Bombproof Infrastructure and Green economy

31 July 2020 _ News

These are the topics that, according to the management committee of Pharus, will dominate the market scene in the upcoming years. In addition to technology and biotech.

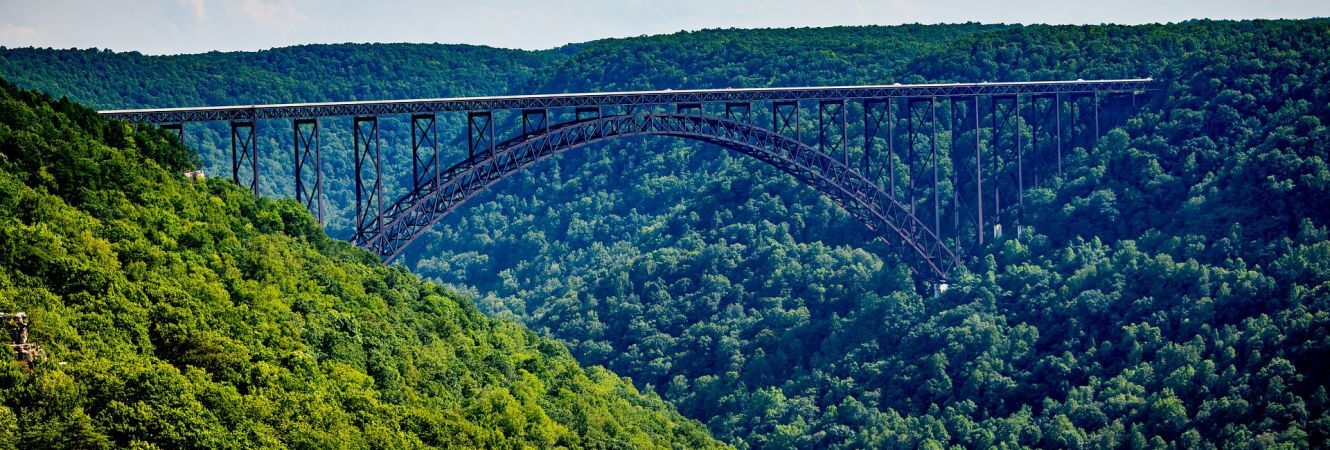

First of all infrastructures, from America to Europe, further to technology and biotech. With an eye on sustainability, these are the trends that, in a risk-oriented climate, are holding the market high and that will most probably dominate the scene in the coming years.

This is what has been emerged from the last management committee of Pharus, which sees in the actions of the central banks a valuable ally of these trends and of the equity in general. For what concerns the green and the infrastructures, it seems to be a bombproof theme, from every angle it is observed .

Also in view of the upcoming American presidential elections, the candidates to the White House, Joe Biden on one side and Donald Trump on the other, are also riding this trend. Both have expressed the will to invest 2 trillion dollars into an American infrastructural plan. In a nutshell, we are talking about important figures, which hold every political faith.

Even in Europe, we are moving in this direction, although with "more limited" resources: the Green Deal provides sustainable investments in the order of a trillion dollars for the next ten years.

Finally, in the Old Continent, hydrogen is the main topic, with companies like Snam and Enagas well positioned both in Italy and in Spain.

Ahead with equity

Looking more generally at the markets, equities appear to be more interesting than bonds.

From the bottom in March, the stock exchanges have rebounced strongly, and the American stock exchanges have already recovered to pre-Covid levels. The S&P 500, which has returned to positive territory since the beginning of the year, is only a few points away from the maximum, while Nasdaq has gone further, establishing a new absolute record.

Europe, on the other hand, having lost 10% since the beginning of the year, is still 15% far from its highest. This picture reflects well what has been emerging from the reporting season of the second quarter of 2020, with American results being significantly more positive than the European.

In the United States, about 80% of companies that have already reported (about 25% of the total) are reporting results above expectations.

Technology, materials and utility are the sectors that are doing better, while energy and consumer services are among the worst. Precisely, medium companies are recording a earnings decrease of -42%, compared to the second trimester of last year; nevertheless still better than against initial expectations of -44% (the only sector that shows an increase in earnings is utilities).

Earnings toward recovery

The sideways phase that is affecting the prospective growth of American earnings should be noted (the estimates for the S&P 500 to date are for a decrease of 20% at the end of the year, against initial expectations of -21,5%).

It is important because analyzing the previous corrections, each new bullish cycle has always been accompanied by a lateralization of the estimates. If this figure were to materialize this time as well, it would be a very good sign; it would mean that the downward revision of the estimates on earnings has come to an end.

As a result, the bear market would officially be over and so we would find ourselves today only at the beginning of a new bullish cycle.

Europe, on the other hand, is far behind. Half of the listed companies have already communicated the data of the second quarter of 2020, with 70% of reported results that are indeed higher than expected, but only of a few points.

While the rest of the world is “drawing” the bottom figure, Europe is still facing a downward earnings revision. This justifies the -10% loss (on average) on European stock exchanges since the beginning of the year.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.