The end of AI enthusiasm: selectivity returns

13 November 2025 _ News

After a week of widespread selling, stock markets are attempting to rebound this morning.

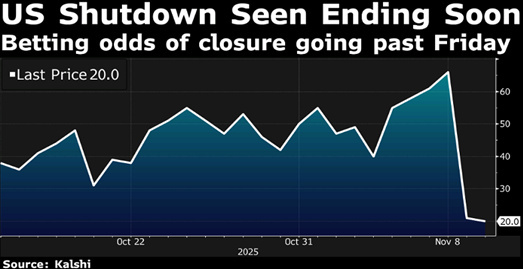

Stocks are opening higher and Treasury yields are moving lower, with sentiment improving and buoyed by hopes of an agreement to end the longest government shutdown in US history, now in its 40th day.

The end of the shutdown would allow official data on employment and inflation to be available again, reducing uncertainty about the Federal Reserve's path and upcoming rate cuts. However, despite this rebound, the market remains nervous: last week's sharp sell-off in AI and technology stocks has reignited the debate about the sustainability of valuations and the ongoing rally.

The US macro narrative continues to fluctuate between signs of strength and new warning bells.

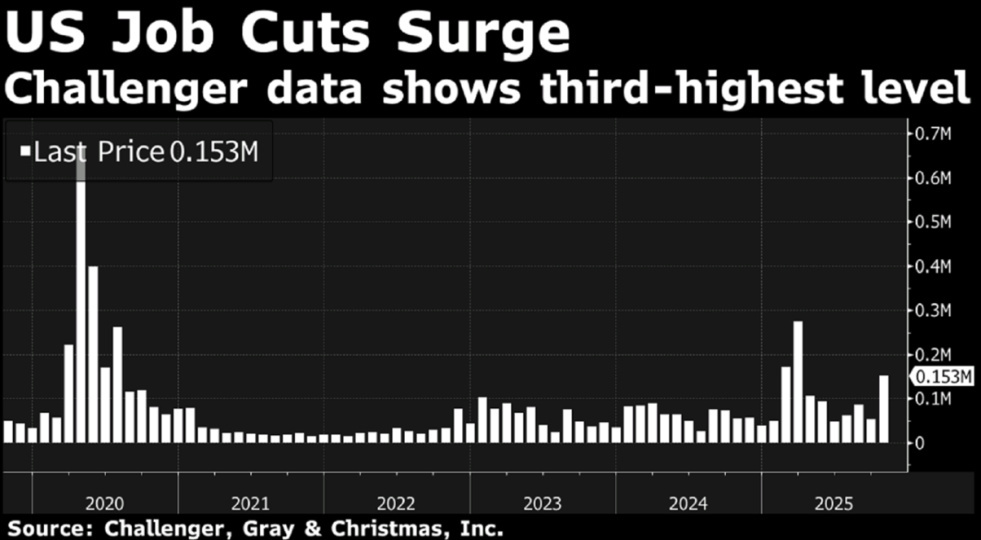

The ADP employment report gave an encouraging signal with 42,000 new jobs in the private sector, the first increase since July. But the effect was short-lived. The Challenger Report showed over 153,000 layoffs announced in October, the worst figure since 2003. Since the beginning of the year, there have already been over 1.1 million job cuts, up 44% compared to 2024.

Two figures that appear to contradict each other, but only at first glance: large companies continue to hire, while job cuts are concentrated in sectors most exposed to technology and logistics. This is the combined effect of automation and cost pressures: in warehouses as in the cloud, artificial intelligence increases productivity but reduces the need for labor. And while layoffs in the run-up to Christmas may seem unusual, companies are now bringing forward cuts to improve margins in the fourth quarter.

The result is a two-faced labor market: still resilient on the surface, but with cracks that could soon reopen the debate on further rate cuts by the Fed.

For now, the probability of a cut in December remains around 65%, down from 85% before the last meeting. Powell hinted that further action is “by no means a foregone conclusion,” and as Treasury yields rise again, equities have begun to price in the risk of a longer pause.

At the same time, the Supreme Court has opened proceedings to assess the constitutionality of Trump's tariffs, which are now worth over 0 billion a year, double the pre-tariff period. A possible rejection would reduce Treasury revenues, forcing greater debt issuance and thus, paradoxically, higher yields, just as the Fed is trying to contain them. The ruling is expected in December, coinciding with the Fed meeting, in a potentially explosive mix for the markets.

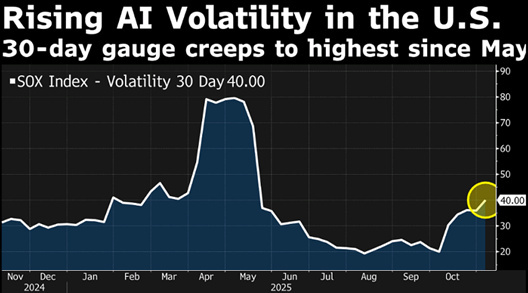

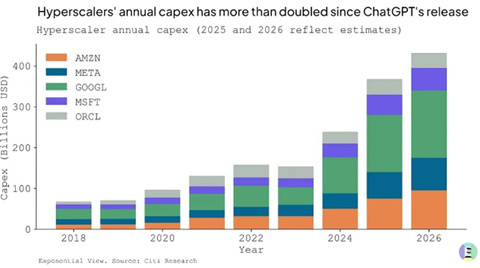

In recent days, an increasingly complex debate on AI has emerged. After months of almost unconditional enthusiasm, a distinction is beginning to be made between what is potential and what is already sustainable. Three issues stand out clearly. The first concerns the actual technological trajectory, with many experts in the field—including figures within the AI world—recognizing that so-called generative AI is not necessarily the main route to general intelligence. Today, we are talking about a timeframe of 5-10 years, much longer than was predicted just two years ago. The second issue is economic. The sector invests around 0 billion annually but generates revenues of just billion. OpenAI alone has planned capital expenditures of over .4 trillion in the coming years: a huge figure that transforms artificial intelligence into a highly capital-intensive engine of growth.

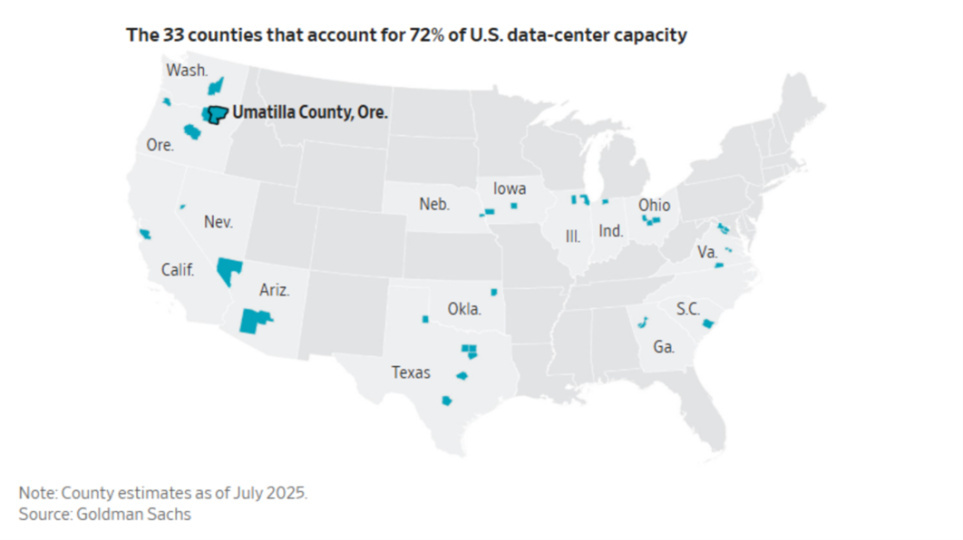

Ever larger data centers, expensive GPUs destined to become obsolete in a few years, energy and logistical bottlenecks: the race for infrastructure has become the real limitation of the system.

There is increasing talk of a possible recourse to federal debt, with OpenAI reportedly considering a public guarantee to support its investments — a move that many investors interpret as a kind of request for a government bailout.

OpenAI has chosen an extremely aggressive growth strategy, which has brought it, together with Nvidia, to the center of the AI ecosystem. But today it has become too big to fail. And the last time someone was too big to fail, in 2008, it didn't end very well.

The third issue is evaluative in nature: although not at “Internet bubble” levels, multiples remain high and difficult to justify if revenues do not accelerate soon. The most common mistake at this stage is to think that because we are not in 2000, we can afford not to be cautious. The risk today is systemic: AI has become so pervasive that it is, in fact, a fundamental pillar of US growth. It is already estimated that US GDP growth without the contribution of AI would be at least halved. If the momentum were to slow, the backlash would spread to the entire market, generating a negative wealth effect that would force the authorities to react with new monetary or fiscal stimulus.

In summary: AI remains a long-term trend, but the phase of blind enthusiasm seems to be over. Now the market distinguishes between those who build real value and those who live off hype. Meanwhile, earnings are no longer enough to sustain the prices of many stocks. Earnings are growing but are not surprising. Those who beat estimates do not rise, and those who disappoint fall. This is a classic sign that the market has already priced in perfection and needs, at least in the short term, to adjust expectations downward. It is not a question of predicting a collapse of the Magnificent 7, but of building portfolios that can withstand a normalization of AI trading.

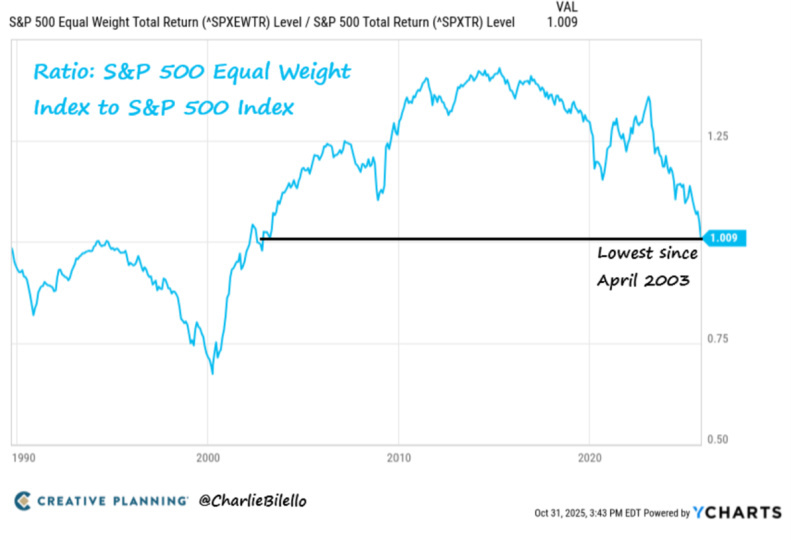

Market breadth is deteriorating, with fewer and fewer stocks trading above their 50- and 200-day moving averages, and the performance of the S&P 500 equal weight index lags far behind that of mega-caps.

The overall picture therefore suggests that we have entered a new phase of the cycle characterized by less euphoria and more selectivity. Markets are beginning to grapple with interest rate uncertainty, labor market fragility, and the structural limitations of AI-trade. At times like these, it is not those who guess the direction of the next rally that make the difference, but those who maintain discipline. Artificial intelligence is not a disappointment, but neither is it a shortcut. Like any great technological revolution, it will go through phases of exuberance and normalization. For investors, the challenge is to remain clear-headed: to understand where unjustified excitement ends and economic reality begins.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.