Utilities: rough diamonds

15 February 2024 _ News

While the markets are increasingly dominated by the narrative about the so-called magnificent seven and expectations about everything AI-related are rising, we want to give the defensive sectors, and in particular the US utilities sector, the spotlight as we believe they are reaching a level of extreme pessimism, thus laying the groundwork, as a contrarian investor, for excellent expected returns.

What are utilities?

For those unfamiliar with the utilities sector, we are talking about companies that generate electricity and manage public service infrastructure such as electricity, gas and water networks. We are talking about companies that often operate in de facto monopoly regimes, with tariffs defined at the regulatory level and for this reason characterised by growth that is not affected by the economic cycle.

There are no comparable businesses on the market in terms of stability of growth in fundamentals to such an extent that they are considered by equity investors not only as a defensive sector, but even compared almost to a bond due to the certainty of cash flows and dividends distributed.

Fundamentals remain solid, but weigh on rising interest rates

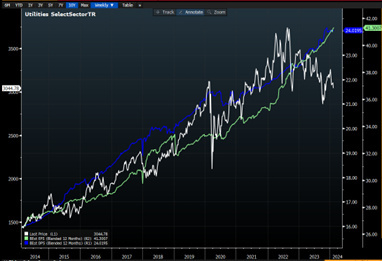

But let's come to the point, the US utilities sector was the worst sector in the market in 2023 recording a -10% decline compared to the market which instead rose by 24%, but this price correction (white line) is not justified by the company's fundamentals, which record, in line with history, profits (green line) and dividends (blue line) up by 5-6% and a return on equity for the sector at 11%, also in perfect historical average.

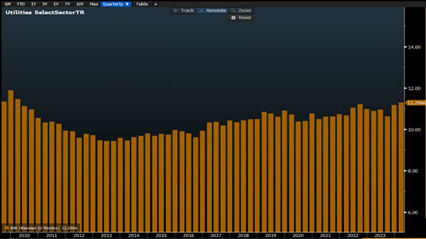

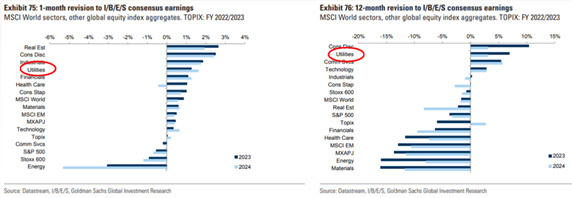

We do not find a justification for the underperformance of the sector even if we look at the earnings growth estimates. Stock markets are always looking ahead, they are a machine that discounts future growth and are therefore driven by the revision of earnings growth estimates, which have even been revised upwards, not downwards, over the past month and twelve months.

Why is the sector correcting at the moment?

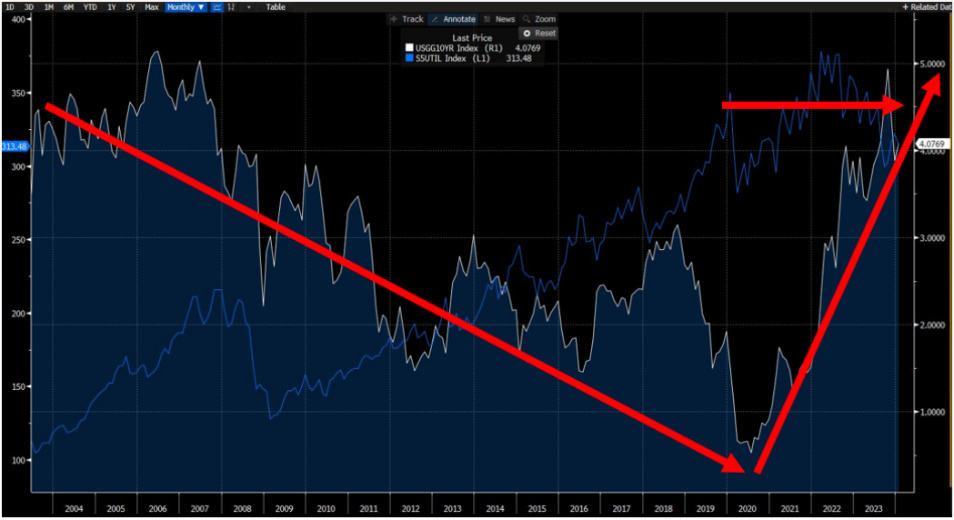

The reason is the rise in interest rates. Not just any rate increase but the fastest in history, which, for the sector, has resulted in a real paradigm shift, being characterised by volatile and fundamentally lateral movements since 2020, i.e. since rates started to rise again.

In the zero-rate world, the sector boasted a dividend yield almost 400 basis points higher than the risk-free rate. In the space of a few months, with rising rates, this difference was completely wiped out and this resulted in a major compression of the valuation multiple. Whereas the sector used to be paid up to 22 times earnings, the multiple has now been reduced to 15. At 22 times, valuations were close to the highs of the last 10 years, now at 15 they are at the lower end of the historical valuation range, with the sector dividend yield now aligned with that of the government yield.

All the defensives are following the rate trend

Interestingly, utilities are not the only sector that is experiencing these dynamics: if we superimpose the chart of the utilities sector over that of the consumer staples sector and then add the inverted interest rate chart, we can see how the three lines overlap almost perfectly. Every upward movement in rates is driving down defensives and vice versa.

The market is often described by leading investors as a pendulum that always swings between two extremes and is rarely in the middle of its swinging motion. This movement from one extreme to the opposite is regularly repeated in the markets and is caused by human emotionality oscillating between the extremes of fear and greed, leading to irrational behaviour.

The rate factor is therefore weighing on the defensive sectors, but we believe that the market pendulum has reached a level of extremes.

The return to the mean, and to fundamentals, lays the foundation for solid expected returns

That the value is already there in the utilities sector can be seen, for example, by the valuation multiple differential between the sector and the market, which is now at a discount close to its 10-year highs, with utilities being one of the very few sectors in the market trading at a valuation multiple lower than its 5- and 10-year average.

We believe that a return to the mean is one of the few certainties in the markets, which I would describe as a physical law, and today we have some of the easiest businesses in the market to understand that are at one end of the pendulum with great feelings of defeatism and negativity. We do not know when the pendulum will swing in the opposite direction, but the value today is already on the table, and since this time will be no different from the others, when it does it will swing to the next extreme.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.