Volatility to be grasped

28 January 2022 _ News

Fearing the uncertainties associated with Covid, the Fed and the US government have flooded the market with liquidity over the past two years. 2022 represents the transition year from pandemic to endemic, characterized by the ability to live with the virus, managing it in the naturalness of economies, and therefore requires a return to monetary normality.

This return is favored by a positive context, characterized by strong economic growth, as shown by GDP at + 6.9% compared to expectations of + 5.5%, by a recovering labor market with a consequent unemployment rate at the lowest levels in recent years, and by strong financial stability.

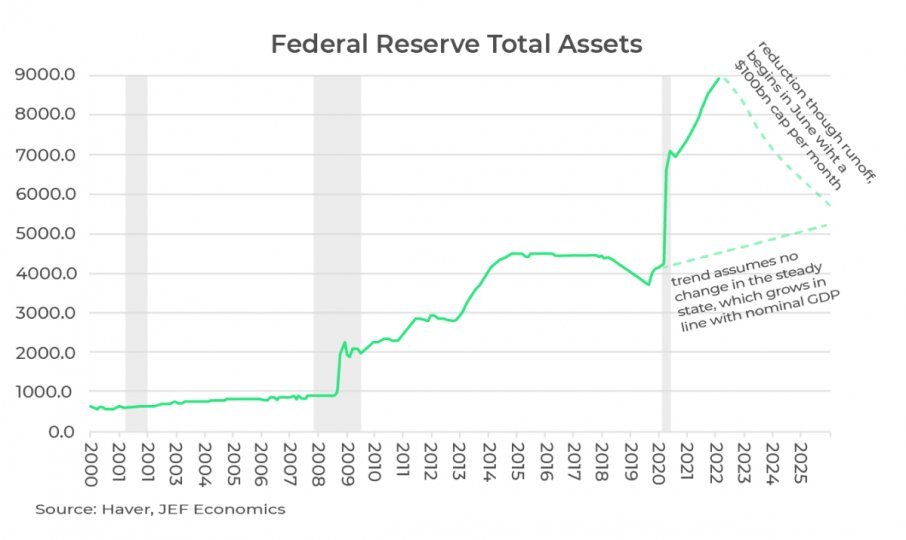

The return to monetary normality would also help to manage the FED’s current problem: inflation, and in particular expected inflation, which, if not managed properly, could lead to the creation of wage spirals. The FED minutes in early January showed that some FOMC members want to start reducing the balance sheet by at least $ 100 billion per month as early as this spring, i.e. shortly after the first rate hike, with a total target amount of at least $ 1.5 trillion. The market reacted with increased volatility and corrections, particularly in the technology sector.

The last FED confirmed the US Central Bank’s commitment to the budget reduction, although Chairman Powell did not clearly define the agenda for the planned interventions, as he believes that the upcoming macroeconomic data will determine the pace of FED rate hikes and balance sheet reduction. Powell also stressed that the budget reduction will be implemented through a resizing of reinvestment scaling rather than asset sales. In addition, it will be done primarily through MBS rather than Treasury, with the aim of cooling the housing market, especially rents. The US President also stressed that he does not expect the rate hike to have an impact on the labor market, which he said is in good health. Finally, he added that the possible fall in asset prices (read equities) is not a threat to households and companies, as they currently enjoy better financial conditions than in the past.

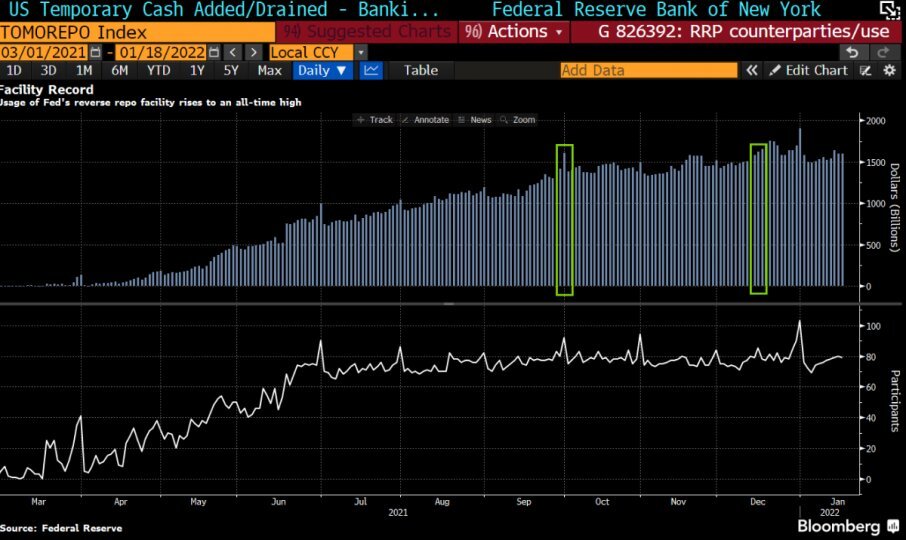

In conclusion, the planned reduction in assets should not scare off investors, as the $ 1.5 trillion cited as a possible amount to be reduced is equivalent to the amount of "excess liquidity" returning to the Fed each day through the Reverse Repo Facility. 85 participants have placed $ 1.62 trillion at the Fed's overnight repo facility, where counterparties, such as money market funds, can place cash.

At this time, we believe it is necessary to focus on the investment opportunities that are being created, particularly among technology companies, which despite substantial earnings are trading at discounted valuations following the recent corrections.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.