Massimi storici, Nervi tesi: cosa c'è davvero dietro il Rally di fine anno

11 December 2025 _ News

We begin the last month of the year with an almost schizophrenic feeling. On the one hand, the S&P 500 continues to hover close to historic highs, just below the peak reached on October 29. On the other hand, the widespread perception is that the market has lost some of its momentum, is struggling to find a clear direction, and is driven more by nerves than conviction.

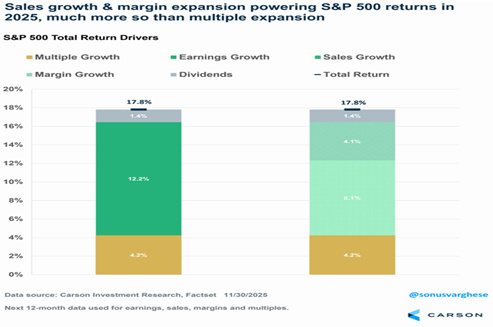

However, if we look at what has really driven this year's performance, the picture is less fragile than it seems at first glance. The index has risen by around 16% since the beginning of the year, and the most significant part of this rise comes not from multiples, but from earnings.

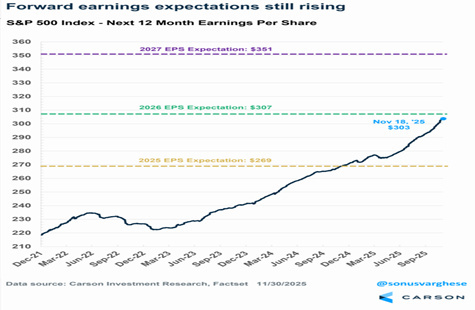

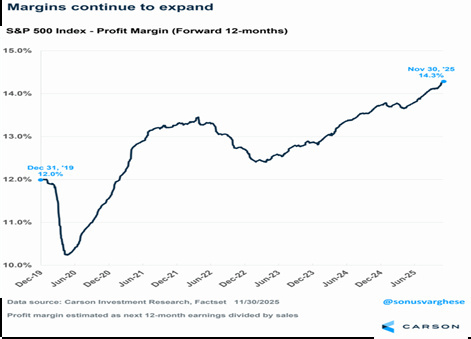

The expected earnings per share for the next 12 months of the S&P 500 is up more than 12% since the beginning of the year, with expected operating margins reaching a new all-time high of around 14.3%.

In practice, if we break down the S&P 500's return, we find that about three-quarters of the 2025 performance was generated by earnings, rather than simply by expansion in valuations and multiples.

On the macro front, the Federal Reserve remains the focus of attention. The US economy still appears solid, with GDP growth close to 4% between the second and third quarters, but the labor market is sending mixed signals.

Official data is distorted by the shutdown, while private data (such as ADP) shows a weakening: for the first time since the pandemic, the quarterly average for employment has turned negative, with losses concentrated in small businesses and certain regions such as the Northeast. Larger companies continue to hire, while those with fewer than 50 employees are reducing their workforce. Unemployment is rising among young people aged 20–24, a group that is struggling to adapt to the new skills required, partly due to the impact of AI. Initial claims for benefits remain low, a sign that layoffs are not skyrocketing, but the time it takes to find a new job is getting longer.

In this context, Fed funds futures are currently pricing in a 90% probability of a 25 basis point cut at the December 10 meeting. The problem is that the Fed will have to decide with partial visibility: a significant portion of the employment and inflation data will arrive late, and the Committee will be forced to rely more on alternative statistics, surveys, and private indicators. This increases the risk of internal dissent and makes the narrative of “certain and continuous cuts” that had supported the markets until a few weeks ago less linear. The central bank finds itself at a crossroads: cutting too much risks fueling suspicion that it is letting go of its 2% inflation target; cutting too little, or not cutting at all, could be interpreted as indifference towards a labor market that is losing momentum precisely in the most fragile areas of the productive fabric.

On the tariff front, here too the reality is less monolithic than newspaper headlines suggest. At the beginning of the year, the most discussed scenarios spoke of effective tariffs in the 15-20% range, with a potentially very heavy impact on corporate margins. Today, however, the average effective rate is around 12%, which corresponds to the “best” scenario hypothesized by analysts. Companies have done what they always do when hit by a regime change: they have adapted. They have reoriented their supply chains, reducing their direct dependence on China and making more efficient use of agreements with Canada and Mexico; they have passed on part of the higher costs to final prices; they have used automation and, increasingly, artificial intelligence to improve productivity and reduce pressure on labor costs. It is not a painless process, but so far it has worked. Sales growth remains robust, at around 8%, with a very significant contribution from companies with strong international exposure, and margins are not only holding up but growing.

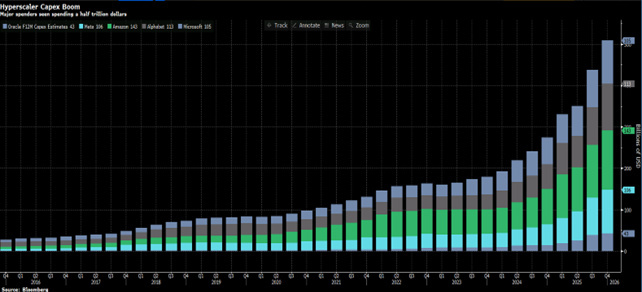

Where the narrative has become truly more complicated is on the topic of AI. For months, we lived in an almost perfect story: a clear leader on the hardware front, Nvidia, a small group of hyperscalers racing to conquer the new frontier of digital infrastructure, an avalanche of capital directed toward data centers, GPUs, and large language models, expanding multiples, and the feeling that we were witnessing a new “Internet story.” . In recent days, this linearity has been broken. The launch of Gemini-3 by Google, which runs on proprietary TPU chips instead of Nvidia GPUs, reminded investors that the competitive advantage in this sector is real, but not untouchable. Other players – such as DeepSeek – have presented models described as equal to or superior to the latest generations of the big American players. At the same time, doubts have begun to circulate about the quality of hyperscalers' profits, starting with how investments in AI chips and infrastructure are amortized.

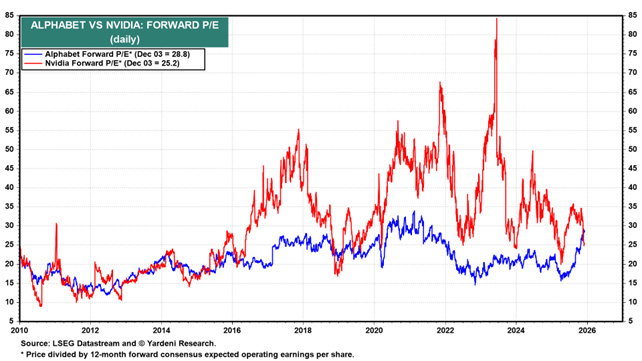

The result of this change in perception was a violent repricing: Nvidia's forward P/E (i.e., valuation multiples) quickly compressed, while some competitors—such as Google—saw both multiples and market narrative shift in their favor. But the key point for investors is another: the race is long, and it is by no means certain that today's leaders will be tomorrow's winners.

The revolution is real, the investment figures, capex and impact on productivity are real, but excessive valuations and overly “perfect” stories remain fragile by definition. We are only at the beginning of technological development related to AI, and consumer adoption of artificial intelligence has barely begun. We continue to see many companies operating in more traditional businesses as the next winners in the AI race, all of which can be found on the market today at very reasonable valuations.

Amidst this barrage of confusing data, narratives about AI, and the Fed's uncertainty, there remains one point that, in my opinion, should be kept in mind. The S&P 500 is close to its highs today not because “it always goes up,” but because earnings have met expectations so far. At the same time, however, risks are increasing: in the labor market, in the concentration of returns on a few mega-caps, in the possible overconfidence in the Fed's ability to perfectly manage a very delicate balance between inflation, employment, and financial stability, and in the expected earnings growth for the coming years. In phases like this, the risk is not so much “staying invested” as how to stay invested. It makes little sense to give in to catastrophism and completely eliminate equity exposure, ignoring the strength of earnings; but it makes even less sense to concentrate the portfolio on a few stocks or segments dominated by narrative, assuming that nothing can go wrong.

The discipline required at this stage of the cycle is that of a mature market, with particular attention to earnings quality, margin sustainability, and above all, valuations. Now more than ever, great caution is needed in overweighting the most “fashionable” stories. Clear risk management rules, a liquidity buffer in the portfolio, and the correct time horizon are needed, without ever chasing short-term maximums.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.