Credit spreads: how to prepare for excesses

18 April 2024 _ News

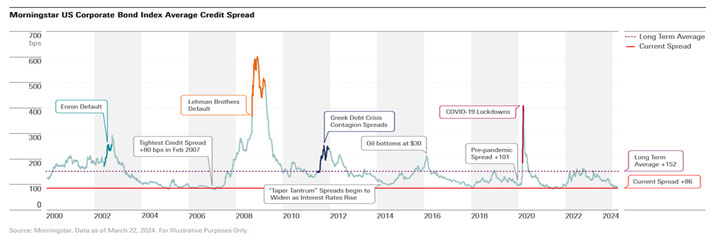

Both stock and bond markets always tend to move from one excess to another. As can be seen from the chart below, spreads reach highs at times of great uncertainty and fear and converge on lows at times of euphoria.

The conversion to the average spread is a mathematical/statistical factor that tends to return over time. It is not known when this will happen, and anyone who wonders about this is looking for an answer that does not exist. In fact, it is known that at some point a new reason will come along, as shown in the upper graph, which will cause spreads to rise again. How to prepare for this?

What are Credit Spreads?

Credit spreads represent the spread between the yield of a corporate bond against a benchmark government bond. The spread thus measures the additional return required by an investor to invest in corporate bonds compared to investing in government bonds.

How are the spreads doing?

Let's start with investment grade corporate bond spreads, which narrowed by 10 basis points to +86. This tightening brought spreads to their lowest level in 24 years, only 2% of the time IG spreads were tighter.

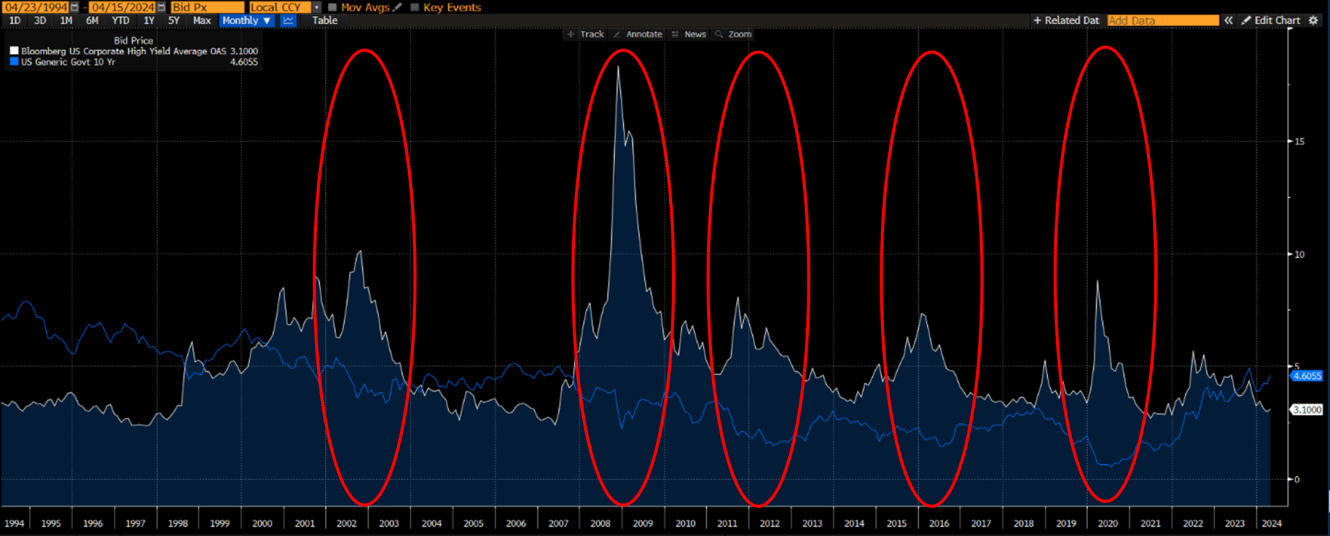

We move on to high-yield corporate bond spreads, which narrowed by 10 basis points to 31 basis points at +302.

This tightening brought spreads to their lowest level in 24 years, just 3% of the time HY spreads were tighter.

What do such low spreads tell us?

Spreads are the counterpart to valuations in equities. low spreads on bonds are in fact equivalent to high valuations on equities. Low spreads tell us that investors are positive about the asset class and require a lower return to invest in this asset class. However, history teaches us that, as in the case of high equity valuations, low spreads anticipate lower-than-average returns in subsequent years. The chart below relates the earning yield of the S&P500 (measured as the inverse of PE) to credit spreads and we see their strong relationship. That is, spreads that narrow (blue line), i.e. more expensive bond markets, are accompanied by equity markets that become more expensive, i.e. earning yields that fall (white line).

What is the best hedge when spreads widen?

Finally, history teaches us that one of the best hedges to have when spreads widen is a position in US government bonds, to take advantage of the so-called 'fly to quality'. When the white line, which indicates spreads, tends to rise, the blue line, which is treasuries, tends to fall.

This combined with the high yield on government bonds leads us to prefer this asset class in the bond world. The question that grips the investor is when to invest in treasuries to hedge against spread widening? Those who try to do timing on average get hurt by the market.

What does the value compass suggest?

The value compass as always is based on rationality and shows us that we are in an extreme. The low level of spreads leads us to be very careful when selecting corporate bonds as the expected return does not counterbalance the risk taken. This is why one should not spend time looking for answers that do not exist, such as when they will widen, but be ready for the event.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.