S&P 500: Technical Rally or Fundamental Signal?

05 May 2025 _ News

The week that just ended offered interesting insights into the underlying dynamics moving financial markets at this particularly sensitive stage. In the absence of any major new developments on the tariff front, it was macroeconomic data and quarterly reports that drove investor sentiment. But the real common thread remains one: the increasingly concrete perception that there is a “Trump Put.”

Let's start with the equity markets with the S&P 500 (in dollars) being about -7 percent from its all-time high, despite the tariff turmoil of the past two months, the resilience of the index is surprising. After a maximum decline of -20%, we have seen a +17% rebound from the April 7 lows.

A move that seems to confirm the pain threshold of the current Trump administration: as soon as the market went above -20%, easing on tariffs was announced, a sort of implicit statement to the markets that the presidential put will be exercised around the S&P500's 4850, and that it will therefore be difficult to see, at least in the short term, new lows below this level.

In the bond market, the behavior has also been similar. When 30-year long-dated Treasuries touched 5 percent, it took little to generate a relaxation of government rhetoric. Today, 10-year rates are back to 4.30 percent, while 30-year rates are hovering around 4.80 percent. Signs that markets have interpreted well.

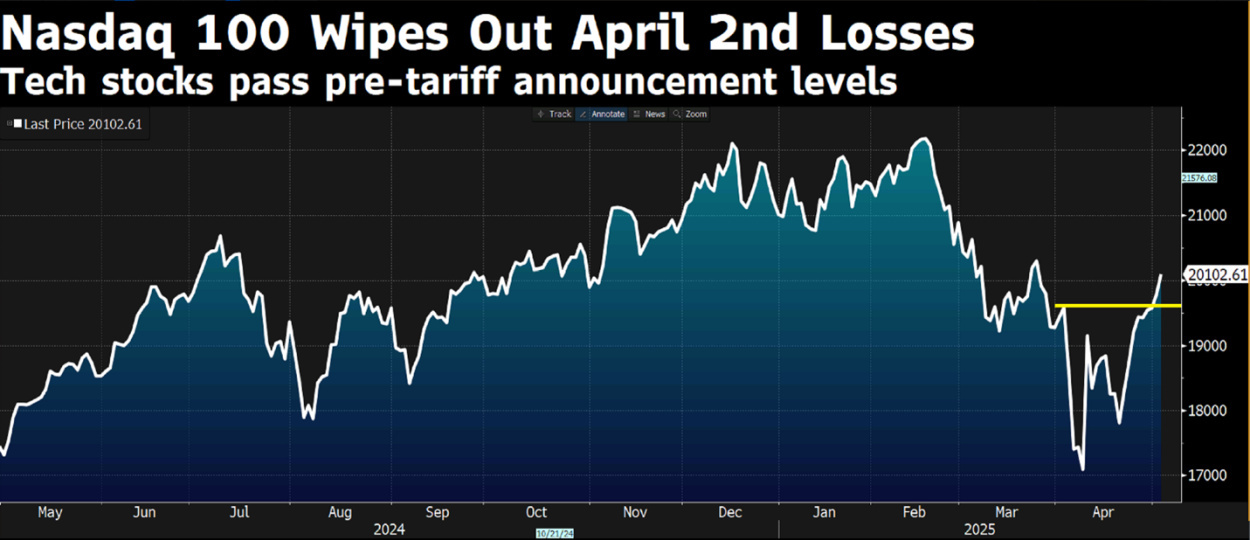

On Friday, May 2, the S&P 500 in fact recorded its first consecutive nine-day winning streak since November 2004. While the index has had many streaks of seven and eight consecutive up days in recent years, the nine-day winning streak had not been seen in 20 years, until Friday, with the S&P 500 Index and Nasdaq now surpassing their close on Liberation Day, just before Trump announced his reciprocal duties on the world.

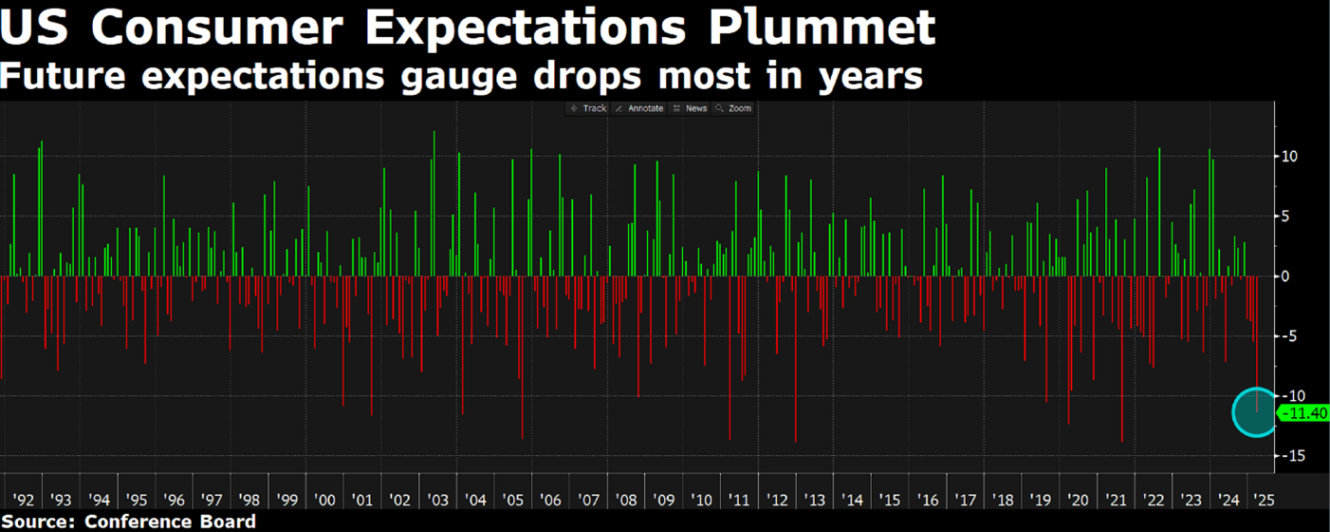

Interesting to point out that the equity recovery comes just as the first signs of economic cooling are appearing. Indeed, it is on the macro data that the least good news comes, with recent economic reports increasing the likelihood of a recession in the US, according to Polymarket.com. Indeed, examining the latest macro data shows Consumer Confidence dropped to an almost five-year low, and also not encouraging are the manufacturing data with the April ISM falling to 48.7, this is the second consecutive reading below 50.0.

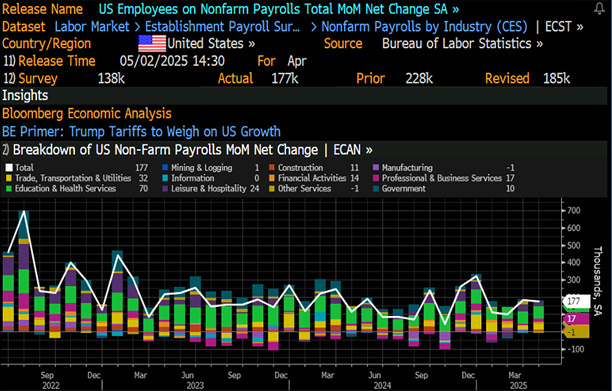

Mixed data also come from the labor market, with higher-than-expected claims for unemployment benefits but better payroll data for the nonfarm sector and an unemployment rate at 4.2 percent in line with expectations, suggest a still resilient labor market.

Following this data, the Citi Economic Surprise Index (CESI), an indication of economic surprises shows a value returning to negative at -13 after having just risen, from -20 in mid-April, above the zero line in recent weeks.

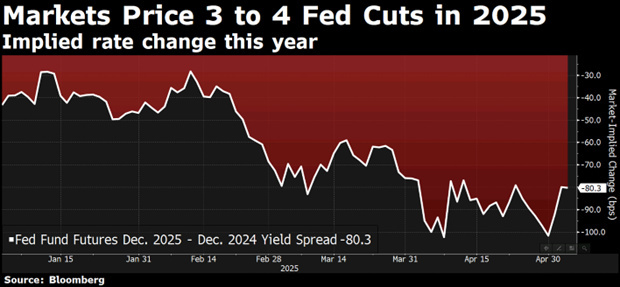

Following the latest set of economic indicators, federal funds rate futures show that the market expects four to five 25 basis point rate cuts in the next 12 months, which helps explain why the stock market has held up well in the face of the latest set of relatively weak economic indicators.

Other support for equity markets also came from the earnings season with three of the magnificent seven (Alphabet, Meta, and Microsoft) returning to magnificence and surprising the markets when results were announced.

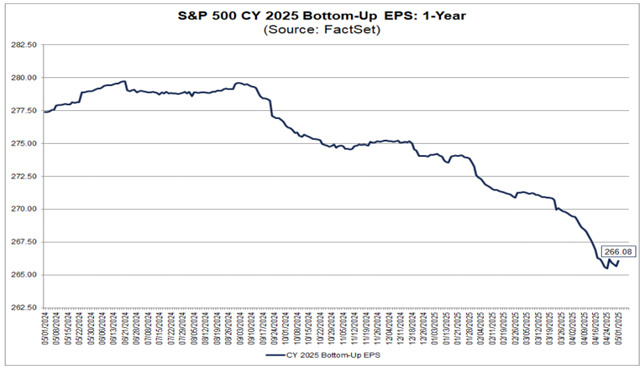

More generally From a corporate earnings perspective, the first quarter season is turning out to be less bad than expected, but with a clear message: the worst, if it comes, will be in the second half of the year. We are at 72 percent of S&P 500 companies reporting so far, beating estimates in 75 percent of cases, with analysts raising estimates for the first quarter, but instead continuing to d lower expectations for the second, third, and fourth quarters, with the estimate for the full 2025 falling today to 9.5 percent from the 15 percent expected at the beginning of the year.

However, it is precisely in the earnings season that an element of resilience should be sought. Large companies, especially in the technology, health care, and consumer sectors, are showing remarkable resilience to new scenarios. Margins, while under pressure, are also defending themselves better than expected, and operating cash flow remains robust in many cases. Should the trade war find a balance, it is likely to expect a rebound in business confidence and, with it, a pickup in investment.

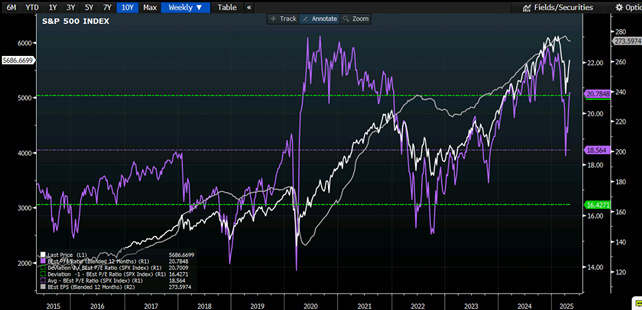

Finally, a look at valuations: the rebound in the stock markets was driven by a reassessment of multiples rather than an upward revision of the outlook on earnings. The forward P/E of the S&P 500 fell from 22.5 to 20 while that of the magnificent 7 fell from 30 to 22. Valuations closer to historical averages and consistent with a normalization scenario, but still not attractive if we really were to approach a recessionary phase.

Valuation-wise, European indices continue to be more attractive, trading at 14 times prospective earnings over the next 12 months, perfectly in line with the historical average of the past 10 years, just as in valuation average we find Chinese indices trading at 12 times earnings.

On the macro front, the coming weeks will be crucial. Data on retail sales, inflation, and ISM will provide clearer indications of the state of domestic demand and the degree to which tariff strains are being transmitted to the economic system. While the Fed appears to be leaning toward gradual cuts, it needs confirmation that inflation will not return and that growth will hold up.

In sum, we are in a fragile equilibrium, the market seems to have learned that Trump will intervene before he loses control of the market, an attitude that may temporarily reduce perceived volatility but does not eliminate structural uncertainties, especially if, as seems likely, economic growth begins to feel the brunt of tariffs in the second half of the year. The Fed is scheduled to meet this week, but for now it remains in the background, ready to intervene, but not yet convinced; with the indexes briefly returning to the valuation mean, selectivity will remain key.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.