Pharus Outlook 2021

17 December 2020 _ News

Effects of the crisis

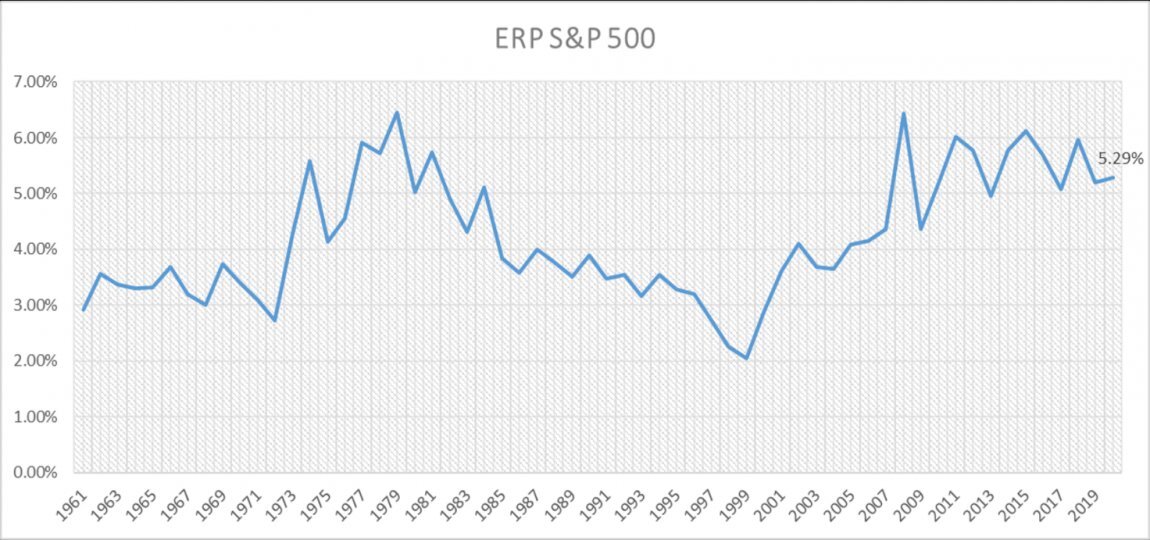

There is just one ingredient that can give the necessary boost to the 2021 portfolio. And that is the stock market, which is in the initial phase of a new bullish cycle. Just take a look at the equity risk premium to get a clearer picture, with equities now earning 5.29% more than bonds. A differential that has never been so high in the last 50 years.

"In addition, there are three important drivers to support the stock market: expectations of earnings growth, fiscal stimuli and the flow of positive news, particularly with regard to the development of the coronavirus vaccine", says Stefano Reali, manager of Pharus. "Making predictions about where the stock markets will end up is not an easy exercise, but we can try, especially for the S&P500, which could reach as high as 4,000 points", requiring a rise in current prices of about 10%. And, at least until now, the trend not only of Wall Street, but also of the other main international financial markets, is confirming the thesis that there are no alternatives to shares. So much so that "in the last few months we have seen important sector rotations, with a strong recovery in the most cyclical sectors", underlines Reali. "Energy, finance, industry and raw materials, for example, are the sectors that have recorded the best performances in America. The fact that other stocks and sectors are contributing to the growth of the stock markets is a positive and healthy factor, which confirms our vision of a new bullish stock market cycle".

The economic scenario

Analysing the macroeconomic context, we can identify a common trend that is characterising all major countries, from Asia to Europe, to the United States. Governments' responses to the coronavirus pandemic are following the same path, with the imposition of restrictive measures that characterised much of the first half of 2020 and now, after a short summer break, also the third and fourth quarter. Similarly, the effects on the economy are also more or less homogeneous: the average growth expected for the end of the year is -7%, with some countries that will behave worse, such as Spain (-11.6%) and Italy (-9%), as against China that will close 2020 in positive territory. For 2021, on the other hand, a strong recovery is expected, with an average GDP increase of +5%, while in 2022 the estimates are for growth of 3%.

Interest rates

On the bond front, Treasury yields fell from 2% to a minimum of 0.50% in 2020 and then stabilised at around 90 basis points in recent months. The last 40 years have seen a well-defined downward trend in US rates, which are likely to continue to travel at very low levels for a long time to come, for three main reasons. The first is inflation, which is unlikely to rise again. The high level of unemployment, the high output gap (difference between real and potential GDP), low expectations for the cost of living over 5 years, globalisation and digitisation, are all factors that have (and will continue to have) a downward effect on prices, keeping inflation well below 2%. But the level of rates is destined to remain at low levels also due to the ageing of the population, with a consequent increase in the demand for savings, and a high level of debt, both public and private, which makes the prospect of an increase in rates by central banks far from likely.

Company earnings

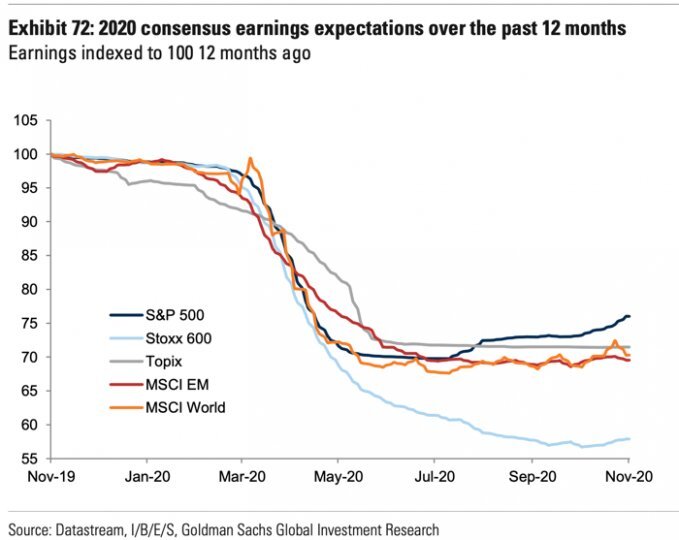

In a scenario of rates reduced to zero, the only way to generate returns is through the stock market, which has just entered a new bullish cycle. This has been shown by corporate earnings, whose curves are rising in every corner of the globe. "It is a significant element, because the change in the earnings cycle has always historically marked the official passage from a market in recession to one in expansion", underlines Reali. "And the change in the earnings cycle that we are experiencing in recent months is incredible, with America in the third quarter recording a drop in earnings of 6.5% compared to the estimates at 30 September that predicted a 21% drop. This is an important recovery, which should bring the year-end balance sheet to -14%, the best figure in the last 9 recessions".

Added to this is the additional positive element of earnings sentiment (the difference between upward profit revisions and downward revisions), with analysts increasing their estimates of companies. And once again, US market earnings are expected to reach 0 per share in 2021, a higher level than in 2019. "In plain language, the market is telling us that 2020 was only a parenthesis, which can now be said to have been closed" concludes Reali.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.