Long-term: the watchword, according to the market too

16 April 2020 _ News

An apocalyptic scenario in the forecasts and the mass media, but stock indices and bonds are in clear recovery from the massive withdrawal due to the coronavirus. Stefano Reali explained the reasons at the last investment committee meeting

It is not uncommon, just now, to find apocalyptic scenarios in the media and read how the current Covid-19 crisis will lead to the most severe global recession since '29, more violent even than in 2008.

In the meantime, however, over the past week, global stock indices have made significant recoveries on the financial markets. Just think of the S&P 500 which, since the outbreak of the health emergency, had corrected by -35% of the high, to go on to recover in recent days half of what it had left behind, reaching -18% of the high. The bond market has also rebounded strongly, recording a recovery especially on the high yield side after the publication of the Fed minutes. What is the explanation for this trend?

Our deputy director, Stefano Reali, tried to answer that question at the last investment committee:

"The market is simply thinking something that we've had for a long time and is very sensible. It is now clear that 2020 will be a very difficult year and it will be enough to understand how severe it will be in terms of cuts in business results and macro negative data". But we must not forget that cuts and recessions have an end, they are limited in time. And it seems that everyone agrees that 2021 will be a year of recovery in the markets, of total rebound, in terms both of economic and business data and of earnings. Especially in a case like this, where the recession is linked to a very particular contingent factor. The market is therefore simply minimising the strong volatility of 2020 and instead looking at 2021, in the long term".

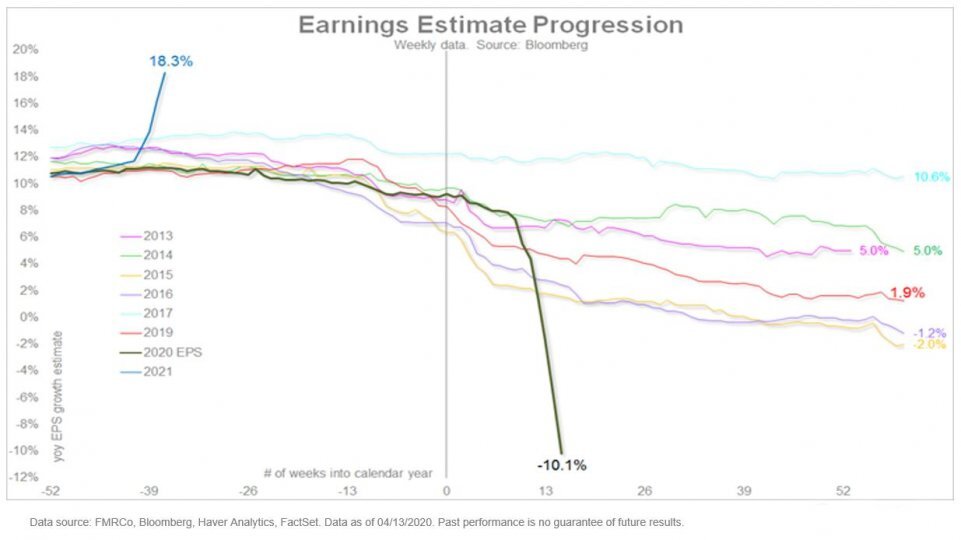

For this year, in fact, the market forecasts a 10% drop in profits for the year as a whole, while a recovery in profits is expected for next year, with a growth rate moving towards +18.3%. In this scenario, the Price-Earnings ratio is back at around 18, a higher level than in February 2020, i.e. before the Covid-19 emergency.

As the chart shows, given a profit multiple in 2021, the market is in line with or just below its historical average. In fact, profits in 2020 represent only one eighteenth of the valuations, because the market takes long-term profits into account.

Even considering the issue from the perspective of the Equity Risk Premium (the relative valuation of shares compared to bonds), it can be seen that it is at an all-time high, in favour of shares, today as never before. If we were to assume that equities would take as long as ten years to recover the 18% that is missing to return to highs, it would mean that the total return on US equities for the next ten years (recovery of 18% of the price + dividend) would be 4% per year, which is still 5 times higher than that of the United States at ten years.

Many investors are beginning to perceive that "this time is no different", so much so that although shelter assets are hitting new highs, the Vix index (which measures volatility) is returning to more "normal" levels.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.