Why choose a minimum volatility investment

31 August 2022 _ News

Today, we launch a range of content focused on factor investing and how it can help us build our portfolios.

Factor investing is a criterion for constructing asset allocation through the use of factors, in other words specific characteristics that bring different stocks together.

For the past few years, empirical evidence has shown how investment factors can help in creating effective active portfolios that can achieve better risk-adjusted returns than market indices.

Active management of a portfolio, however, can result in deviation, even temporary, from the benchmark index performance, primarily because not all factors contribute positively at the same time but have their own cyclical nature which distinguishes them according to the market environment (for example, MOMENTUM tends to perform well in periods of accelerating economic growth).

Secondly, not all investors behave rationally and, due to cognitive biases, tend to overweight more widely held stocks (typically large caps), for example, which are probably also the most volatile because they are more heavily traded. Therefore, at certain times in the market, it would be more appropriate to overweight MIN VOL stocks instead.

It is precisely in a market environment such as the one we are currently experiencing that we begin to analyse the MINIMUM VOLATILITY factor.

If the managers focuse their attention on this style, then they will choose stocks that help to reduce risk within the portfolio by taking into account the correlations generated among its components, thus not only stocks with minor price fluctuations, but also elements that are not correlated with each other.

Of course, this process must be methodological and disciplined, that is, applied and monitored periodically so that the least risky portfolio is obtained at all times.

Why choose a minimum volatility investment?

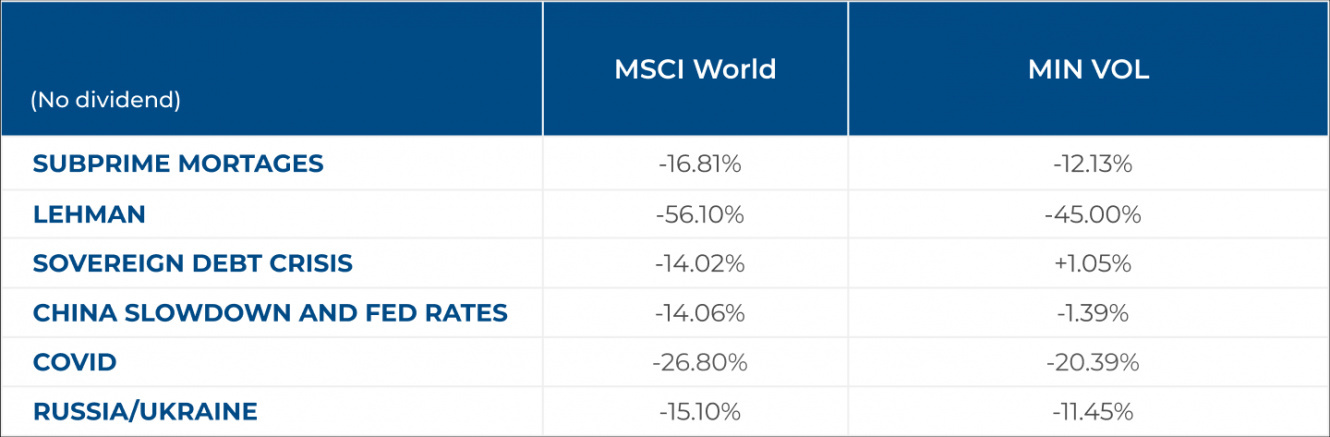

Minimum volatility strategies have been shown to be able to generate better performance than the market and with less risk, especially during high-stress phases, as highlighted in the table, in which we have analysed previous periods characterised by very sharp declines.

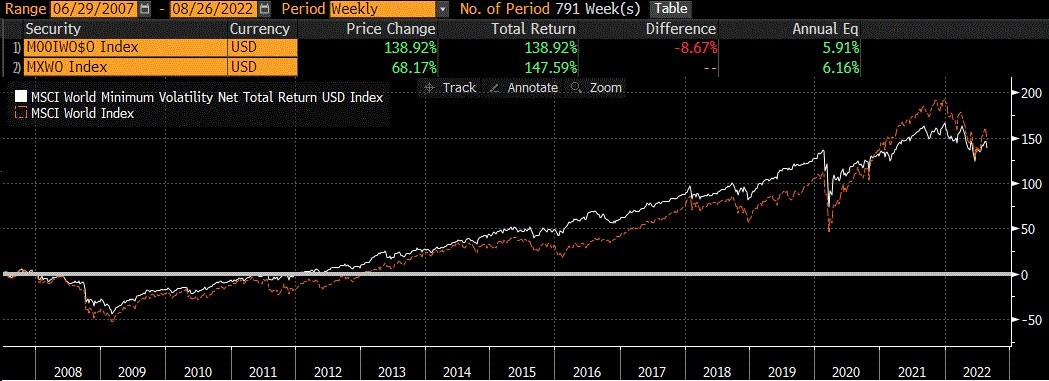

And when does the "calm" return to the markets? As the chart shows, this strategy obviously achieves lower grade recoveries, even though it is absolutely competitive with the parent index, MSCI WORLD Local, ensuring less risk. In fact, the strategy's return evaluated over the past 15 years, in which the markets have witnessed continuous reversals and improvements, is certainly in line with the market and even more rewarding when adjusted for risk, which averages 14% for MIN VOL and 17.50% for the parent index.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.