Equity Risk Premium

10 September 2020 _ News

Equity Risk Premium (ERP) reflects the additional return required by traders to invest in equity rather than risk-free bonds. The main determinants of the ERP are:

- Risk aversion: the higher the risk aversion of investors is, the higher the additional required return of investors will be, to invest in equity rather than risk-free bonds.

- Economic uncertainty: in an economy where inflation expectations, economic growth and interest rates are more predictable, the additional return required by investors to invest in equity is reduced.

- Completeness of the information: a stock market characterized by transparency of the information concerning financial statements and forecasts, has a lower risk and this induces a lower equity risk premium;

- Liquidity on the market: a more liquid market, reduces transaction costs and possible disposal of shares, thus lowering the equity risk premium;

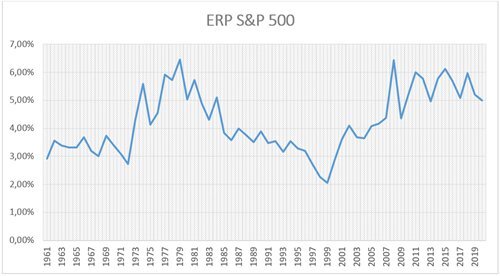

The current market Equity Risk Premium is higher than the average value recorded since 1960, reaching 5% against an average of 4%. This parameter is calculated considering a 20% hourly cut for 2020 as a result of the Covid-19 pandemic.

The higher value of the ERP compared to the average shows how much the share is currently decidedly more interesting than the bond.

In times of market stress, it is also necessary to analyze the strategies implemented by the Central Banks. The current approach of FED is symptomatic of the US Central Bank’s focus on the stock market. Some researchers at the National Bureau of Economic Research have shown that negative returns on the stock market are strongly correlated with successive cuts in interest rates, the so-called FED input. This mechanism has a positive effect on the ERP, keeping the investment in equity profitable.

In a scenario characterized by a value higher than the average ERP value and by strategies to cut interest rates by central banks, Pharus Management Team confirms its propensity to invest in equity rather than in bonds.

The ERP, together with the interest rates, in fact, is without doubt one of the variables that mainly impacts every valuation model based on fundamental analysis and, as such, represents a guide for every investor in the allocation processes.

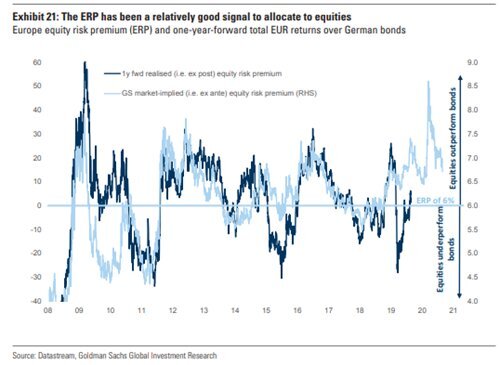

It is no coincidence that, as highlighted by a recent study performed by Goldman Sachs, high levels of ERP are followed by over-performance of the stock market.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.