Coronavirus: Pharus Sicav Absolute Return turns positive after just one month of suffering

21 April 2020 _ News

The current turbulent situation in the financial markets is proving to be fertile ground for the balanced sub-fund, which has found in the spread of the coronavirus the perfect opportunity to demonstrate its conservative character.

The conservative approach and diversification of the Pharus Sicav Absolute Return balanced fund has led the sub-fund to a new positive performance only one month after the outbreak of the crisis triggered by the spread of the coronavirus, thus confirming its ideal strategy to handle market phases such as the current one, with its strong uncertainty and volatility.

In particular, Quantamental's management approach, which combines the principles of a quantitative approach with those of fundamental analysis, seeks to preserve and stabilise capital growth through investment in equities (equity exposure of between 20% and 40%) and high-quality government bonds (mainly the US Treasury and the German Bund), which make up the core portfolio, and dynamic hedging of derivatives to move equity exposure quickly.

The risk of the equity component is mitigated by the government bond component through the so-called fly to quality, typical of situations of high market stress, reducing the overall volatility of the portfolio.

In fact, while liquidity keeps its value almost unchanged over time (the famous "cash is king"), high-quality government bonds such as US Treasuries can protect the portfolio by acquiring value, even more so during market storms, as demonstrated by the +9% in these pandemic months.

For stock selection, a robust proprietary system is used to monitor how consensus expectations on company profits vary over time and to select only the most promising companies with solid businesses and above-market growth rates in profit.

The investment universe excludes small to medium companies and focuses instead on large caps (the US S&P100 index and the first quartile of the European EuroStoxx 600), mainly US, of relatively high quality and undervalued. Examples are Facebook Inc., Cigna Corporation and Bristol-Myers Squibb.

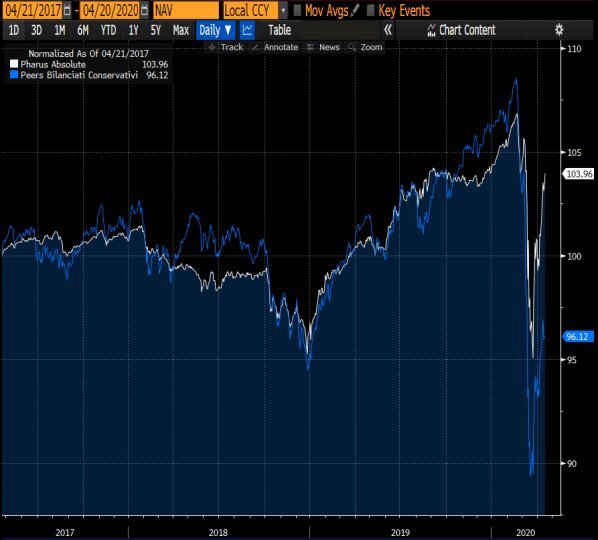

The result just obtained makes it possible to respond immediately to the comment made by some investors in the past that the portfolio allocation is too defensive at the expense of further performance points: since the beginning of the year, as can be seen from the graph below, the sub-fund has recorded a performance of +0.15% compared to the global equity market, down 13.83%, and the cluster of competitors, which recorded an average performance of -9%.

Sticking with the strategy has paid off once again.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.