Sideways markets, but tensions on the move

20 November 2025 _ News

It has been a week of ups and downs between risk-on and risk-off on the markets, ending with indices virtually unchanged and indices on short-term technical support levels.

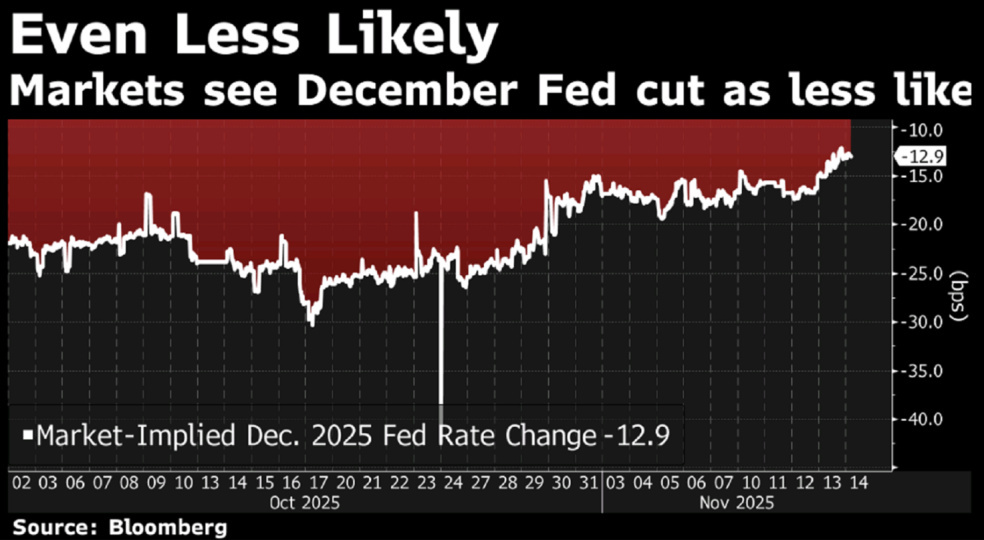

On the one hand, sentiment is improving thanks to the end of the longest government shutdown in US history, which lasted 43 days and should bring some clarity to the suspended economic data. However, investor sentiment remains uncertain and the probability of a Fed rate cut in December has fallen from 70% to around 50% following recent comments from some more cautious board members, such as Bostic and Collins.

In short, the market finds itself at a crossroads: relief at the reopening of the government, but still fears about inflation, economic trends, monetary policy, and above all, high valuations.

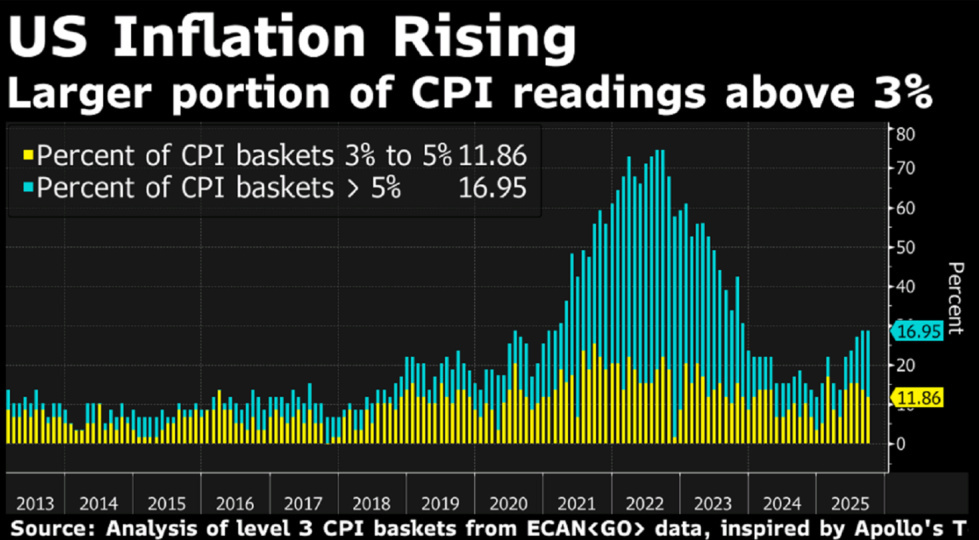

Official inflation data are still incomplete, but the picture emerging from private indicators is not reassuring. Essentially, inflation is not accelerating, but neither is it falling back toward the 2% target.

This persistence, together with a difficult reading of labor market trends, is fueling the Fed's caution. Williams, president of the New York Fed, has spoken openly about the possibility of “returning to asset purchases” to stabilize the overnight financing market, which is showing new tensions. This language effectively evokes the possibility of a return to quantitative easing. As a result, Treasury volatility, as measured by the MOVE Index, has risen significantly, signaling instability and potential risk of tightening in the bond markets.

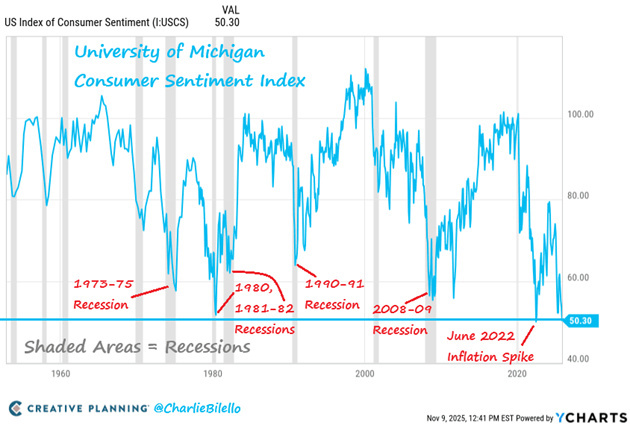

Consumer sentiment data also tells a contradictory story. The University of Michigan's consumer confidence index fell to 50.3, the second lowest level ever recorded since 1952.

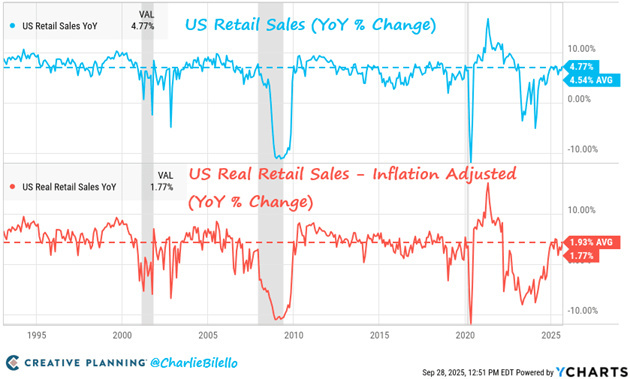

Yet, during the same period, retail sales grew by 4.8% year-on-year, well above inflation, a sign that household spending remains strong.

It is a paradoxical but recurring dynamic in the final stages of the cycle: consumers say they are pessimistic, but continue to spend.

A sort of “macroeconomic denial” that often precedes a slowdown, because behind the stability of consumption lies an increase in consumer credit and a decline in available savings.

But the main topic of debate on the markets was once again artificial intelligence, with investors seemingly beginning to question not so much revenue growth as the physical and financial sustainability of this race. Behind the high-tech narrative, surprisingly low-tech problems are emerging: there is a lack of electricity, permits, and infrastructure capacity to build enough data centers to support the coming demand.

One example: AI infrastructure provider CoreWeave has warned that it will not be able to complete its new data centers on schedule in the fourth quarter, postponing them until 2026.

The result is that the market has begun to price in, for the first time, the possibility that physical limitations will slow down digital growth. Microsoft CEO Nadella himself stated that “the problem is no longer chips, but the ability to connect them.” In other words, we have excess GPUs but few data centers ready to be connected to the network.

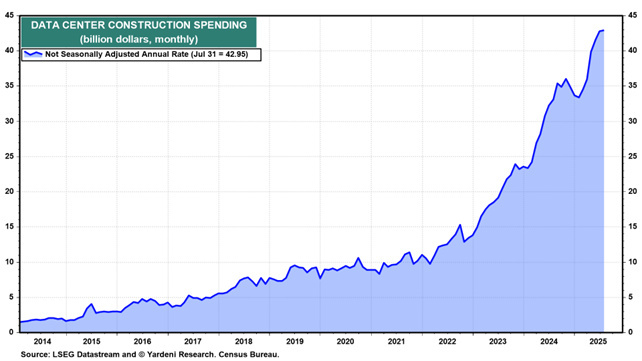

Spending on data center construction reached billion per month, double last year's figure and four times the level in 2023.

Meanwhile, the average cost per square meter has risen from 5 to nearly ,000.

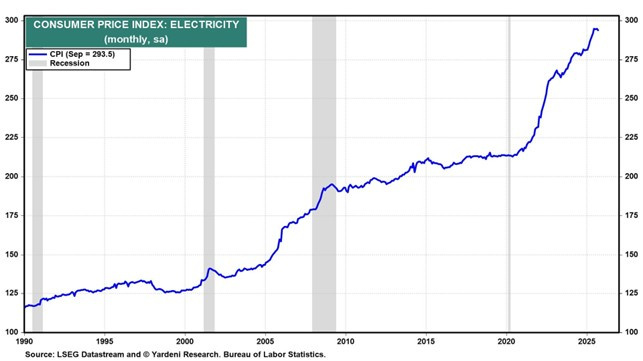

And it's not just a question of cost: today, US data centers consume around 183 terawatt hours per year, equivalent to over 4% of national electricity demand. By 2030, this figure is estimated to more than double, reaching 426 TWh.

A third of these facilities are also concentrated in three states—Virginia, Texas, and California—where the grid is already under strain.

In Virginia, as much as 26% of the electricity produced is absorbed by data centers. Utilities are talking about connections being delayed by up to five years. This is the paradox of the new digital economy: it can only grow as long as the energy infrastructure of the old economy can support it.

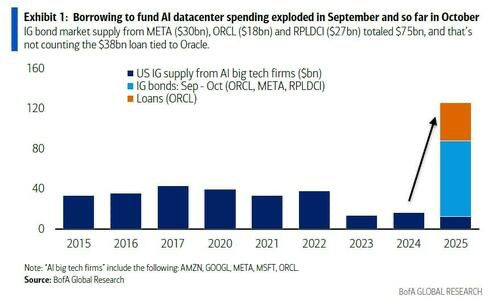

There is another contradiction. The AI revolution, which was supposed to free companies from their dependence on human capital, is creating a new dependence on financial capital.

In recent months, Meta and Google have placed billion in bonds to finance new data centers, while Oracle has taken out a billion private loan, despite already high leverage.

Hyperscalers, which until recently were self-financing with record cash flows, are returning to debt. It is estimated that the global development of AI infrastructure could require between trillion and trillion over the next few years. This is a huge figure, which makes it clear that the artificial intelligence revolution is no longer just a technological issue, but a gamble involving financial leverage and energy availability.

Gli hyperscaler, che fino a poco tempo fa si autofinanziavano con flussi di cassa record, stanno tornando al debito. Si stima che lo sviluppo globale delle infrastrutture di IA potrebbe richiedere tra i 5 e i 7 trilioni di dollari nei prossimi anni. Si tratta di una cifra enorme, che rende chiaro come la rivoluzione dell'intelligenza artificiale non sia più solo una questione tecnologica, ma una scommessa che coinvolge la leva finanziaria e la disponibilità di energia.

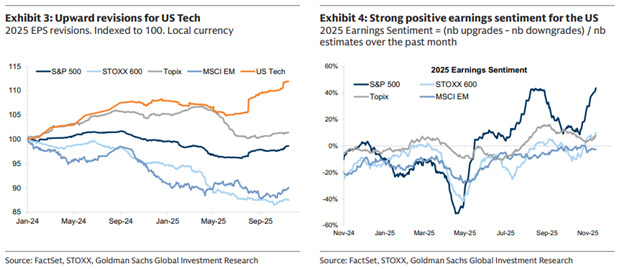

The market seems to be rediscovering a basic truth: even the most revolutionary stories have to contend with the constraints of the real world. After months of enthusiasm and upward revisions to earnings estimates, the AI narrative is entering a more mature phase, where a distinction is beginning to be made between economic potential and execution capabilities.

For investors, this is a time that calls for discipline. There is no need to shy away from the issue, but rather to understand its limitations and timing. Many of today's valuations assume linear and immediate growth, but the reality is likely to be more intermittent: periods of acceleration alternating with phases of adjustment as technology encounters its infrastructural constraints.

The lesson is always the same: in markets, as in life, technology can accelerate everything, but it cannot eliminate cycles. And the task of a rational investor is to remain clear-headed while others swing between euphoria and fear. For this reason, at a time when markets are showing signs of complacency and valuations remain stretched, we continue to favor defensive sectors, which offer greater earnings visibility and less exposure to short-term volatility, at a time of potential sector rotation.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.