Equity takes-off thanks to the reporting season

11 February 2021 _ News

The current American reporting season confirms that the earnings bottom is now behind us. This was hoped for and expected already at the end of December when the analysis of the 2021 Outlook had shown upward corporate earnings and a positive earnings sentiment, both signs of the closure of the crisis period recorded in 2020.

About 2/3 of US companies have already reported earnings, and with sensational results. Numbers that have allowed the growth expectations of the S&P 500 to return to pre-Covid levels.

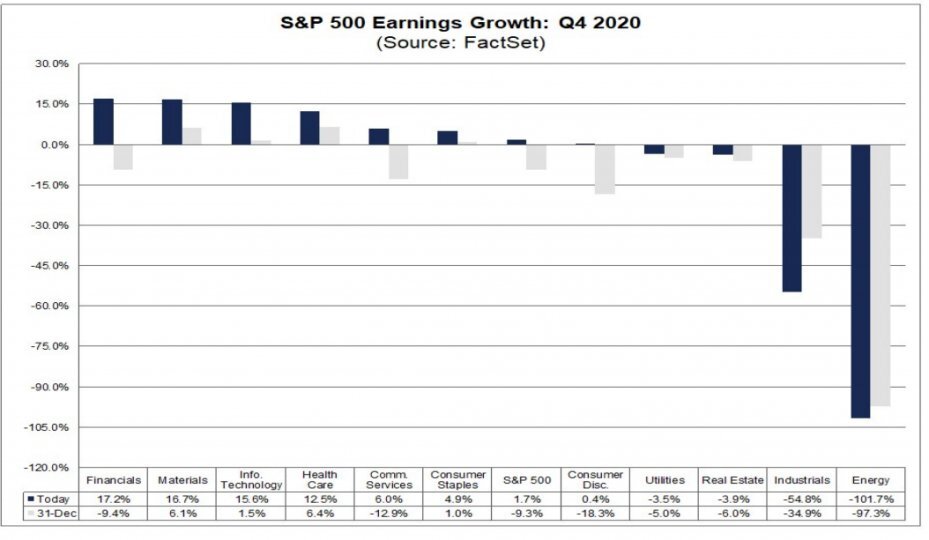

Q4 2020 is therefore closing in America with a growth of + 1.7%, an improvement of about 10% compared to expectations of -9.3% at the end of 2020. This particularly positive result has been driven by company surprises. Almost 80% of American companies have indeed beaten the estimates. The best sectors of the market have been the most cyclical ones: Financials and Materials, which grew 17.2% and + 16.7% respectively.

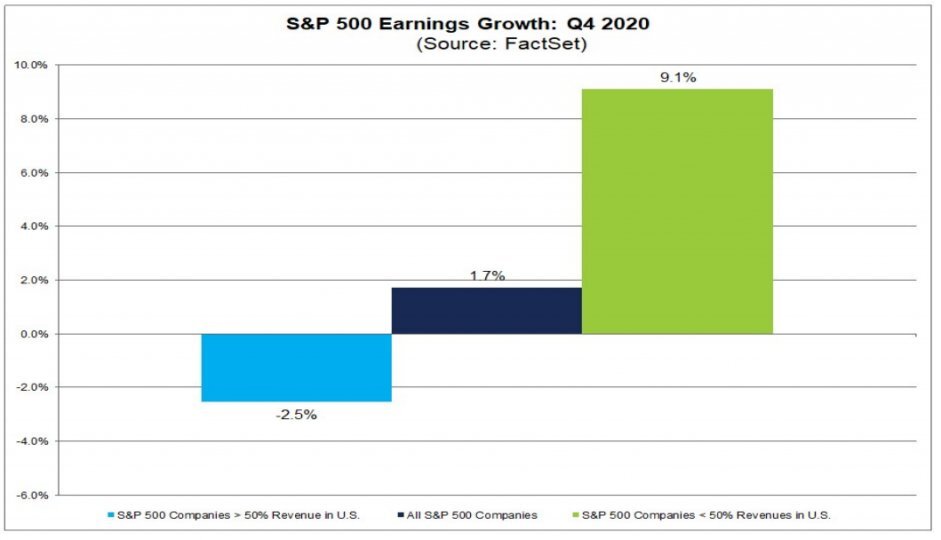

Interesting to notice in this reporting season the growth shown by the companies most exposed to national markets, which had the best performances. This highlights how the lockdowns in the various countries have affected exports.

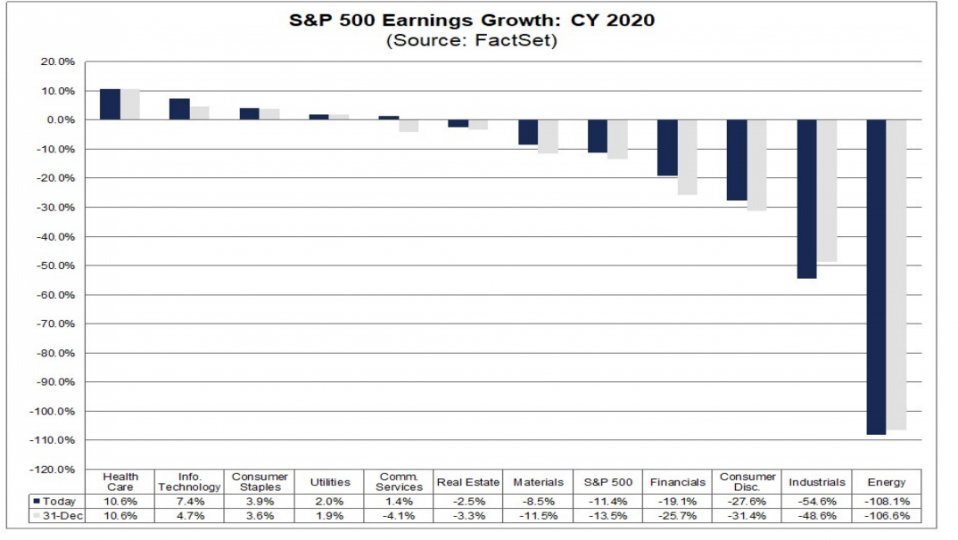

2020 should therefore close with only a -11.4% decrease in earnings, a really good result compared to the -30% forecasted months ago:

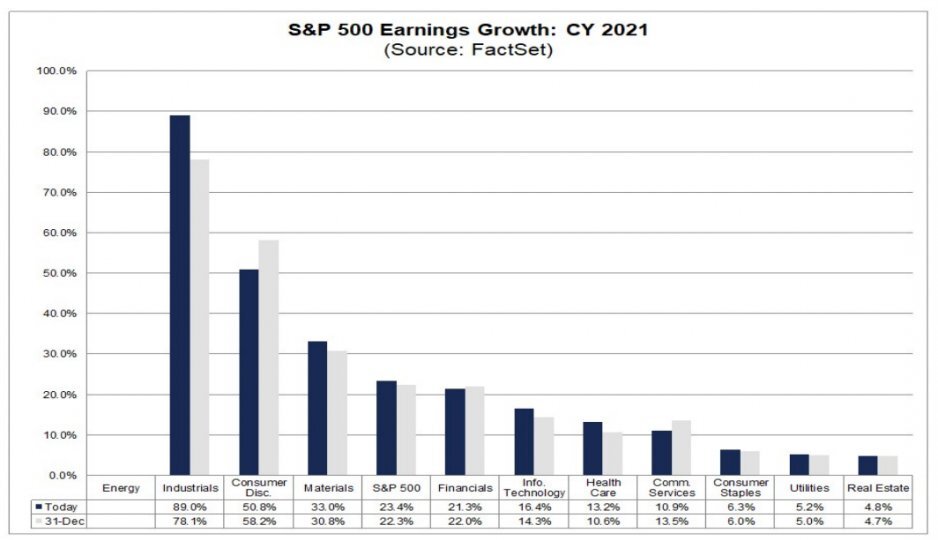

For 2021, current expectations are for a +23.4%, an improvement compared to the end of 2020:

Considering the sensational numbers of the reporting season and the coordinated economic recovery, we continue to be positive on the cyclical recovery in earnings and on equity in general, with the willingness to focus on those assets whose value has fallen during the past year of Covid and whose potential has yet to be realized in this new post-crisis year.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.