Impressions of September

06 October 2022 _ News

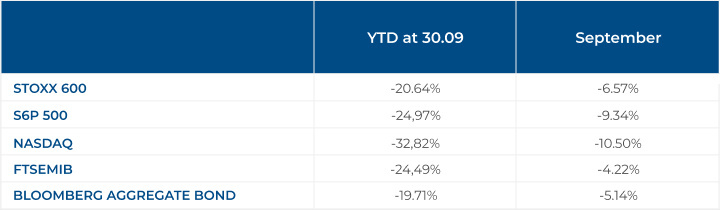

At the start of September the agenda promised to be quite comprehensive, it also proved to be very demanding. Consecutively, we experienced Fed rate hike to 3.25% (+ 0.75%), ECB rate hike to 1.25% (+ 0.75%), US inflation + 0.1% and EU inflation + 0.6% in September.

Moreover, it was expected that the Italian election could bring some concerns in the market, however, fortunately we haven’t seen any distress yet (and we think also not later) on the spread of BTP-BUND.

The market reaction was negative.

Overall, the topic of discussion always remains unchanged, Inflation, Fed, ECB rates, and economic slowdown with the hypotheses of a potential marginal recession. The markets observe, take note, and adapt to the evolution of probable future scenarios. The market anticipate in advance and, if possible, align itself. Hence, for this reason, the decline of stock prices in recent months also affects both the quality and its absence in an undiscriminating way.

For example, Google drops, although it is a company that manages to invest with much higher profit rates than the cost it incurs for its capital (24.38% vs 9.88%) and price/earnings that falls to a significant 8 years low of 15.69x.

Hermes also comes down with the same features as Google, but the list of quality stocks is extensive. In our portfolios, these types of companies are broadly present, not directly, but through the managers of the funds, we have selected and not by any chance. We have specifically chosen this basic philosophy in the management of our investments and will continue to do so.

As we said, the current market sell-off is indiscriminatory, and we lose sight of what should drive the investments or the value. Accordingly, only the price counts and it is in these situations that the most common and serious mistakes are made in the management of portfolios. Fortunately, value never lies, once the moment of irrational madness has passed value will be the only thing that matters, especially if reflected at such attractive discounted prices.

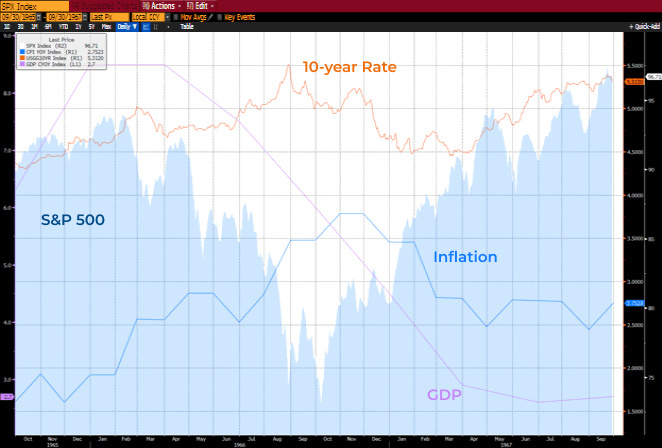

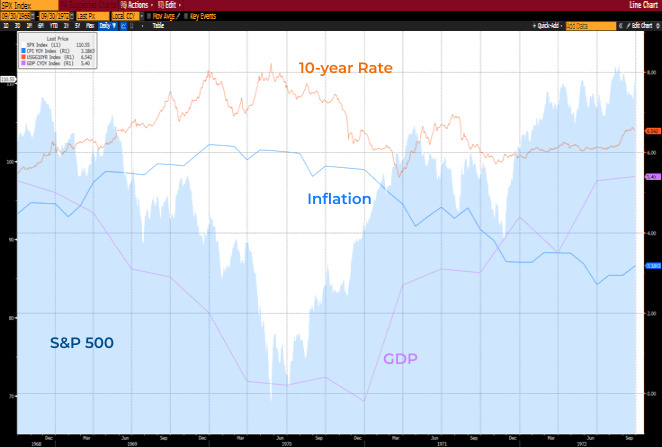

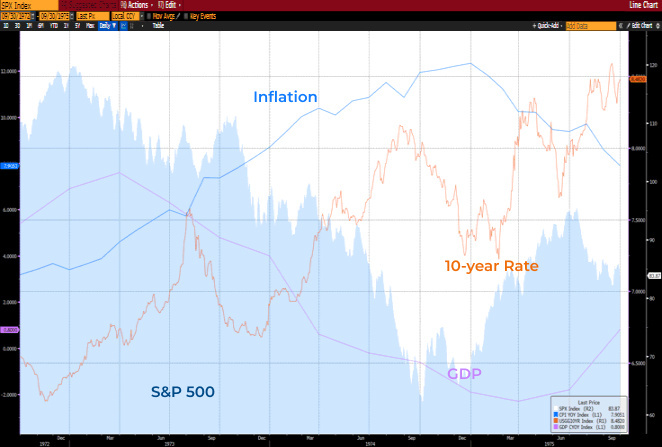

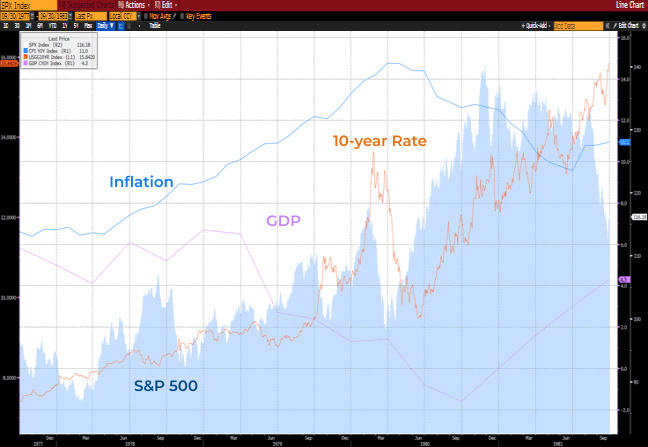

These moments of macroeconomic variables in cyclical coincidence have already occurred in the past.

In 1965, for example, until 1967 the peak of inflation and the US ten-year rate almost overlapped perfectly with the market lows of the S&P500 index. In the following twelve months from October / November 1966, the stock market rebounded by 32%.

The current context makes us think that we are close to the maximum inflation peak in the US area while in the European region we are going to experience the same within a few weeks of delay. However, the overall picture does not change, the actual downward trend in the gas price supports our projections.

As always, we will face the evolution of the situation with good judgment and caution. The constructive spirit will remain fundamental, although on the one hand the elevated inflation of this period is destined to diminish, on the other what awaits us is a "new normal" characterized by a lower rate of inflation but not necessarily as low as pre-covid period.

"Globalization" as we know it today will change, production bottlenecks and monopolies demonstrated their limits during and after Covid, and there will be more room for renewed national production chains, which is not necessarily bad news.

Comparatively, the last 15 years characterized by low rates (sometimes very low) have been unusual or rather unique, while we witnessed vain efforts by central banks to raise the inflation rate towards more appropriate levels (see past-ECB target at 2 %).

Perspective is important, the quality of the assets in our portfolios are continuously examined and analyzed profoundly. When value and price become misaligned, for the worse as in recent months, patience is needed. The quality is substantial, and the price will eventually adjust, it always does.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.