From Inflation to Credit Crunch

13 April 2023 _ News

The key focus of the market is slowly shifting from inflation to economic slowdown, driven by high rates and worsening credit conditions.

The market consensus, however, mistakenly continues to look at the short term, focusing on inflation.

The macro data that came out last week are proof that the Fed is achieving its goal: slowing down the U.S. economy in order to lower inflation. For example, in fact, the ISM indicator of industrial activity for March fell to its lowest level in 3 years.

However, the market tends to anticipate macro data, which are already discounted in prices when they are released.

An example of this is the average 6- and 12-month performance of the S&P 500, which, in the months following an ISM below 50 (symptom of recession), tends to be almost double the average performance recorded under normal market conditions.

3M, a leading American industrial company, is also an example. The company currently stands at -50% from the highs, and, as the logarithmic chart shows, since the 1980s it has only experienced major corrections in recessionary periods, such as in 2008, when it corrected by -54% or in 2001, when prices fell by 30%. 3M, therefore, to date, is already incorporating a recession into prices.

It is possible to extend the same reasoning to sectors. In fact, the market had already begun to discount a recession in late 2022, and evidence of this can be seen in the prices of the tech-communication and discretionary sectors, which have since turned out to be the best performers from the beginning of the year to date.

In addition to the ISM last week, various labor market data were also released. What emerged was that employment is currently very close to expectations and that although the economy was not in recession in the first quarter, it is gradually losing momentum.

Despite a labor market that has proven strong, wage inflation is moderating, undermining the possibility of further rate hikes by the Fed. However, rates have risen slightly in response to futures markets now discounting a 60 percent probability of a final 0.25 percent increase in the Fed rate on May 3, to a range of 5.00 percent to 5.25 percent.

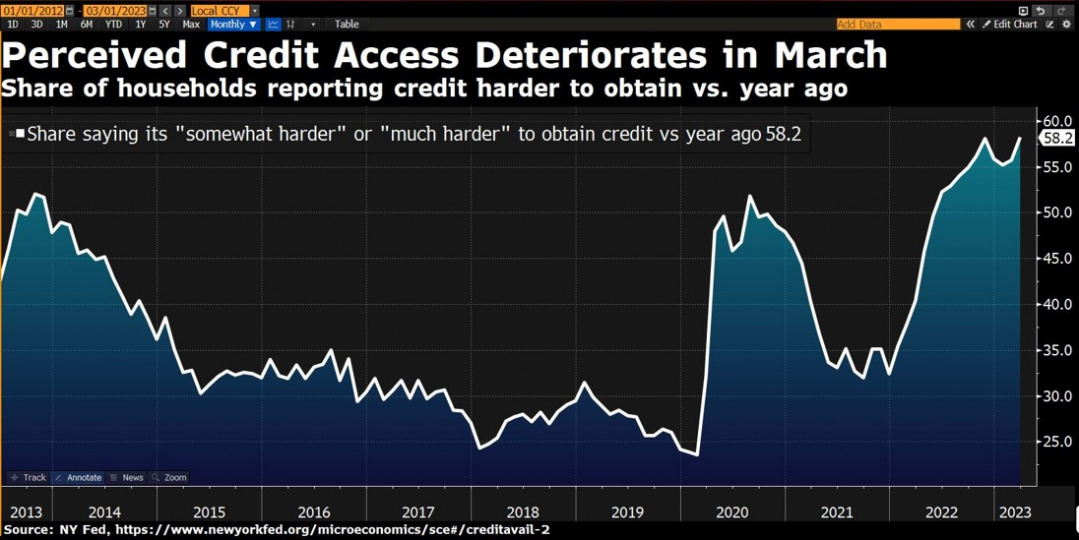

But the main variable to watch in the coming months is corporate credit conditions. In fact, the FED's rate hikes should no longer follow inflation, as it is clearly slowing, although not very fast, but should consider the worsening conditions for companies to access credit. Indeed, the banking crisis in March made it necessary for the FED to intervene to try to prevent a worsening of credit conditions, the so-called credit crunch. The percentage of households reporting that obtaining credit is relatively more difficult or significantly more difficult than last year stands at 58.2 percent, a figure that, as the chart shows, is at its highest level in 10 years, showing a marked deterioration in the perception of credit conditions.

High rates and more difficult credit conditions are the prospective problems in the coming months, not inflation.

A first estimate of the effects of the credit crunch will be found in the reporting season that begins Friday. Earnings are expected to decline by -6.8% for Q1 2023, a negative revision of -6.4% from expectations on the quarter as of December 2022. Earnings expectations remain at +1.2% for 2023. These expectations stem from the fact that approximately 80% of the companies that reported guidance for the quarter, reported it negative.

In conclusion, the consensus continues to focus on inflation, which, however, is not the key variable to watch for the coming months. In fact, inflation has been replaced in importance by worsening credit access conditions. This week the reporting season begins and we will start to see how companies are reacting to high rates on the one hand and worsening credit conditions on the other. In this context it is good to stay focused on leading companies and sectors that have already discounted an economic slowdown.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.