Economic and financial data in a time of coronavirus

08 April 2020 _ News

Aware that in the coming months there will be a series of earnings data and dramatic guidance signals, our mission will be to remain lucid and detached. All the reasons for this were explained during the last investment committee meeting

"In the coming months macro and corporate data, both in the US and Europe, will inevitably be negative, but we know that macro data is a lag indicator and that the process of analysts reviewing profits takes time. It will be essential to assess what the market has already discounted, not least considering the element of absolute unfamiliarity linked to the reduced reliability of so much data that will be released" said Stefano Reali, our deputy director, to introduce today's management committee.

The certainty of uncertainty. The recognition of uncertainty is the first step to measuring and containing uncertainty. Incorporating it in the way we think about what we believe creates an openness of mind that gets us closer to an objective position.

And this is precisely the message we want to convey today: aware that in the coming months a series of dramatic figures will come in, our mission will be to remain lucid and detach ourselves from the multiple macro and corporate data that will filter through the negative news, assigning it just the right significance. Why?

It is misleading to rely on data collected from surveys - or questionnaires, a method used mainly in the USA - because the number of users willing to fill them in gets lower every year, and those few who do fill them in rarely fill in all the required fields.

If to the damage of "time wasted" is added the discomfort of the crisis in which the markets find themselves, certainly the few data points available will represent a small part of traders and businessmen:

- Businesses that have been closed during quarantine (e.g. restaurants) will have no reason to respond to a survey of their performance;

- On the contrary, the sectors that have worked most intensively (such as the food and disinfectant industries) will not have had enough time to complete a market survey;

- People who run a company may not want to talk about retail in the period of greatest economic paralysis in recent years.

Given these assumptions, it is appropriate to consider one fundamental element: quarantine has inevitably changed our way of thinking about work and business activities, so that it is necessary to evaluate the individual elements and relate them to the type of reality we are facing. So it is better to rely on objective data, which are based on official studies rather than personal perceptions: in the USA, it is not so much the unemployment rate that counts, but the increase in unemployment benefit applications (data that can be traced back to a specific time frame).

One example is that of pollution - which can serve as an incentive for a "greener" economy - which, taken in complete isolation, did not coincide with productivity at all: all the companies that allowed their employees to work from home helped to increase GDP without affecting traffic and smog.

Another cue is the use of electricity: a drop in electricity consumption does not necessarily have to correspond to a drop in GDP - if we remember that all workers who continue to work remotely with smart working - or those sectors that have had a lower drop in electricity (such as the tertiary sector) may suffer the same productivity losses as sectors that by contrast use a lot of electricity (e.g. factories) and for which the difference in electricity consumption is now more significant. Finally, there are particular sectors of activity (such as metal processing facilities) that produce low GDP despite high energy consumption.

Translating this reflection to financial markets, and once they are aware that the sharp reduction in the number of US companies will occur naturally, investors need to be aware of the current lack of certainty: relying blindly on the data collected can be a fatal error, because approximate data are like wrong data (they mean that investment models will be wrong). If the survey results are of low quality, they can compromise the entire acquisition system and require continuous review. In such a climate of confusion in structures and upheavals in the economic cycle, even the myth of "big data" as a reference point collapses. Getting by in today's market is like tackling an obstacle course with an ancient and hard to decipher map!

It is essential to make wise choices in the months to come: it will therefore be appropriate to "take with a pinch of salt" the indications relating to the first quarter as well.

Where is the consensus of US companies so far? We know that numbers take time to adapt, a bit like the way inflation expectations are reflected in the current price level.

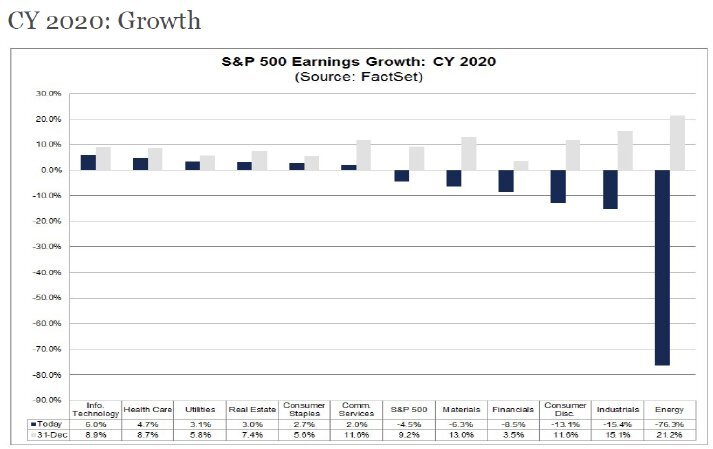

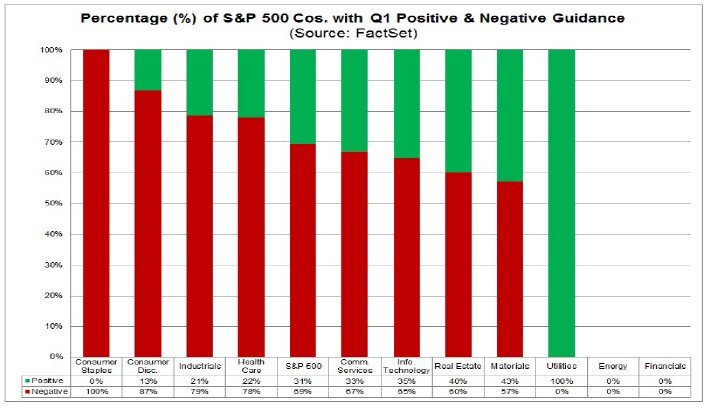

To date, the market estimates a drop in profits of -4.5% against the forecasts made at the beginning of the year which expected growth of 9-10%. However, these estimates take some time to adjust and we expect the US stock market to factor -30% profit growth into the prices. A curious thing to note is how, for the more defensive sectors, a drop in profits is not yet expected. On the contrary in fact, they are expected to grow.

The thesis of the "unreliability" of the data in times of pandemic is further corroborated by the latest indications released for the first quarter, which show that estimates for the entire basic necessities sector have been significantly reduced, despite the fact that it is defensive and despite the fact that spending is the only activity allowed during this quarantine. On the other hand, the utilities sector has positively guided the market towards its profits.

The reality, however, is that defensive sectors have been at the forefront since the beginning of the year, both in the USA and in Europe.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.