Forget Big Tech: the real winner of 2026 surprises everyone

12 February 2026 _ News

The week just ended marked an important shift in market sentiment. Not so much in terms of the magnitude of the movements, but rather in terms of the nature of the selling. It was a volatile week, but not in the classic sense of systemic shock or sudden deterioration in fundamentals. Rather, we saw confirmation of the fragility that arises when many things are going well and expectations are too high, a theme we have discussed at length in previous podcasts.

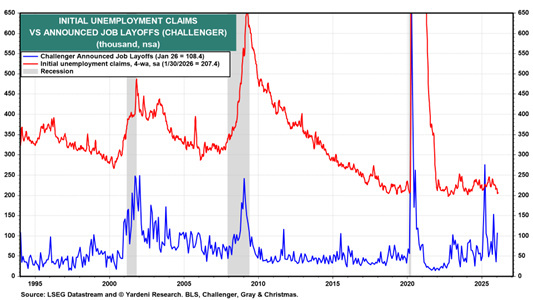

Macroeconomic data in the United States has begun to show a more visible cooling of the labor market. Jobless claims, Challenger layoff data, and JOLTS openings were all worse than expected. None of these indicators, taken individually, point to an imminent recession. But taken together, these signals suggest that employment growth is weakening, even as the economy continues to grow.

We are entering a phase in which growth may remain robust, while the labor market cools, partly due to artificial intelligence and productivity gains. This scenario complicates the traditional reading of the cycle and makes it more difficult for markets to anchor themselves to simple narratives.

On the central bank front, the message has been consistent with this ambiguity. The Bank of England surprised on the dovish side, with an internal split opening the door to a possible early rate cut. The Fed and the ECB, on the other hand, remain in wait-and-see mode.

In this scenario, what really drove the markets was rotation, not panic.

Sales were concentrated in three specific areas: technology and software, cryptocurrencies, and precious metals. Not surprisingly, these are precisely the segments that had benefited from very strong narratives in recent months, and when sentiment changes, they are also the ones that tend to correct first.

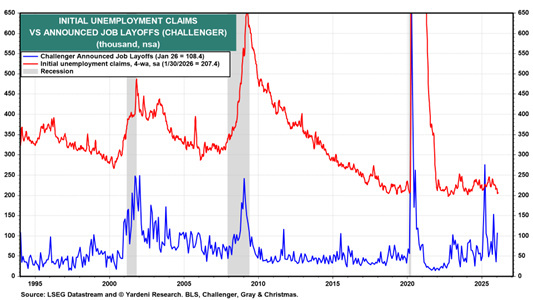

The software sector became the focal point of the week.

This is not yet a collapse in profits, but rather a revaluation of the value of future cash flows. The fear that artificial intelligence will commoditize many software programs has triggered a compression of multiples for all companies in the sector, without exception. At the same time, the “AI narrative premium” is beginning to fade. Today, the market is demanding something different: measurable monetization, returns on capital, and cost discipline. Announcing new investments is no longer enough. In fact, formally solid quarterly results have been severely punished when accompanied by explosions in CapEx.

Amazon is the most emblematic example (but we have seen the same dynamic with Microsoft and Alphabet): growing revenues, a strong cloud business, but a 0 billion investment guidance scared the market. The implicit message is clear: investing more does not necessarily mean creating more value, especially at a time when the cost of capital is no longer negligible.

Cryptocurrencies have experienced a similar, but more violent, dynamic. The collapse of Bitcoin and the spiral of deleveraging have mainly affected retail investors and structures heavily exposed to leverage. However, there are no signs of systemic risk and losses are currently concentrated in specific niches.

Precious metals have also corrected, but this was predictable given the parabolic growth seen in recent periods.

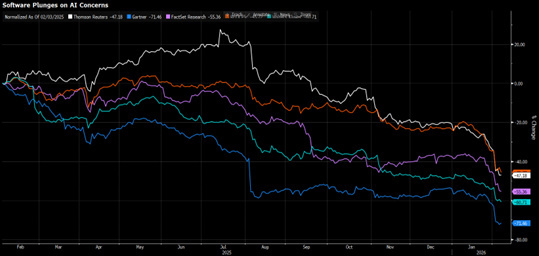

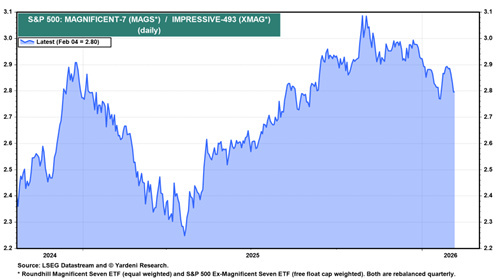

The most important thing, however, is what did not happen. We did not see a widespread sell-off. The broad indices held up relatively well. Since the beginning of the year, the S&P 500 has been relatively flat, the Russell has outperformed, the S&P 500 is at historic highs, and Europe also remains positive. This confirms that we are not facing a bear market, but rather a phase of rebalancing and broadening of leadership.

While the Magnificent Seven are correcting, in silence, a stock emblematic of defensiveness, such as Walmart, has surpassed trillion in market capitalization for the first time, entering the so-called trillion-dollar club. A club historically dominated almost exclusively by technology companies, with very few exceptions such as Berkshire Hathaway.

The point is not the number itself. The point is why the market is rewarding Walmart today. Over the past ten years, the company has quintupled its market capitalization by undergoing a profound transformation: e-commerce, logistics, same-day delivery, automation, and the use of artificial intelligence to improve efficiency and margins. Technology, yes—but used to strengthen a defensive business, not to chase a narrative.

At a time when the market is becoming increasingly unforgiving, this contrast is very instructive: on the one hand, growth models that require enormous amounts of capital and promise long-term returns; on the other, companies with stable demand that demonstrate discipline, visibility, and returns on capital.

This is not an invitation to buy Walmart at a peak price of 45 times earnings. Rather, it is a very clear sign of how market leadership is changing in nature, a sign of how the market is beginning to reward the other 493 companies outside the Magnificent Seven, those that will benefit from the increase in productivity and efficiency made possible by artificial intelligence.

And this is precisely the point we had already discussed: moving away from hyper-concentration on technology and AI, and favoring greater geographical and sector diversification. Europe, emerging markets, small caps: not because they are “defensive,” but because they are less priced for perfection.

The market today is not fragile because fundamentals are collapsing. It is fragile because expectations are still very high, while the cycle is changing. Being an investor today means living with this tension. Accepting volatility as part of the process and not chasing narratives when they are crowded, but questioning where the market is ceasing to pay for perfection.

Positioning ourselves for 2026 does not mean reinventing ourselves, but respecting the point in the cycle where we are now. This is not the time to chase high betas or speculative narratives. It is time to do what always pays off in the long run in the markets: manage risk, preserve capital, and prioritize quality. At this stage, caution is worth more than any forecast. Because market cycles are not a matter of pinpoint timing. They are a matter of rhythm: investor psychology, capital flows, fundamentals, and valuations. And in 2026, that rhythm suggests caution. And remember that every cycle, sooner or later, resets.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.