July 2024: Preparing for the unpredictable

08 August 2024 _ News

"You can't predict, but you can prepare."

In a financial world characterized by uncertainty and volatility, the wisdom of Howard Marks, co-founder of Oaktree Capital Management, offers a beacon of guidance.

"You can't predict, but you can prepare" represents one of his most famous quotes, in which Marks emphasizes the impossibility of accurately predicting financial market trends, but highlights the importance of strategic preparation that includes realistic expectations, intelligent portfolio allocation and even more important, sound mental discipline.

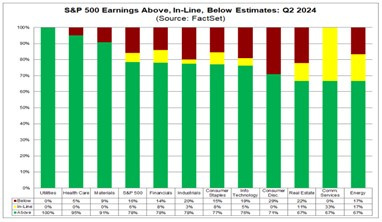

One of the key aspects of preparation is understanding expectations about the earnings cycle and the implications for market valuations; the two key variables that drive equities over the long term. Currently, after about 75 percent of S&P 500 companies reported results for the second quarter of 2024, about 80 percent of U.S. companies reported earnings above estimates, with an average earnings per share surprise of between 4 percent and 5 percent above expectations.

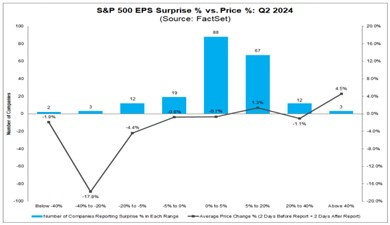

However, price reactions were not uniformly positive, with many companies that, despite exceeding expectations, did not see a corresponding increase in share prices.

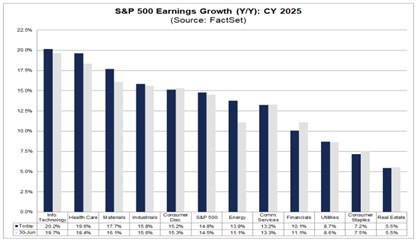

This phenomenon is explained by the high expectations already embedded in the market, making it difficult to impress investors. The revision of expected earnings for the future shows a slight increase for estimates on the third quarter, but a moderating trend for the following quarters of the year, suggesting overly optimistic expectations and thus a downward revision process that could continue. After an 11 percent earnings growth expected for 2024, the market consensus today also expects another year with very high growths (+15 percent) and significantly above historical averages for 2025. We continue to believe that these growths are overly optimistic and believe them to be incompatible with a deteriorating macro picture combined with a high interest rate environment, which historically have been accompanied by earnings growths below averages, certainly not above.

Earnings season for large technology companies is also beginning to run up against this backdrop of excessive expectations and an increasingly challenging basis of comparison (very strong prior quarters), which is resulting in significant corrections in those stocks that seemed to be untouchable and had contributed significantly to the rise of the indexes since the beginning of the year. Valuations finally seem to be returning to relevance and the market is beginning to adjust to a new narrative of economic slowdown with an inevitable compression of multiples.

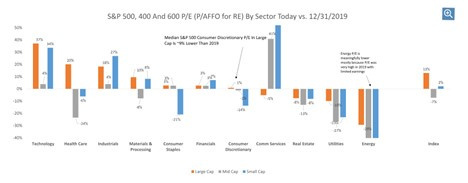

From a valuation perspective, markets in general, as well as a great many sectors within the market, have now returned to pre-pandemic levels. Some of these sectors are trading at substantial premiums relative to 2019, for example, the technology and consumer services sectors are at a 40% premium.

Sector analysis reveals, however, that not all parts of the market are overvalued. Sectors such as energy, utilities, and real estate have attractive valuations by historical standards. The health care sector, if we exclude large companies with high valuations, offers significant opportunities, especially among small and mid caps. We can make the same argument with small caps within the nondiscretionary consumption sector, which appear extremely attractive from a valuation perspective. Non-discretionary consumption, utilities, with a focus on historical companies that pay steady dividends, represent an attractive defensive option. Real estate, influenced by interest rates, could benefit from future rate cuts, making it a sector to monitor closely.

Discretionary consumption: a sector in trouble

The consumer discretionary sector is facing significant challenges. Leading companies such as Nike and Lululemon have seen major corrections due to slowing consumer spending in Europe, America and China. The automotive and affordable luxury sectors are also experiencing declining demand, highlighted by companies during commentary on quarterly results, reflecting global economic difficulties. These are sectors to monitor closely because weakness could create attractive valuation opportunities on companies characterized by high returns on capital and exceptional leadership position.

Technology sector

Despite optimism for the long-term growth trend in the AI and chip world, high valuations require a great deal of caution and, above all, patience. We believe prices do not realistically reflect future growth prospects and await corrections to re-enter a key sector within the indexes.

Energy and utility sector

The energy and utility sectors offer attractive opportunities. Valuations in the energy sector are still relatively low from historical highs, while utilities, due to their stable dividends, are a defensive choice whose valuations have returned to historical averages. These sectors could benefit from any global economic slowdown and future interest rate cuts.

Real estate sector

Real estate is another sector to watch. With expectations of falling interest rates, real estate, which is still one of the sectors with the most negativity, could see a recovery instead. Current valuations are attractive, especially considering the potential for recovery in the coming years. Investors should consider exposure to this sector as part of a diversified strategy.

Health sector

The traditional health care sector, excluding large companies with inflated valuations, offers many significant opportunities. Companies with solid fundamentals and reasonable valuations can be a good investment in an uncertain market environment. Post-pandemic normalization is returning many of these companies to sustainable levels of profitability.

Non-discretionary consumption

The non-discretionary consumer sector has seen a significant correction in valuations, one of the most violent in history. These companies, which produce basic necessities, offer stability in times of economic uncertainty. Current valuations are low, making this sector an attractive option for investors seeking safety and stable returns.

Bonds: interest rates and spreads

In the bond sector, the focus is on interest rates and spreads. The experience of Switzerland, which has already cut interest rates twice, offers important lessons for the rest of the world. The reaction of the Swiss bond market, with a significant drop in yields, suggests that other central banks may follow a similar trajectory, and rates may also behave similarly, with declines far more violent than expected.

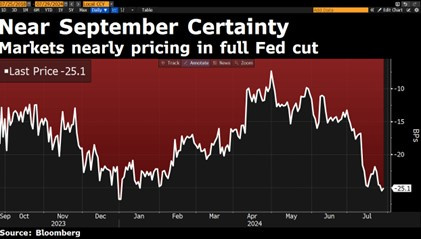

The FED (and also the ECB) may be forced to cut rates in response to an economic slowdown, with significant implications for global financial markets. The market today expects an initial 25 basis point cut in September, but there are already those who are beginning to think that the cut could be as much as 50 basis points.

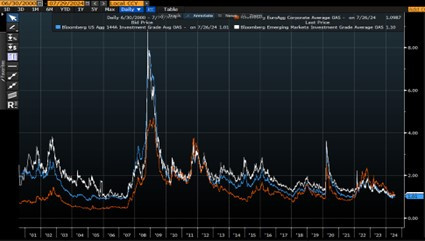

Bond spreads, particularly investment grade spreads, are a key indicator of economic health. Spread compression or widening reflects market expectations regarding credit risk and economic stability. Identifying opportunities in the bond market requires careful analysis of these spreads and global monetary policy. Currently, spreads are highly compressed, but widening would be physiological if the macro picture deteriorates.

Conclusion

In conclusion, Howard Marks' approach to preparation rather than prediction remains a viable strategy in a constantly changing market. Adopting a prudent and disciplined mindset, with a focus on valuations and long-term opportunities, can help investors successfully navigate through market uncertainties. Identifying undervalued sectors and maintaining a long-term perspective are essential keys to building a resilient portfolio in times of volatility and uncertainty.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.