Inflation: Look ahead, not in the rear-view mirror

19 October 2023 _ News

Investors always tend to focus on the past to extrapolate the future. This approach is also used when analysing inflation, where there is a tendency to focus on recent months without considering that interest rates have now been higher than 4% for 12 months. This pressure from rates on the economic slowdown is the key that will continue to drive the fall in inflation.

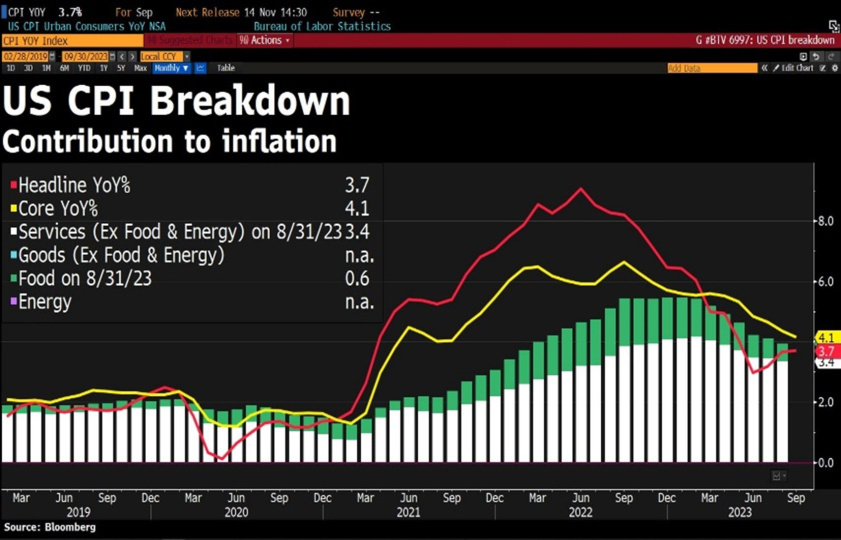

US inflation showed a CPI at +3.7% last week, in line with the previous month, and core inflation at +4.1%, down on the previous month, when it had been +4.3%.

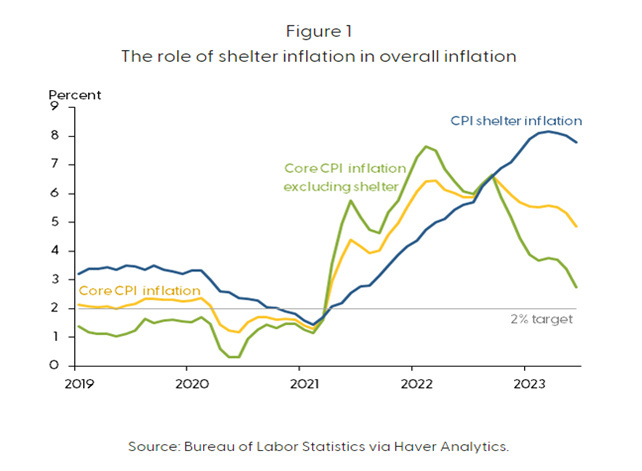

The inflation index continues to be heavily affected by rental prices. This component accounts for around 30% of the index and has increased by 7.1% YoY, showing apparent resistance. I say apparent because there are many reasons why rents inflation is an unreliable indicator for understanding the current US housing market.

First and foremost, we must not forget that the rents inflation component is also created by asking tenants at what price they would be willing to rent, not using market variables. If, on the other hand, we were to look at market variables, the Zillow Index, which tends to anticipate rents inflation, is falling sharply, with values slightly higher than 3%. If we also take core inflation, which excludes rents, the index stands at around 2.9%.

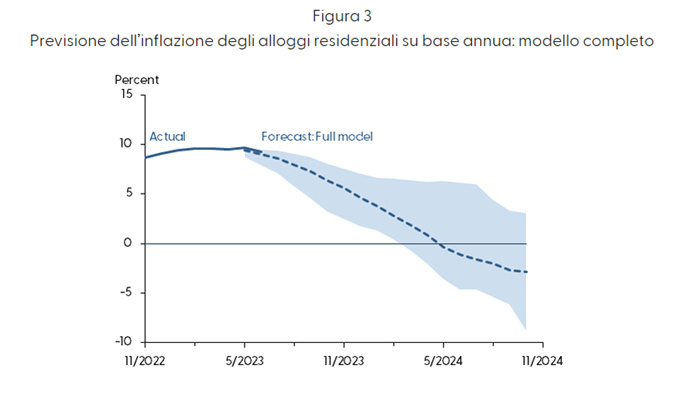

Secondly, a study by the San Francisco Fed a few months ago showed how rents inflation on an annual basis would continue to slow down until the end of 2024 and could even become negative by mid-2024. This model assesses the evolution of rental prices on the basis of different monthly market figures: Zillow Home Value Index, Zillow Observed Rent Index, CoreLogic’s Single-Family Rent Index, S&P/Case-Shiller National Home Price Index, etc. This would represent an abrupt inversion in the trend of rents inflation, with significant implications on the behaviour of overall inflation.

Therefore, with high interest rates, we could see a deflationary effect in the coming months which would be the most serious contraction in rents inflation since the global financial crisis of 2007-2009.

In conclusion, this week we will hear from various members of the Fed and also Jerome Powell, where the market focus remains on how many rises there will be. We believe that the current rates are already weighing on the economy, as shown by the slowdown in bond issues and the drop in lending to businesses.

So what should investors do? As always, look ahead, and the only way to do so is to follow the value.

For equities, we continue to opt for defensive sectors at a valuation discount: utilities, healthcare, and consumer non-discretionaries. Curiously, since 1990, every time that utilities and consumer non-discretionaries have underperformed the equity market in a year by more than -20%, in the next 12 months, the equity market showed much lower average performances than the historical and slightly positive performances.

For bonds, we prefer longer durations over quality, especially for government issues, as a result of the economic slowdown caused by the rates and because of the reduction in inflation that we will see in the coming months.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.