How you should be positioned with equities and bonds in the final 4 months of the year

31 August 2023 _ News

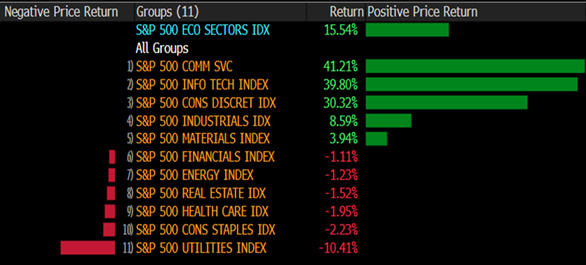

The stock markets have shown positive double-digit performance driven by several sectors which have polarised market performance. This outperformance, concentrated into a few sectors, stems from the fact that these same sectors performed below -35% in 2022, creating great value. Today, however, the value has shifted to the sectors that were left behind, such as utilities/consumer staples and healthcare.

The question springs to mind: How should investors be positioned?

To answer this, let’s briefly describe the main drivers of performance in the coming months.

First and foremost, we have interest rates (white line), which, in recent months, have risen sharply, driven by higher expectations for economic growth (blue line).

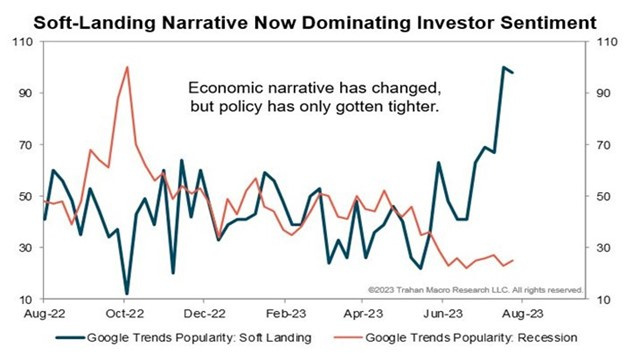

These excessively positive growth forecasts led to an increase in positive investor sentiment. As reported by a Bank of America survey, investors lowered the likelihood of recession and thus increased the expected probability of a soft landing. This phenomenon of investors chasing after the market, who become positive when the market rises and negative when it falls, can also be seen in the most searched words on Google Trends. When the market was at its lowest in October, investors were searching the word “recession”, and no one was searching “soft landing”, and now it's the opposite.

In our opinion, there are multiple reasons why such positive expectations are excessive. Firstly, mortgage rates are at their highest, and even the index representing the affordability for American consumers to purchase a house is at a 35-year low.

Secondly, the excess savings of American consumers have practically fallen to zero, and this will lead to a slowdown in consumption in the coming months. Thirdly, the effects of interest rate hikes begin to weigh on the economy 12 months later, so we'll only just start to see the effects of higher rate in the coming months. Fourthly, the Fed's goal is to manage inflation by slowing down the economy, and it is determined to get there.

So what should investors do?

Investors should continue to maintain composure and not chase after market euphoria. To succeed:

1. For bonds, considering the normal slowdown that we will see in the coming months, it will be necessary to increase the duration of government bonds and even accumulate 5-7 year investment grade senior bonds.

2. For equities, market expectations have risen slightly too high, especially on some overpriced sectors like tech and consumer discretionaries. This leads us to remain constructive and positive in slightly more defensive sectors, such as healthcare/consumer staples and utilities.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.