easing tensions also came for the markets on the geopolitical front, with the awaited meeting of leaders of the two global superpowers, China and the US. The prevailing message from Biden and Xi Jinping was one of cooperation, particularly on climate, and with reassurances and very clear messages on Taiwan, with the Chinese leader guaranteeing that China is not planning military action.

Thus, while the narrative of monetary policy tied to the data leads us to await the next round of macro-data with trepidation for confirmation of the downward trend in inflation and the health of the economy, it is the earnings season that actually offers the real indications for investors. In fact, only by following the reporting season is it possible to understand why so many large investors dedicate so little time to macro-analysis, based on data that by definition arrive late and lead to investment looking in the rear-view mirror.

Thus, that sought in the macro-data for months, i.e. confirmation of a return to lower levels of inflation, has been clearly underlined by many companies in reporting on quarterly results. Many companies have issued guidance speaking of an increasingly evident decrease in consumer demand and have consequently reviewed and lowered growth forecasts provided to investors, with a clear reduction in the number of companies discussing inflation in quarterly reporting.

The biggest surprise came from Walmart, the largest retailer on the planet, on Thursday. Not only did CEO, McMillon, cease to mention inflation, but for the first time he spoke of deflation, stating that the US could begin to see deflation in the coming months, with prices of the main food products being cut in order to support demand. The CEO of Walmart is the first to speak explicitly of deflation, but two days before the financial director of Home Depot, McPhail, also stated more indirectly that the worst of inflation was now behind them.

The statements of these two American managers follow those around a month ago from the CEO of IKEA, one of the most famous global franchises, who stated in an interview that they had started to reduce prices again with cuts of 20% on the price of many of the most widely purchased products in their catalogue.

The messages emerging from the reporting season are very clear on future prospects: more and more companies are speaking of falling consumer demand, and there is also an air of deflation rather than inflation (also for energy costs, with oil dropping 20% from October), with the response of companies being generalised cuts to guidance figures.

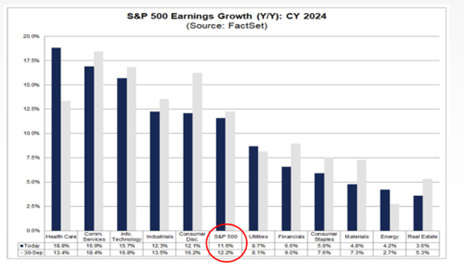

We believe it is worth listening to companies rather than following the market narrative, and this is why we continue to follow value, which for a while now has been indicating great opportunities on bond duration and an overweight position on stocks in defensive sectors, which are already pricing in economic slowing. We continue to believe that the consensus should reduce expected earnings growth for the S&P 500 in 2024, today forecast at +11.6%, already down from the +12.2% forecast until a few weeks ago, but still too optimistic.

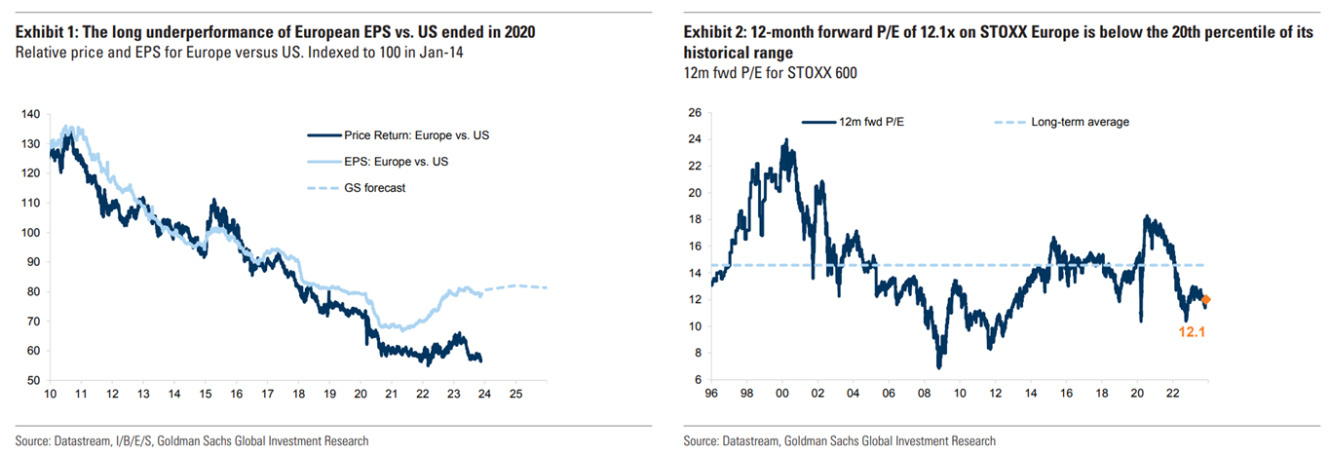

We expect that this process of reviewing estimates will only marginally affect defensive sectors, where expectations have already been greatly lowered and there is also the support of strong valuations. There are also very attractive valuations in European stock markets and multiples of 12x profits, with a large discount of approx. 35% compared to the 19x of the American market, highlighting plenty of value in relative terms.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.