Summer rally between enthusiasm and fragility.

31 July 2025 _ News

It is the end of July, and looking at market trends, it would seem to be a quiet summer. The S&P 500 and Nasdaq continue to hit new highs and are moving within a narrow daily range, while the US 10-year bond is moving within a stable range between 4% and 4.5%, and the dollar remains strong.

Despite obvious risks, including trade tariffs, geopolitical instability and mixed signals from the economy, markets prefer to focus on positive earnings momentum and the enthusiasm generated by recent US fiscal stimulus measures with the Big Beautiful Deal.

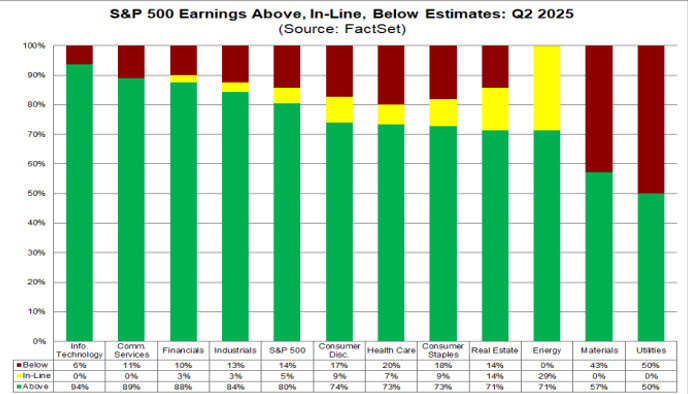

The quarterly reporting season is officially underway. So far, about a third of S&P 500 companies have reported their second-quarter results, beating expectations in 80% of cases, with earnings growth of +6.5% according to FactSet, and margins holding steady, a sign that, at least so far, the impact of tariffs has been absorbed. But it is a fragile balance, and the real tests will come in the coming months, when visibility for many companies will be put to the test.

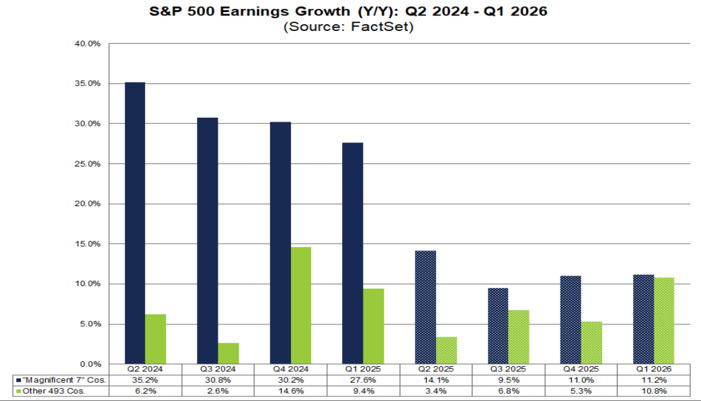

The index continues to be driven by the ‘Magnificent 7’, which alone account for most of the expected earnings growth.

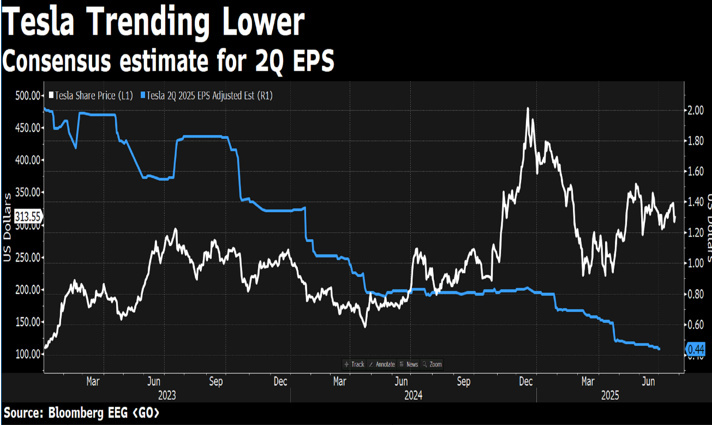

Among these, Alphabet, in its quarterly results release, surprised positively across all business lines, including Google search and cloud computing. The company also increased its capex forecast to billion, with a significant portion earmarked for investments in artificial intelligence. Tesla, on the other hand, disappointed, with its sharpest decline in revenue in over a decade and no update on its guidance. Despite an increase in gross margins, car sales remain weak and promises about artificial intelligence do not seem to be enough to support valuations. In a market environment where most expectations are focused on future promises, especially in the field of AI, narrative matters as much as numbers.

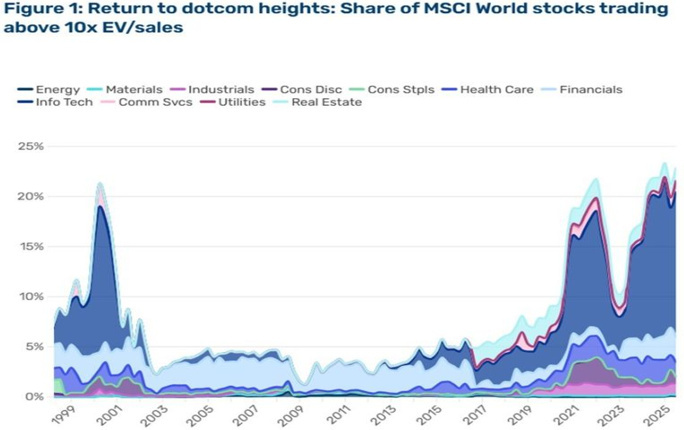

And it is precisely on the topic of artificial intelligence that one of the most delicate aspects of the current rally is focused. According to a study by Man Group, over 20% of the MSCI World is currently trading at price/sales multiples above 10, levels that historically coincide with phases of speculative excess, and many of these companies are concentrated in the growth sector.

The historical evidence is clear: stocks with price/sales multiples >10 have underperformed the market by an average of 65% over a five-year horizon. This is because companies trading at these multiples rarely manage to generate returns on capital and sustainable growth that justify such valuations. At zero interest rates, anything was possible. But today, with the Treasury at 4.5%, the price of fantasy is much higher.

We are faced with a paradox: on the one hand, AI is undoubtedly a disruptive technology; on the other, not all companies involved in it will have profitable business models. The dispersion of multiples – i.e. the gap between extremely expensive and undervalued stocks – is widening again, signalling that the ground is improving for those who select and approach value.

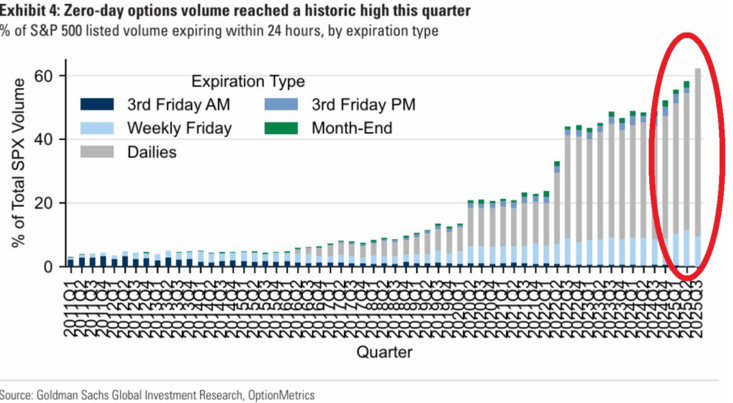

But that's not all. In recent months, we have seen a marked return of retail speculation, particularly through daily options, which many use more as bets than as real investment strategies. Today, more than half of the volume on these options is generated by individual investors attracted by the possibility of quick gains and high leverage.

It is a ‘market lottery’ climate, fuelled in part by the return of meme stocks, cryptocurrencies and the most speculative tech stocks.

Robinhood, the broker synonymous with retail trading, now generates more revenue from options than from traditional stock trading. But behind this euphoria lies an important historical fact: in most cases, retail traders on these instruments end up losing money. And when the euphoria subsides, the market enters a dangerous dynamic, with margin calls, cash withdrawals and forced sales that can trigger violent corrections.

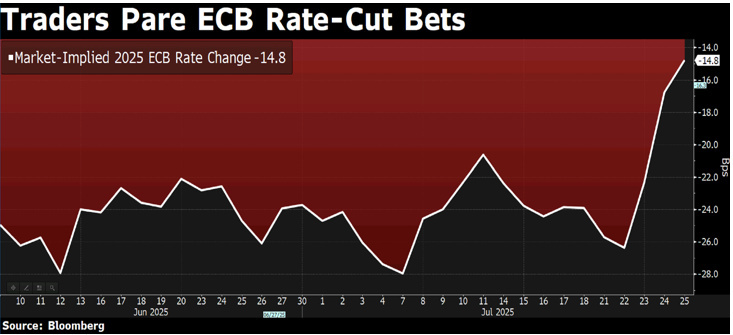

But back to the markets. As expected, the ECB kept rates unchanged and gave no indication of future monetary moves. Nevertheless, Lagarde said that the Eurozone economy has so far shown resilience, although risks remain on the downside.

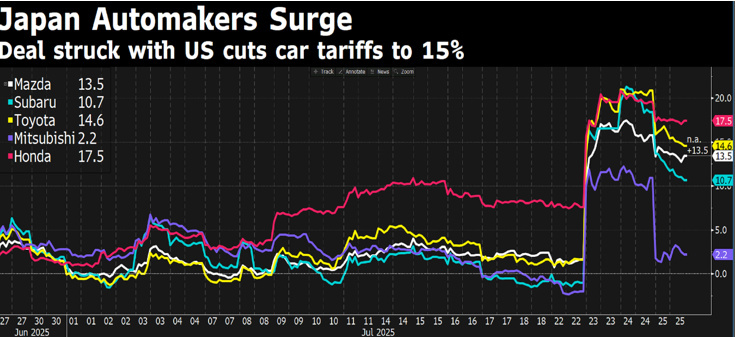

On the tariff front, the trade agreement between the United States and Japan, which provides for 15% tariffs, was welcomed with optimism, and on Sunday, after a meeting with European Commission President Ursula von der Leyen, President Donald Trump announced that the United States and the European Union had reached a similar agreement with 15% tariffs on most European exports, averting a trade war that could have dealt a severe blow to the global economy.

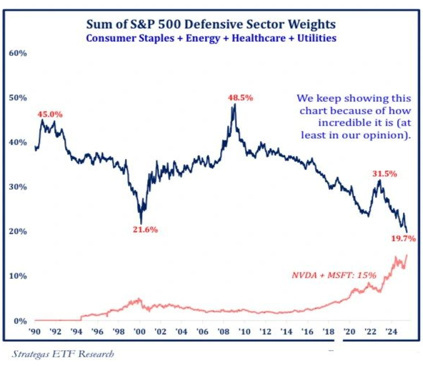

In this scenario, it is interesting to observe the behaviour of defensive stocks. For the first time in decades, their weighting in the S&P 500 has fallen below 20%. But history teaches us that, in times of stress, these sectors tend to come back into favour, offering protection and stability to portfolios.

Diversifying across sectors today, with high valuations and extreme concentration in growth stocks, is not only prudent but strategic.

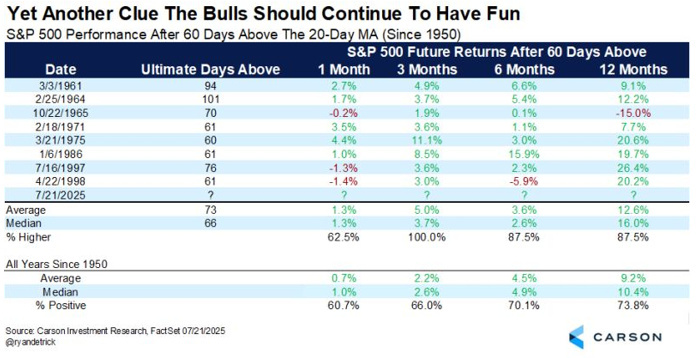

I will conclude with a technical data point that may seem secondary but offers an interesting insight into sentiment: the S&P 500 has closed above its 20-day moving average for 60 consecutive sessions – a very rare event that has only occurred four times since 1950. Historically, one year after this type of configuration, the market has offered returns of between 20% and 26%.

It is difficult to say whether this will be the case this time around, but it is certainly a sign that the medium- to long-term upward momentum is still alive. We have repeatedly pointed out that if a market has high valuations (as it does today), this does not mean that the markets will correct tomorrow, because valuations can remain high for a long time before falling back towards the average.

According to Polymarket.com data, the daily probability of recession has fallen sharply: from 60% between late April and early May to the current 18%. This decline reflects growing confidence in the resilience of the economy and helps explain why investors are willing to pay high valuation multiples on the S&P 500. Historically, there is an inverse relationship between recession risk and valuations: the less fear there is of an economic slowdown, the more willing markets are to reward equities. In this context, current multiples could prove sustainable for some time to come, provided that the consensus continues to recognise the resilience of the economy as a factor reducing systemic risk.

However, we must remain clear-headed. The combination of favourable momentum, stretched valuations and exogenous risks suggests caution, not euphoria. In contexts such as this, portfolio discipline, fundamental analysis and the ability to read sector rotations become crucial for the expected future returns of our portfolios.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.