Capex Boom: Opportunity or Bubble?

04 August 2025 _ News

For the first time in a long time, the week just ended was a “risk off” week, with global stock indices falling by around 3%.

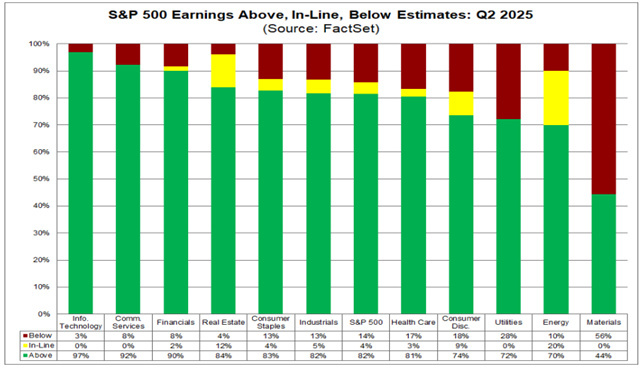

Markets have begun to grapple with a less optimistic narrative, despite the continuation of a positive earnings season.

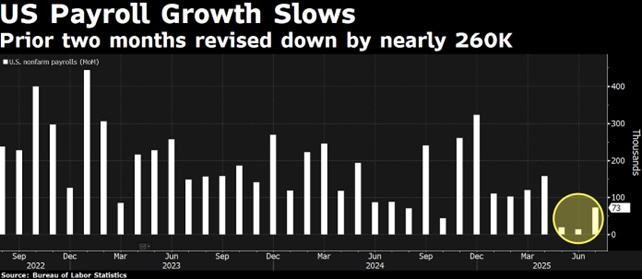

Sentiment was weighed down by a mix of macroeconomic data that reignited fears of stagflation, while the labor market and consumer spending, two pillars of domestic demand, showed clear signs of weakening. In particular, the very weak labor market data had a significant impact, with non-farm payrolls coming in at 73,000 below expectations of 104,000, with a downward revision of May and June data by as much as 258,000 jobs. To further complicate the picture, on Friday Trump fired the head of employment statistics, accusing her of providing incorrect data.

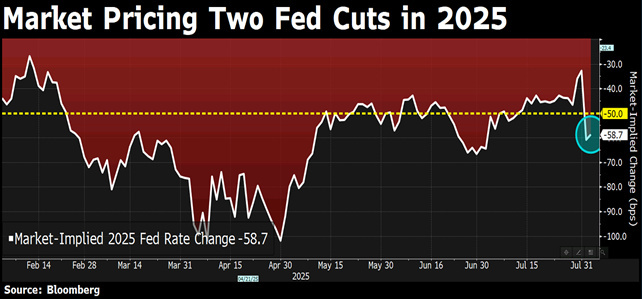

While the yield on 10-year Treasury bonds fell by 17 basis points and that on 2-year bonds fell even further, as the bond market bet that, after this week's pause, the weakness of the economy will force the Fed to cut rates in September and beyond.

This corrective move signals that the market was pricing in a near-perfect scenario after an extraordinary rally from April lows. Between April and July, a favorable combination of Goldilocks-style macroeconomic data, a brilliant earnings season, and easing tariff fears had pushed indices to valuations well above long-term averages.

Let's return to the economic data. Real GDP grew by 3% in the second quarter, well above expectations. However, behind this figure lies a less euphoric trend: the strong contribution of net exports, boosted by the collapse in imports, has masked weakening domestic demand, especially in the sectors most sensitive to interest rates.

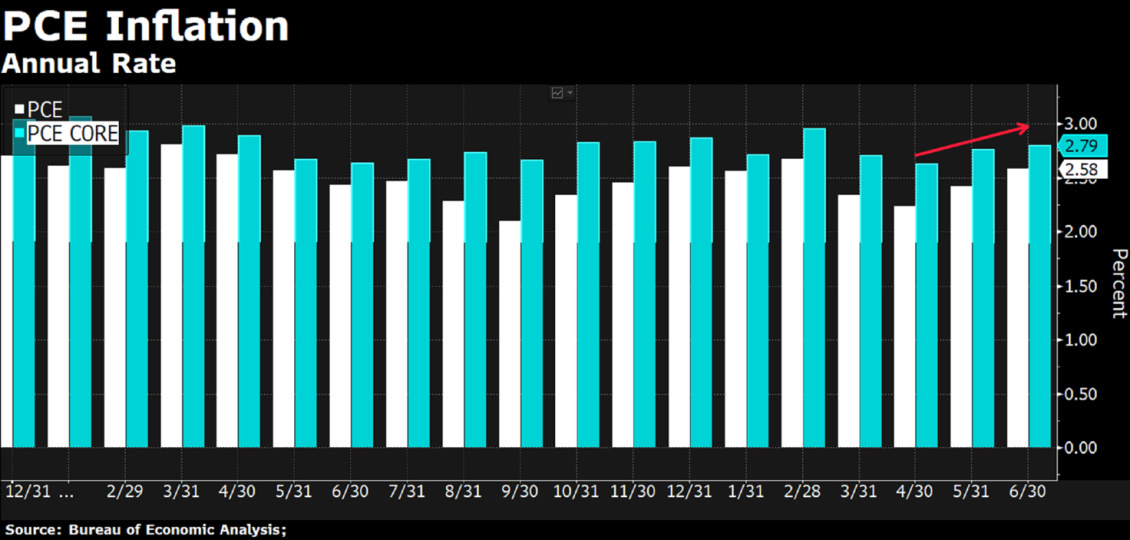

June data show that inflation measured by the PCE index – the Fed's preferred measure – remained virtually unchanged: +2.6% for the headline figure and +2.8% for the core figure on an annual basis. These levels are essentially unchanged since the beginning of the year, suggesting that the disinflationary process has come to a halt.

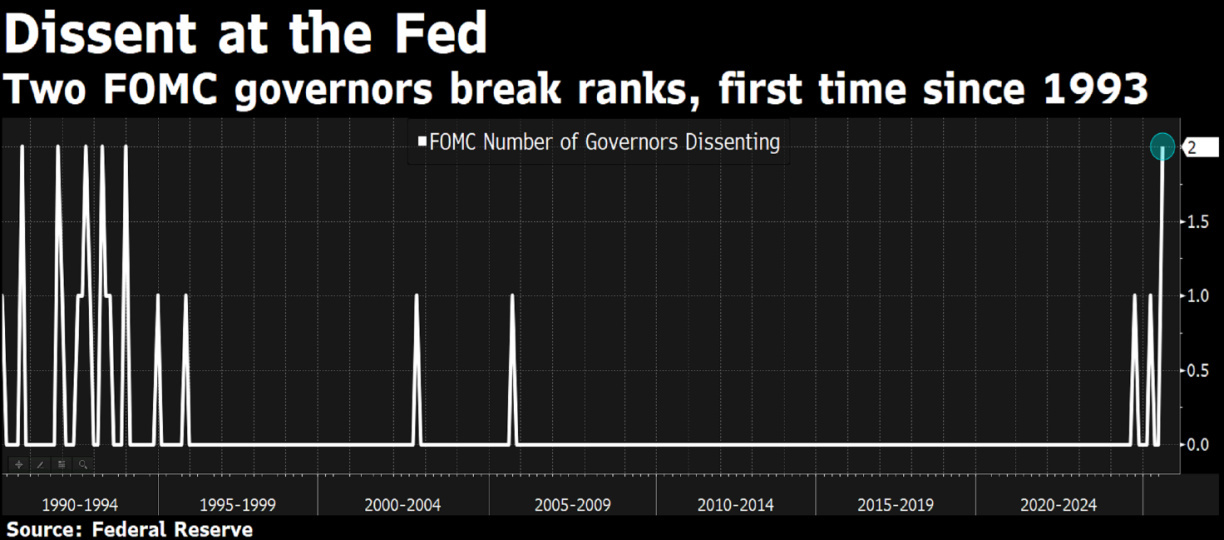

The FOMC left interest rates unchanged, as expected, but with a more hawkish tone than anticipated. Powell reiterated that there were no signs of deterioration in the labor market (but this was before Friday's data), described inflation as “high,” and emphasized the importance of data dependency. However, for the first time since 1993, two board members—Bowman and Waller—voted for an immediate cut.

This double dissent represents a crack in the official narrative and opens the door, albeit cautiously, to monetary easing in the coming months.

On the corporate front, the earnings season is in full swing.

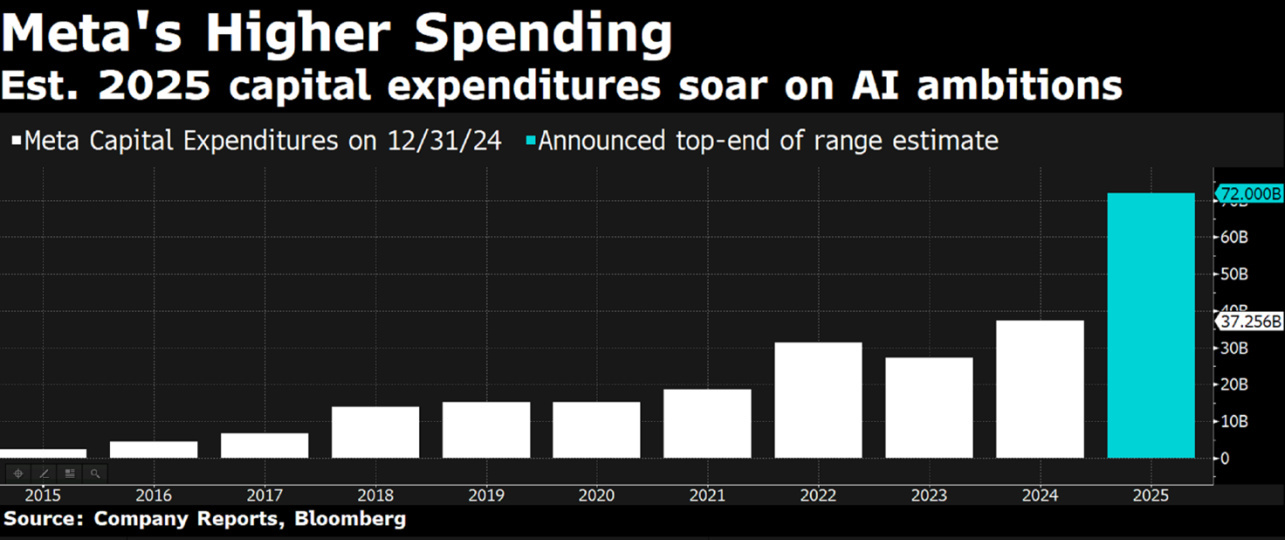

Microsoft and Meta beat expectations by a wide margin, both in terms of revenue and guidance. Azure grew by 39%, and Meta raised its guidance for the third quarter. Amazon disappointed on the operating forecast front despite good data on cloud and advertising, and the stock corrected by 8%. Apple surprised on the upside with solid results on the iPhone and in China, and announced more investments in AI. The impression is that many big tech companies are riding the AI narrative with increasingly significant capex investments, and the market, while lacking clear ideas about the returns associated with these investments, does not seem to be concerned, but rather sees it as a positive thing.

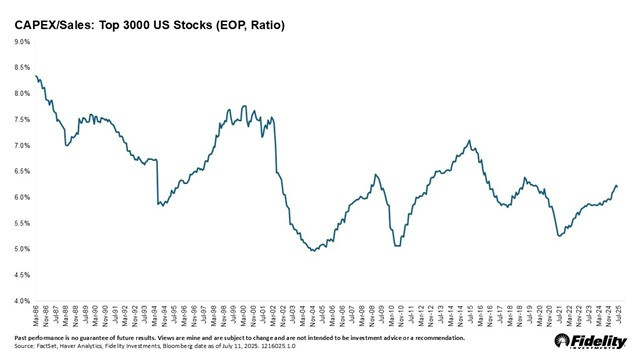

The capex cycle is an often underestimated dynamic, but one with very concrete implications for the stock market. According to the data, since 2022 we have been in a phase known as capex recovery, i.e., a recovery in capital investment by US companies. Driving this cycle are sectors such as data centers and hyperscalers, i.e., the invisible infrastructure that powers much of today's digital economy.

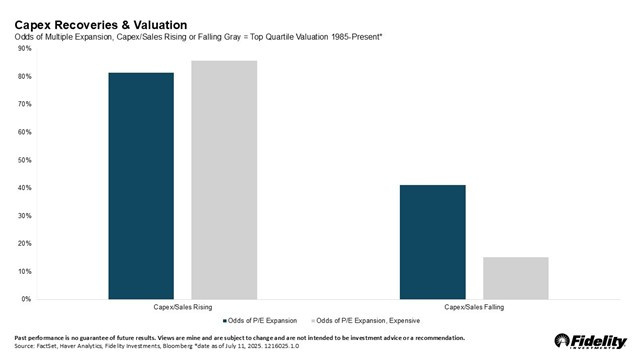

History suggests that periods when the capex/revenue ratio rises often coincide with a higher probability of earnings growth. Not only that, but these phases are often accompanied by an expansion in multiples. This is because markets anticipate. If future earnings look solid, prices tend to adjust before fundamentals fully manifest themselves. And beware: even when markets seem “expensive,” history suggests that this is not necessarily a limitation. In fact, capex cycles that start with high valuations have historically shown an even greater likelihood of further multiple increases. High valuations, in this sense, are a sign of confidence—not excess.

If we look at historical precedents, the sectors most positively exposed to a capex recovery are those in the technology sector. But behind the enthusiasm for artificial intelligence lies a crucial question: are we at the beginning of a new phase of structural growth or in the midst of a bubble?

In recent months, markets have shown renewed enthusiasm for more speculative stocks, particularly those related to artificial intelligence and cryptocurrencies. This dynamic brings to mind certain historical periods, such as the late 1990s, when euphoria took precedence over fundamentals.

Although the current context is different—with high interest rates and restrictive monetary policy—investor behavior shows recurring patterns: rushes to rising stocks, concentration of flows, and outperformance of high-volatility segments. This is not a cause for alarm, but rather an invitation to reflect. In these market phases, it is essential not to get carried away by emotion, but to maintain discipline, balance, and awareness of the risks. Because every cycle has its own story, but certain dynamics... repeat themselves.

The VIX remains at multi-year lows, while credit spreads continue to reflect widespread complacency.

This behavior is the opposite of our investment philosophy, which is based on a countercyclical approach and respect for fundamentals. As we often point out, extreme sentiment is an excellent contrarian indicator. The positioning of large investors also suggests caution: institutional investors are gradually shifting toward defensive sectors, such as consumer staples, while retail investors remain exposed to tech, meme stocks, and leveraged instruments.

Our approach, on the other hand, remains consistent with fundamentals. Macro data show a resilient economy, but one that is not immune to slowdowns. Inflation is under control but still far from giving the Fed the freedom to cut rates. Markets are supported by earnings, but also by potentially unstable speculative dynamics.

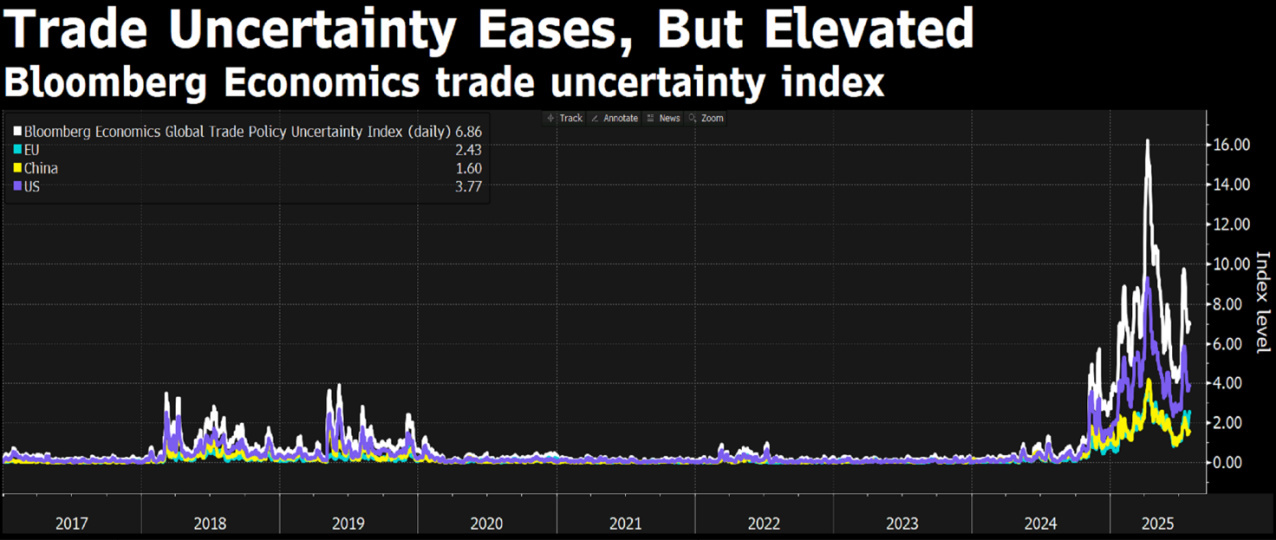

Added to this are uncertainties related to global trade. After signing the new agreement with the EU, Trump announced 50% tariffs on semi-finished copper products and certain exports from India and Brazil, as well as 39% tariffs on Switzerland. If these measures are amplified, they could reignite inflationary pressures and force the Fed to keep rates high for longer. There also remains the legal unknown: the courts could soon rule that it does not have the authority to impose them unilaterally, and there is nothing to rule out the possibility that the tariffs will be renegotiated or modified in the short term.

In summary, we are going through a period of great complexity. Markets are celebrating solid earnings and the absence of new tightening measures, but systemic risks are accumulating beneath the surface: stretched valuations, retail euphoria, compressed volatility, and increasingly unpredictable trade policy. The current positioning requires discipline, selectivity, and a deep respect for fundamentals.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.