Are we sure we don’t want duration in portfolios?

12 October 2023 _ News

Increasing rates continues to be the talk of the markets, with the US 10Y skirting around 4.9% and the German Bund and Italian BTP in Europe piercing their respective mental stops of 3% and 5%. Throughout the week we have seen the rates driven upward by a series of macroeconomic data that came out on average better than expected, as shown by the analysis of the Citigroup Economic Surprise Index, which remains above 50. In this way, the data helped fuel the narrative of a highly resilient American economy that forces the central banks to maintain restrictive policies with high rates, in a scenario in which we now read healthy macroeconomic data as negative due to the monetary policy implications.

Though the Fed’s official dual mandate is to keep unemployment low and prices stable, the latter takes priority. Under this monetary approach, a solid labour market is not a sign of a strong economy, but a problem to be addressed by leveraging rates, which is how strong macro data are reflected on the market by rising rates.

In particular, the JOLTS – job openings and labour turnover survey – came out better than expected, with 9.6 million openings in August, significantly beating the estimate of 8.8 million. We were pleasantly surprised by ISM and jobless claims, but without a doubt the most impressive data in terms of the strength of the labour market came on Friday afternoon: nonfarm payroll jobs stood at 336K, much higher than the expected 170K, even with an upward revision of the figure from the previous month to 227K from 187K.

Truthfully, some data also fell below expectations, such as the ADP number (a prediction of the labour market) and the unemployment rate, which rose to 3.8% compared to expectations of 3.7%. If we look closely at Friday’s figures on nonfarm payroll, albeit better than expected, the number is still falling, but as mentioned previously the market read healthy numbers and brought the interest rate to its maximum level in the past 15 years driven not only by expectations of an increase in economic growth and good macro data, but factors related to the supply and demand of securities.

The current context is experiencing a rapid expansion of the federal government’s budget deficit, with some economists defining the fiscal policy as out of control. Therefore yields are rising due to the need to refinance new debt, for which the central banks are no longer the buyer of last resort, with upward movements in the rates that in the short term are unaffected by changes in macro factors and mainly follow these dynamics of supply and demand.

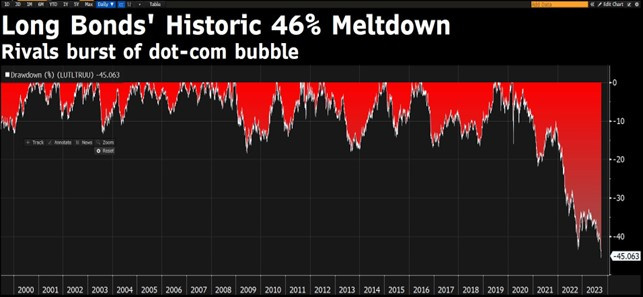

A rate that is closing in on an important mental stop is heavily affecting sentiment, which is once again very negative on the bonds market. Many investment firms had accrued positions on the long-term portion of the curve, but in recent days the sentiment of many management committees has completely reversed and now there are fears around long-term duration. No one enjoys the volatility that duration is bringing to the portfolios, but these are the classic dynamics that create value in an asset class. The market has shown us too many times its tendency to take to extremes, especially in the opposite direction from the consensus. Now that everyone is negative about duration, we can genuinely start to think about positive developments and falling rates. We are in the third consecutive year of losses on the bonds market, which has never happened before, with decreases close to 50% from the maximum levels for securities with duration. We left behind the anomaly of zero interest rates very quickly, but we are now at the opposite extreme.

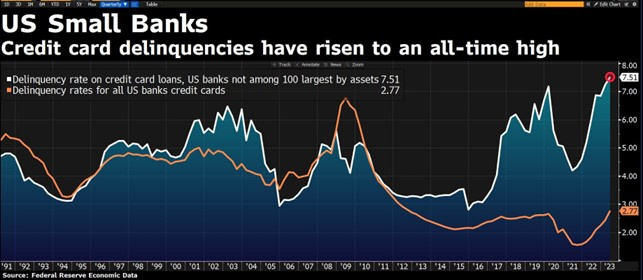

We cannot hide our surprise at the abrupt hike in rates in recent months, but we still believe that the current level of rates is already very high and incompatible with the upward revisions to economic growth. We believe that in the coming months the macro data will show deterioration (something that several leading indicators are already highlighting). In November 2023, 12 months will have passed since the rates were brought to 4%, and 12 months is considered the average time necessary for rate increases to have an effect on economic growth.

We agree that the economy has become desensitised to interest rates and we believe that the Fed does not wish to repeat the mistakes of 2008 when it kept the rates at the very same level as today for one and a half years, until the unbearable rates inevitably wrought havoc on the economy.

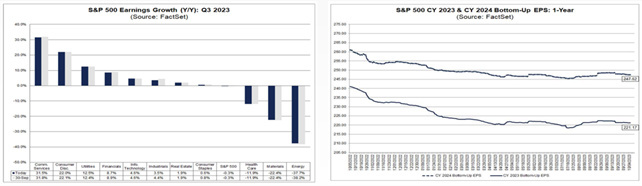

On the other hand, positive news could come from the imminent reporting season, which starts this week in the United States. While the last reporting season was preceded by a significant increase in profit forecasts, which then translated to poor performances due to securities that had already incorporated the best part, in this round of reporting, we are seeing much more prudent expectations, with profits expected to fall slightly by 0.3% compared to the same quarter in the previous year, and this might translate to surprise increases accompanied by positive performances in the days following the release of the results.

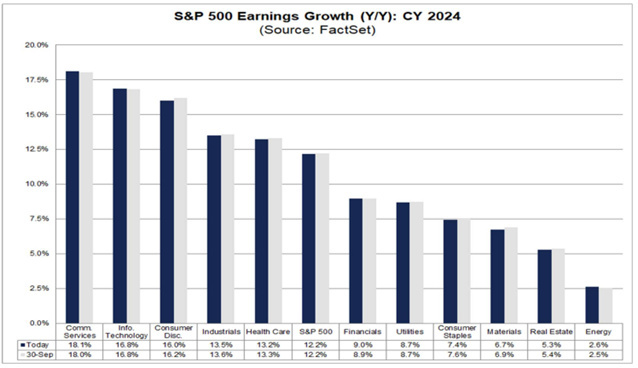

If we look a little beyond the third quarter and broaden our analysis to 2024, we can see how the profit forecasts of +12.2% growth remain, in our opinion, very challenging and so we believe they will be revised downward. In our models we are currently hypothesising a 5% cut but this should not give us cause for concern because we believe this reduction is already reflected by current market prices.

At sector level the prudent view of economic growth and profits is combined with a continued preference for the more defensive sectors, which is the market area where we see the most value for the next 6-12 months, and they remain very interesting in terms of valuation, but continue to suffer from continuous rate increases.

During the week, these rates will also change following several important events, including Thursday’s figure on American inflation, which should fall compared to the previous figure, and the statements expected from the various central bankers at the meeting of the World Bank Group and the International Monetary Fund.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.