The other side of the quarterly reporting season

03 November 2025 _ News

The stock market experienced a week of sharp contradictions. On the one hand, corporate earnings, particularly those of some big tech companies, surprised on the upside; on the other hand, high valuations coexist with mixed economic signals. The central issue remains how to navigate a market that appears strong but is vulnerable in many respects.

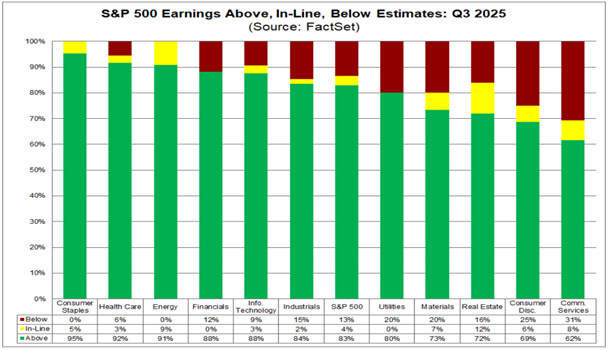

It was undoubtedly the busiest week of the reporting season, with almost half of the S&P 500 companies publishing their quarterly results, which were generally solid and exceeded expectations.

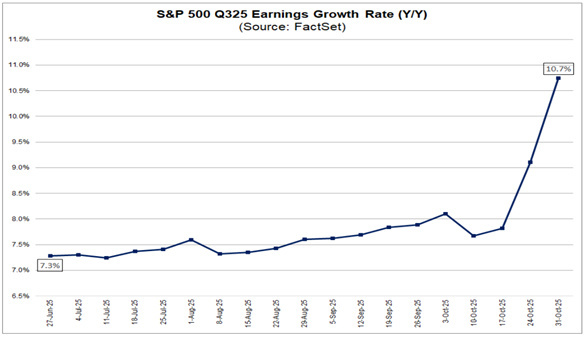

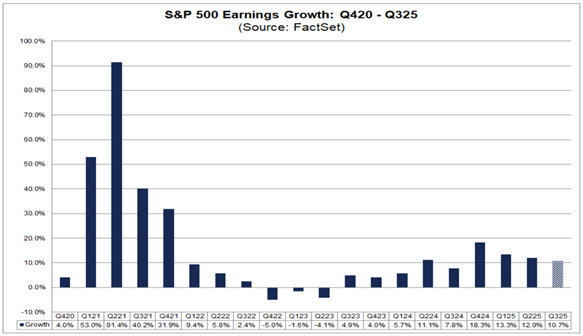

83% of companies are beating estimates, and the earnings growth rate for the S&P 500 in the third quarter rose from 9% to 10.7%.

This is the fourth consecutive quarter with double-digit year-on-year earnings growth.

In Europe, too, the earnings season is showing positive signs, with average earnings growth for the STOXX 600 at +2% year-on-year, compared with expectations of a 2% decline.

Among American big tech companies, the quarterly reporting season offered a mixed picture, reflecting the dualism currently present in the markets between enthusiasm for growth and caution about the rising costs associated with artificial intelligence.

Amazon continues to be one of the most positive surprises: quarterly revenue reached approximately 0 billion, up 13% year-on-year, with results exceeding expectations in all major divisions. In particular, the cloud division grew by 20%, advertising by 24%, and online sales by 10%. The CEO spoke of “strong momentum” and an increasingly efficient group thanks to the extensive use of AI and robotics. The stock reacted enthusiastically, rising more than +12% after the results were released, the largest daily swing in the last 10 years.

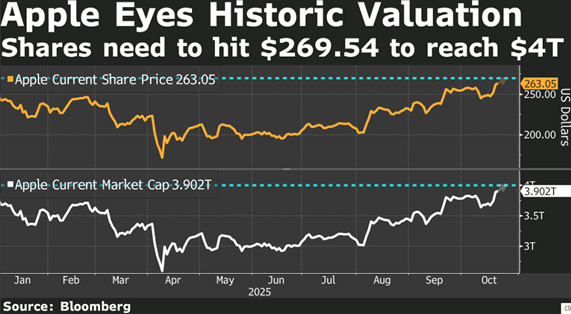

Apple, on the other hand, shows a more complex dynamic. Revenue, at 2 billion, is slightly above expectations, but iPhone sales are below consensus, while the Chinese market continues to be a weak spot due to competition and regulatory issues. However, the company remains constructive, with revenue growth guidance of between +10% and +12% in the next quarter.

Alphabet exceeded expectations across all its main business lines, confirming its position as one of the absolute leaders among the Magnificent 7. It is now the company that is most clearly succeeding in monetizing artificial intelligence, thanks to its effective integration into its products and digital advertising.

Meta, on the other hand, despite beating revenue expectations, disappointed investors due to increased costs related to massive investments in AI, which are growing faster than revenues themselves. This fueled doubts about the sustainability of spending and future profitability, causing the stock to fall by about 7% in after-market trading.

Finally, Microsoft reported a negative impact of .1 billion on net income resulting from its investment in OpenAI. Here too, analysts are focusing on the increase in capital expenditure, an increasingly central issue in industry assessments.

Meanwhile, it was also the week of the Fed and the ECB.

As widely expected, the Federal Reserve cut interest rates by 25 basis points. However, Chairman Powell warned that a further reduction in December is by no means a foregone conclusion, signaling that the Fed does not consider itself to be in “all-in” mode with regard to subsequent automatic easing measures.

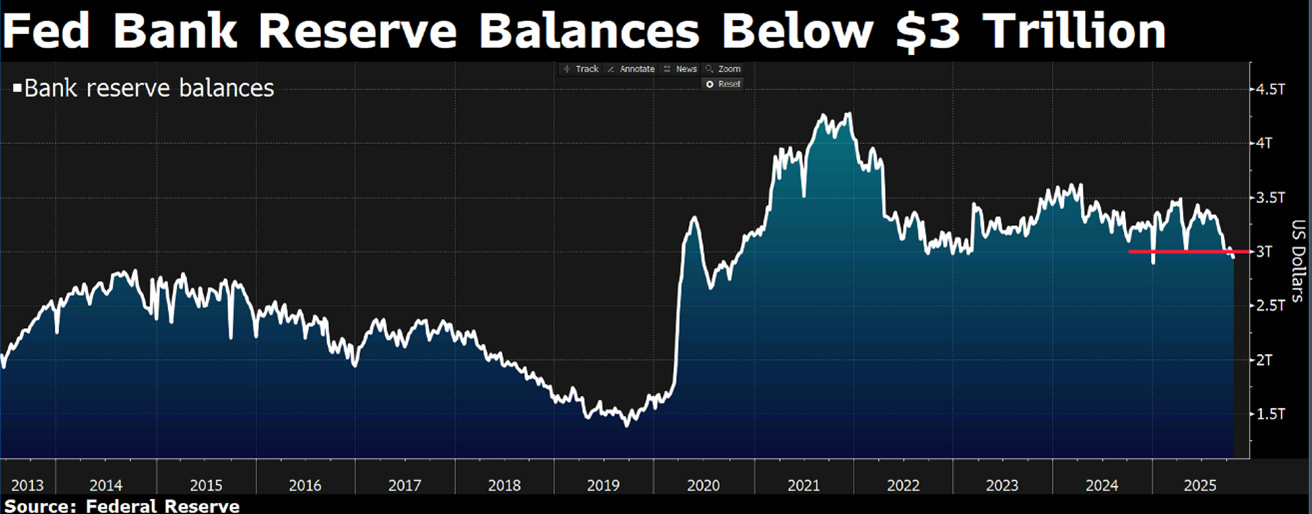

The Fed's balance sheet will end quantitative tightening, i.e., its reduction, on December 1, a sign that liquidity is an important issue and the Fed does not want to drain it further.

While inflation remains “slightly elevated” and employment stable, there are some weaknesses in the labor market.

In Europe, the European Central Bank also kept deposit rates unchanged at 2% and reiterated a data-driven approach, signaling that the outlook remains uncertain.

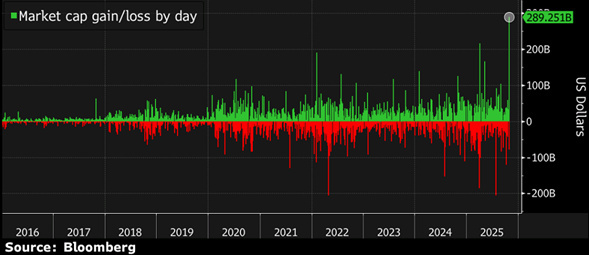

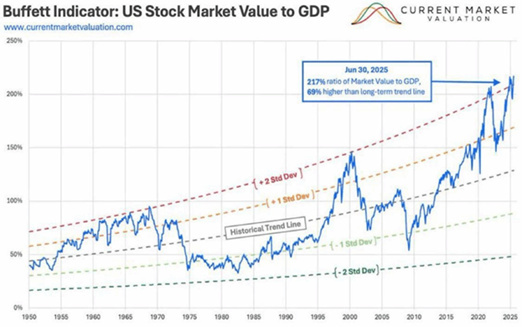

We are experiencing an extraordinary market, but not only in the sense we had hoped for in terms of performance.

It is extraordinary because beneath the surface of fundamental solids, it now thrives on automatisms, mechanical flows, and a collective illusion of stability. The era of passive investment, which began as a tool for democratizing markets, has become the engine that dominates them and perhaps the seed of their fragility. Today, more than half of US equity capital is held by index funds. This means that the direction of the market is no longer guided by analysis, selection, or intrinsic value, but by the simple flow of capital that replicates an index. The largest companies automatically receive more money, regardless of their fundamentals. It is a vicious circle: flows drive up prices, prices attract new flows, and the entire market feeds itself.

But behind this apparent efficiency, a major distortion is slowly developing: the loss of any evaluative anchorage, to the point of rejecting the importance of evaluations themselves.

That is why this is potentially the most dangerous era ever: a time when valuations are stretched to the extreme and passive flows amplify every movement, both upward and downward. When the market is dominated by automatic mechanisms, corrections no longer arise from fundamental events (whether macro or micro), but from an internal fracture, a structural failure of the system itself, a sudden change in sentiment, a change in narrative.

This requires discipline and clarity. Maintaining liquidity is not weakness, but prudence. Staying anchored to fundamentals is not conservatism, but strategic vision.

We are in a context where careful selection of individual stocks plays a crucial role. Investing in companies with reasonable valuations, solid fundamentals, and earnings visibility not only provides access to better long-term return prospects, but above all reduces the implicit risk of the portfolio. Bottom-up, value-oriented selection allows us to build a margin of safety against market distortions, mitigating the impact of any corrections and preserving capital. Investing wisely means avoiding passive concentration and maintaining a disciplined, rational, and data-driven approach.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.