Disruption for a knowing restart in investments too

13 May 2020 _ News

Not all sectors will recover after the Covid-19 crisis. It is therefore essential to entrust your investments to professionals who know how to identify long-term value opportunities.

Meucci and Bell's telephone, Edison's light bulb, Benz's car, Marconi's radio, the Wright brothers' first flight and Fleming's penicillin are inventions that we can call "the grandparents" of disruption.

Clayton Christensen - a Harvard professor who introduced this neologism - defines "disruptive innovation" as reversal due to a specific innovation - be it technological or intrinsic to the market - that ends up completely revolutionising a particular way of thinking or conceiving reality, a cultural cyclone that breaks down previous mental pillars and makes it possible both to build new ones for ourselves and to interact with others. Not all innovative phenomena can be defined as "disruptive": only time can prove whether they are, and it is necessary for the change to spread widely and take root deeply in common experience, whether it is a scientific discovery, a new invention or a change of perspective.

History is full of examples of "disruptive innovations" before their time: the 16th century Copernican Revolution itself is a clear example of how a new theory can lead to a "paradigm shift", upsetting established cultural balances and making it impossible to rely on previous theoretical axioms.

The inventions of the last 150 years prove it: between 1800 and 1900 there was a boom, then a slowdown due to the two world conflicts and the Iranian oil crisis of the 50s, until the advent of the first computers and the dot.com bubble of the 90s/2000s which gave new impetus to innovation.Each historical era has had a range of main activities that have driven the economy and generated wealth, as confirmed by the industrial revolutions and the composition of the US Dow Jones stock index, from which we can see the slow sectoral turnover from real economy to service economy: from 1880 to 1920 it was dominated by "heavy" industry and mining (railways, steel, coal), from 1920 to 1950 by electrical and telephone services and oil and from 1950 to 1980 by the automotive industry and information technology.

Technological innovations are nothing new, but they are the essence of modern civilisation and economic development. Today we are experiencing the fourth industrial revolution, the digital age, Industry 4.0. Research and development in new technologies is running at exponential rates never previously seen (investments in research and development of technological companies are growing almost twice as fast (13%), every year compared to the market, (7.5%) and the rate of internet use in the world has gone from 2% in 1997 to 55% in 2017). Companies that can look to the future and are ready to ride the wave of change are investing to integrate artificial intelligence, big data and robotics into their production systems. Suffice it to say that total spending on technology investment was about .4 trillion in 2015 and is expected to exceed trillion by 2022. And PwC estimates that the impact of artificial intelligence on global GDP growth will be about trillion by 2030. Total sales of artificial intelligence companies are expected to grow from .4 billion in 2017 to billion in 2025, while total turnover of big data companies is expected to grow by 12% per year.

It is therefore not surprising that the health crisis we are experiencing, connected with the spread of the coronavirus, has sanctioned a disruptive phase, because it has further accelerated a revolution already underway, which now sees technology, healthcare and communications driving the locomotive of the various economies, to the detriment of more "old school" sectors (the market profits of the top ten technology companies have gone from around 40 billion dollars in 2000 to 140 billion dollars in 2018). Technology has not just helped us cope with lockdown, but has allowed us to survive, confirming its now indispensable role in the life of every individual. For example, it has made it possible to treat patients at a safe distance, prevented the disruption of all work and school activities and kept families entertained by enabling communication, remote sports and online shopping.

As in any revolution, the winners will be those who best adapt to change. So not all sectors will be protagonists of the restart and, on the contrary, there will be some victims in the field (as happened in the famous case of Kodak, a high-profile victim of the digital transformation).

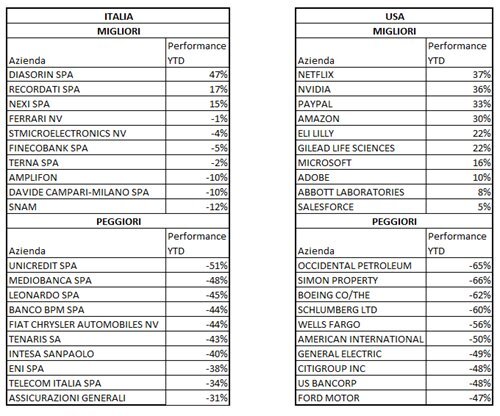

This view is confirmed by the list of securities that are going better and worse in Italy and the United States, which shows that technology and health care are at the top of the podium while automotive, transport, finance and energy are at the bottom of the ranking:

What we want to emphasise is the importance of relying on professionals who can identify the most profitable and least uncertain long-term investment opportunities, with growth prospects exceeding market expectations. They include the managers of Pharus.Cybersecurity, telemedicine, biotechnology, robotics, smart working and training, digital consumption and payments, streaming and video games have been in Pharus' portfolios for many months and will be among the main beneficiaries of the opportunities offered by the "Covid-19 disruption". Suffice it to say that the cybersecurity market grew about 33 times from 2004 to 2017 (from .5 billion in 2004 to 0 billion in 2017) and investment in the sector is expected to reach trillion in 2025. Or that the global robot market should grow from billion in 2017 to billion in 2023.

The flip side of the coin is to proceed with cutting-edge investments in highly innovative companies and sectors, such as Tesla and blockchain, which are faced with very challenging scenarios, so that the additional caution which only investment professionals can afford is essential.

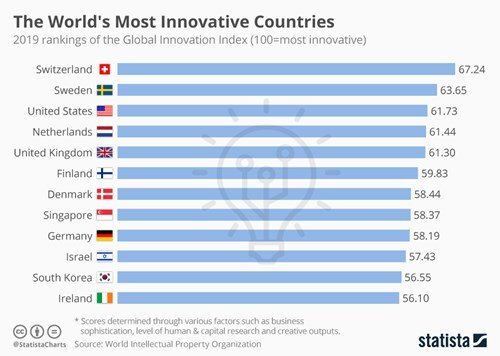

In the meantime, it is interesting to continue to monitor the performance of the Global Innovation Index, which reports the ranking of states with the highest degree of innovation. This was the picture in 2019. Will it be changed for 2020? If so, how? The composition of the Pharus portfolios certainly provides something of a spoiler...

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.