Fed, AI, and record multiples: the week that reshaped the markets

23 September 2025 _ News

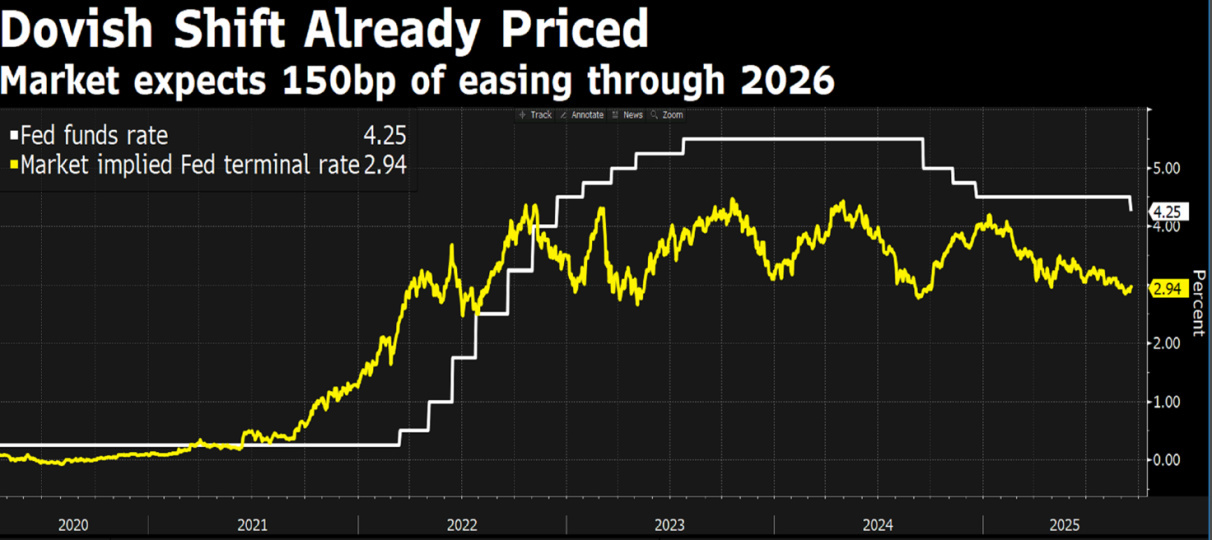

The most significant news of the week came from the Federal Reserve, which, as widely expected, cut interest rates by 25 basis points, bringing the Fed Funds target range to between 4.00% and 4.25%. This is the first cut since last December and marks an important turning point in the monetary cycle.

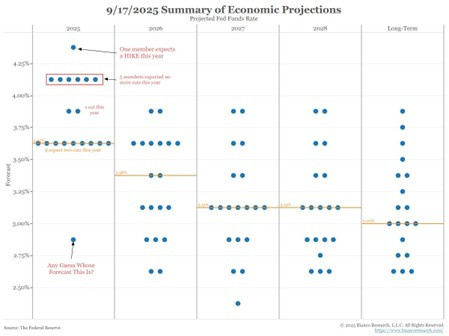

The cut was practically a foregone conclusion for the market, and the reaction of assets was muted, but enough to push equities to new all-time highs. What perhaps surprised the market most were the so-called “dot plots,” which showed a surprising dispersion of expectations: among the voting members of the FOMC, one even expects a rate hike by the end of the year, six expect rates to remain unchanged, while nine see room for two further cuts. Only Stephen Miran, recently appointed by Trump, voted for a more aggressive 50 basis point cut, signaling a Fed that is potentially increasingly and dangerously influenced by politics.

Miran could be considered an outlier, but that would mean denying that this is the direction Trump would like to see the Fed take and that it could coincide with the position of the new president of the central bank, with an increasingly politicized Fed becoming instrumental in containing long-term rates. Beyond the official narrative, we are witnessing a structural change: the Fed, as is already the case with the ECB and the BoJ, is increasingly becoming an instrument of fiscal policy. In a world of high debt, modest growth, and rising public spending, the implicit priority of central banks is becoming the maintenance of stable financing conditions.

This is also demonstrated by the limited reaction of the bond market: the 10-year Treasury remained above 4.00%, signaling skepticism about a lasting easing cycle.

Chairman Powell confirmed during the press conference that future decisions will not follow a “predetermined path” but will be data-dependent. However, for the first time, he also pointed out that the labor market is slowing down and that inflationary pressures remain “moderately elevated,” exacerbated by new trade tariffs.

Thanks to interest rate cuts, optimism is returning to small caps. The Russell 2000 has reached new highs, benefiting from two factors: on the one hand, falling cost of capital; on the other, growing expectations that investments related to AI and digital infrastructure may finally extend to smaller companies. With hundreds of billions of dollars in capex expected in the coming quarters, the flow of capital towards small caps seems almost inevitable.

At the individual company level, the most striking news of the week concerns the giant Nvidia, which announced a billion investment in Intel. The goal is to develop AI data centers and PC chips together. The agreement pushed Intel's earnings close to +30%, bringing it back to levels much more in line with its intrinsic value.

Microsoft has also announced a new billion investment in Wisconsin for an AI data center that will use Nvidia chips. These developments confirm that the second phase of artificial intelligence, linked to infrastructure, is now getting underway.

Macroeconomic data continues to surprise on the upside. August retail sales rose 0.6% m/m, prompting the Atlanta Fed to revise its Q3 GDP estimate upward from 3.1% to 3.4%.

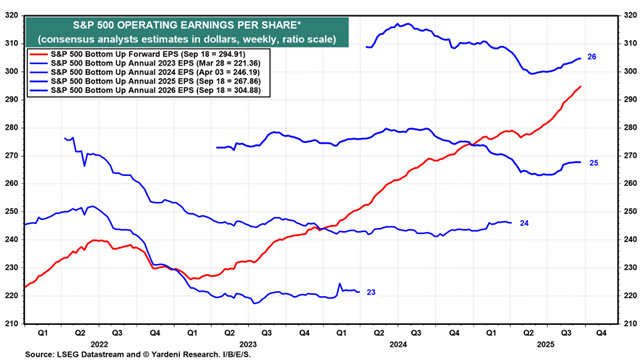

The CEI (Coincident Economic Index) rose 0.2% to a new all-time high. Expected earnings for the S&P 500 also remain on track for growth and record levels, supported by a strong earnings season, positive revisions, and continued optimistic guidance across most sectors.

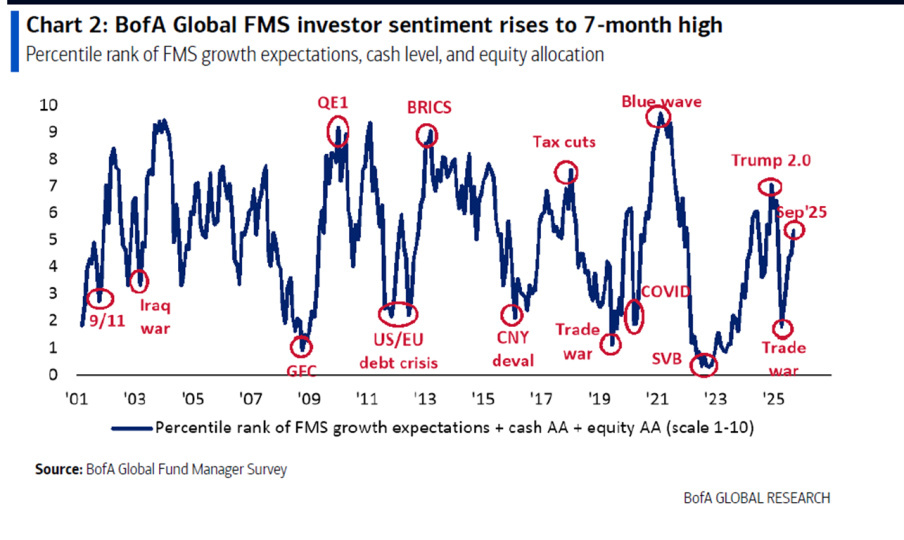

The September global fund management survey, conducted by Bank of America among approximately 200 asset management firms with assets under management totaling around 0 billion, highlights an institutional world in which expectations of interest rate cuts and the end of the trade war are fueling optimism. In fact, fund managers' sentiment is at its highest since February 2025.

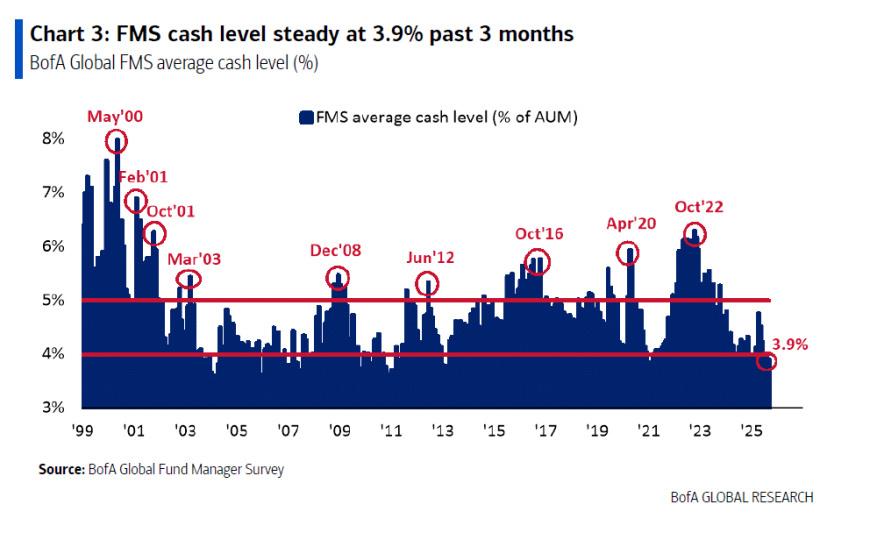

Equity allocation is also at a seven-month high, with liquidity below 4% (a threshold below which market corrections have historically occurred).

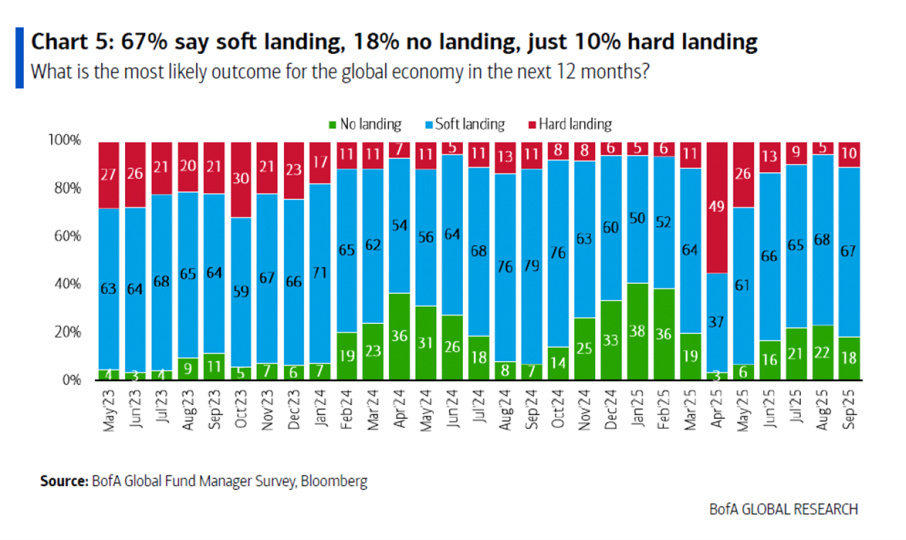

Optimism about global growth is also growing, with 67% of respondents expecting a soft landing and only 10% fearing a recession.

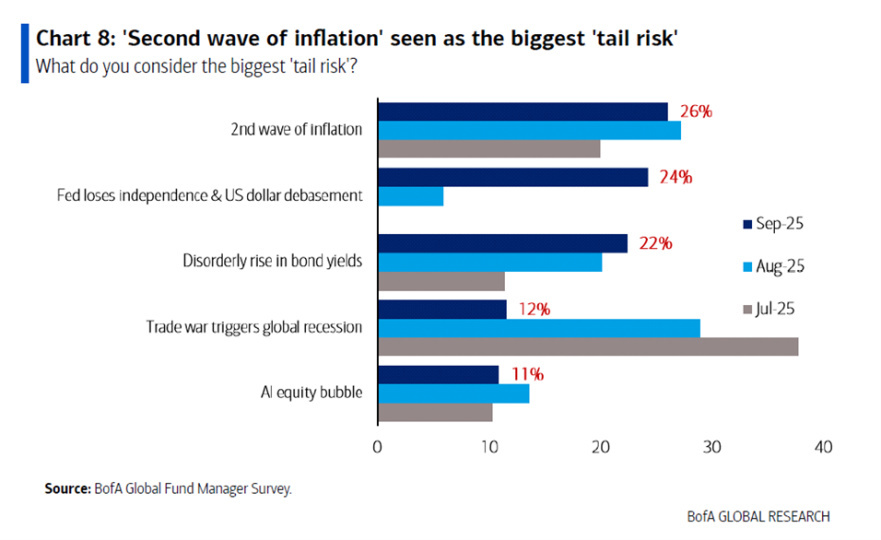

It is interesting to note that 26% of respondents fear a second wave of inflation, which is now considered the main risk on the markets.

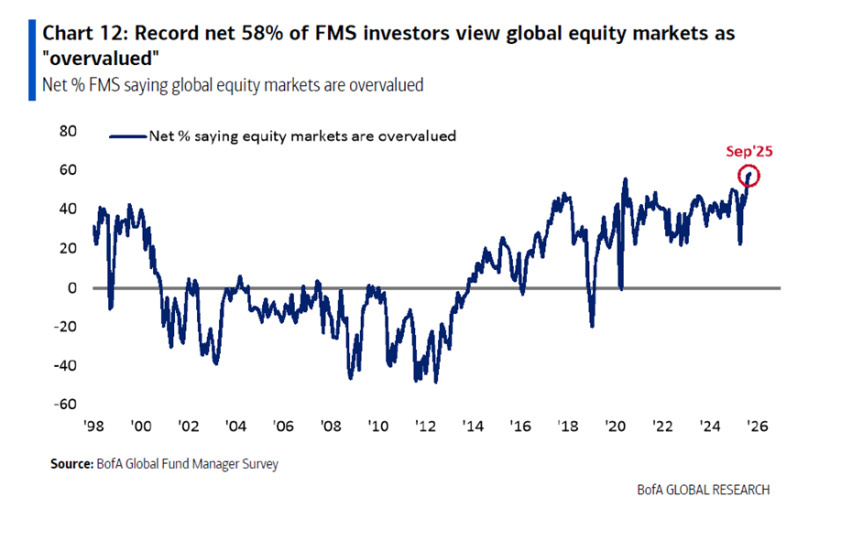

58% of respondents view global equities as overvalued but prefer to remain invested. Overall, we could say that a sense of enthusiasm is emerging, but we are still a long way from levels that could be considered speculative excess.

However, forward multiples for the S&P 500 are returning to near historic highs. While the macroeconomic environment partly justifies current levels, the absence of a significant risk premium, especially in an uncertain environment with real yields still positive, calls for caution.

In conclusion, we are in a complex market phase, in which the narrative of a soft landing is turning into a new expansionary cycle, fueled by falling rates and aggressive fiscal policies. However, the margin for error is narrowing, valuations are high, monetary policy is increasingly politicized, and earnings expectations remain very ambitious because they are mainly linked to developments in terms of productivity gains and cost reductions linked to advances in artificial intelligence, which, if they fail to materialize, could lead to a significant downsizing of expected earnings growth.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.