Narrativa vs realtà: la Geopolitica Rallenta il Rally?

16 June 2025 _ News

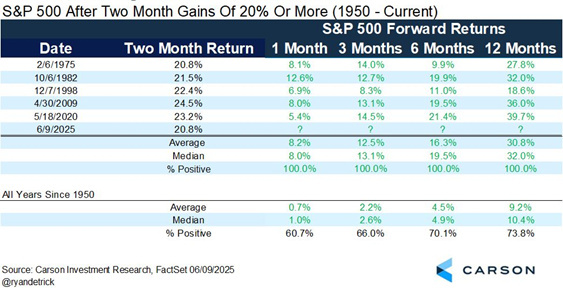

While the media climate remains pervaded by gloomy forecasts, the market continues to demonstrate extraordinary resilience. Global equity indices, after a very intense upward phase, are moving near all-time highs. The S&P 500 has put up a return of more than 20 percent in just two months-one of the best two-month rallies ever.

History teaches us that after these rises, markets usually tend more to consolidate and rise further, rather than crash, even recording rises above historical averages in the following months.

Those who maintained rationality, as suggested in previous podcasts, ignoring the avalanche of apocalyptic headlines about tariffs, stagflation, debt, and systemic crises, today find themselves with a portfolio that is more solid and consistent with their goals.

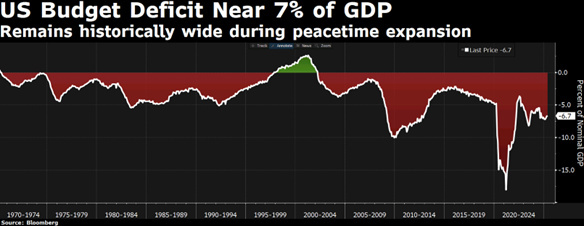

The tariff issue, though still to be resolved, actually seems to be no longer given much consideration by the market, which is now looking more closely at the fiscal front, with Trump's “Big Beautiful Bill” always in the spotlight, and a number of implications that go far beyond political controversy. It is estimated that the proposal could increase the federal deficit by about .5 trillion over ten years, while some estimates push the figure up to trillion.

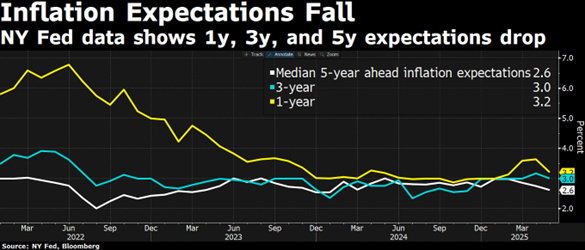

Still, U.S. Treasury yields have fallen in recent days: the 10-year has returned to 4.35 percent, aided by a slowdown in some macro indicators-including ISM services and ADP private employment data-that appear to be cooling inflation expectations, as confirmed by the latest surveys.

In fact, the May CPI showed a much less aggressive dynamic than expected by coming out below expectations, showing that the much-discussed tariffs, seem for now, to have had no particularly significant inflationary impact. This dismantles, at least temporarily, the stagflation scenario that had been feared by many.

Another often overlooked but crucial element is the resilience of the labor market. New business registrations in April remained near all-time highs despite volatile markets and geopolitical uncertainty. This is a sign of structural vitality in the real economy. And while the services ISM fell below the 50-point mark, signaling possible contraction, PMI indices returned to expansionary levels. The divergent readings suggest an economy that is more complex to decipher, but far from recessionary.

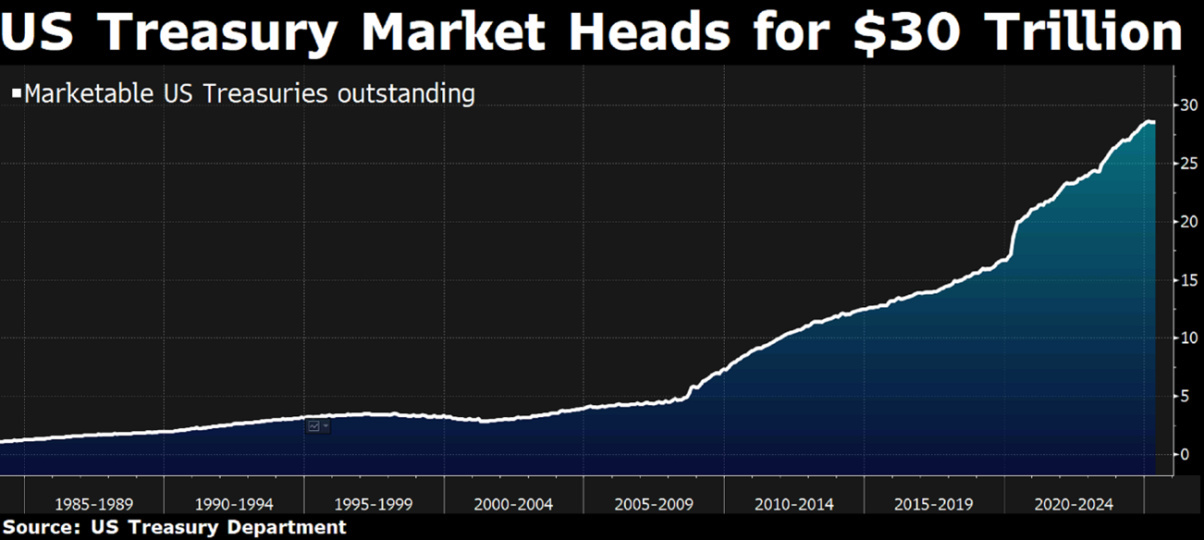

The truth is that the bond market is learning to live with growing public debt.

This is also thanks to the pending structural reform in banking regulation. As mentioned earlier, we expect that in the coming months the issue of deregulation-one of the central points of Trump's political agenda-will take center stage and become the dominant market focus, with very positive potential impacts. The Trump administration could, for example, in this regard push for a change in the Supplementary Leverage Ratio (SLR), or an indicator that requires large U.S. banks to maintain a certain minimum level of capital relative to their total exposure to ‘supplementary’ leverage, essentially allowing large U.S. banks to buy Treasuries to a much more significant extent than they do now. It would, in effect, be a huge implicit support for the bond market - a kind of next-generation Quantitative Easing, but on a bank and regulatory basis.

Another dynamic to note in the markets is the continued weakness of the dollar, one of the most talked about issues in every European asset manager's investment committee, with the euro-dollar exchange rate reaching 1.16, levels not seen since 2021.

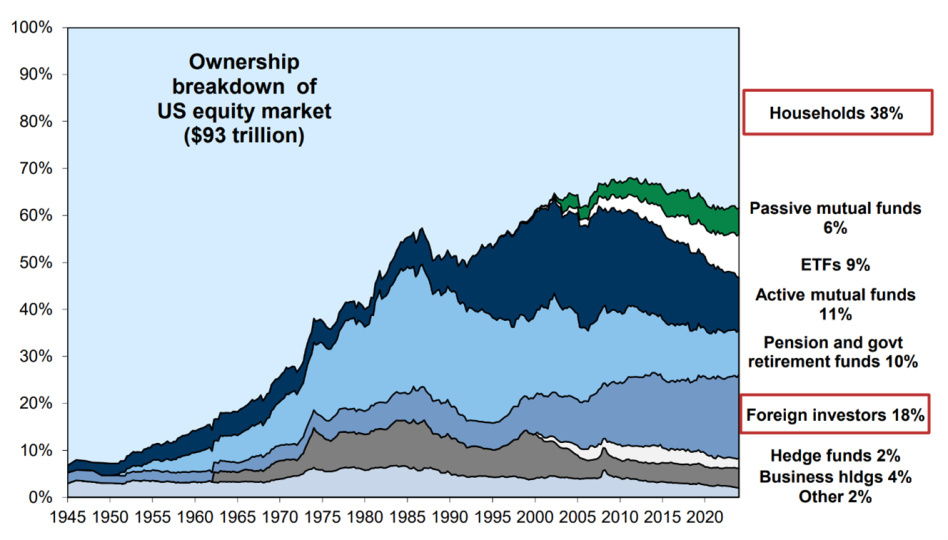

The dominant narrative wants the recent weakness of the U.S. currency to be the fault of Trump's “erratic” policies, growing distrust of U.S. assets and, of course, the usual bogeyman of “de-dollarization.” But the reality of currency flows suggests another, much more interesting and structural key: large global pension funds as well as all European investors, are gradually increasing hedging on currency risk. For years these traders invested in the exceptional growth of U.S. equities and then bought dollar assets and typically kept the exchange rate open, because in times of crisis the greenback tended to strengthen by offsetting losses in the equity markets. But now this pattern no longer works: in several recent “risk-off” phases, the dollar has not strengthened as expected, exposing global portfolios to double losses. Hence, the potential initiation of a giant currency rebalancing process that could put further bearish pressure on the U.S. currency.

The week just past will also unfortunately be remembered as one where geopolitical tensions return to the forefront. After a period of relative calm in the markets, a military action by Israel against strategic targets in Iran broke the reassuring narrative that had fueled Wall Street's recent positive momentum by causing all stock indexes to correct on Friday, with oil rising violently.

In a military operation destined, at the very least, to trigger a dangerous new escalation of tensions in the Middle East, Israel has launched a “preemptive strike based on high-quality intelligence” against Iran, “with the aim of damaging the nuclear program” of the Islamic Republic on the charge that Iran is violating its nuclear nonproliferation obligations.

U.S. President Donald Trump said he was informed in advance of the Israeli operation, but made it clear that the U.S. was not directly involved.

Meanwhile, the U.S. administration continues to closely monitor the situation, concerned about possible retaliation by Iran, and Trump reiterated that the United States stands ready to defend itself and Israel in the event of retaliation by Iran.

We monitor the evolution of events but have now learned how cynical markets are. The truth is that markets absorb narratives in the short run but reward fundamentals in the long run. And net of all legitimate concerns--duties, debt, geopolitics--investors who stay the course are the ones who perform best.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.