Quando il mercato smette di cercare vincitori e inizia a cacciare i perdenti

19 February 2026 _ News

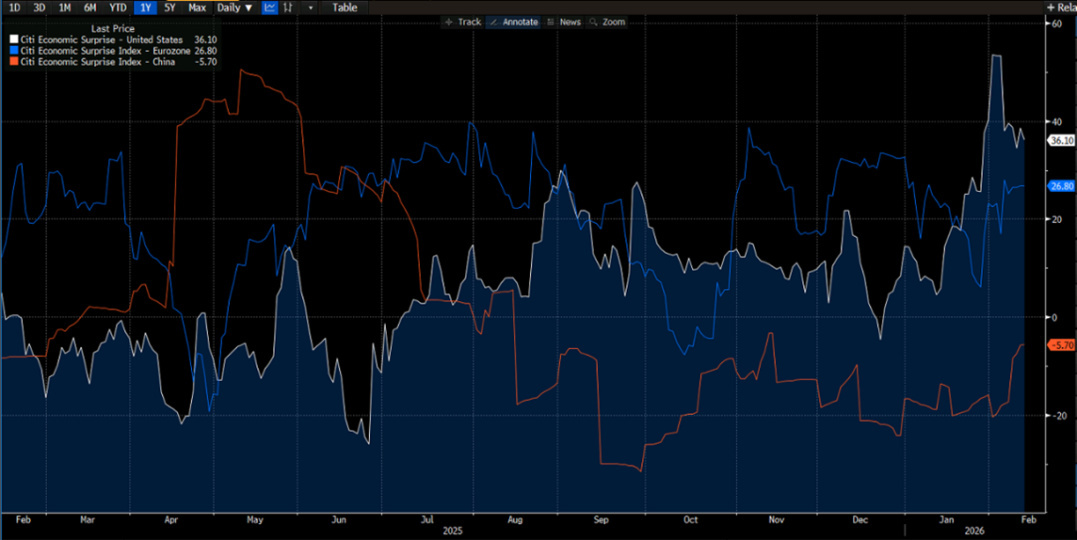

The week on the markets was an interesting balancing act, with macro signals that, at times, seemed to reopen the door to the narrative of rate cuts on the one hand, and a stock market that continues to show the distinctive feature of this phase, namely increasingly marked selectivity, on the other.

We did not see widespread panic. It was not a week of systemic risk aversion. Rather, it was a week of maturity: rotation, compression of multiples where expectations were most tense, and increasingly targeted repricing of certain business models. However, volatility is rising overall.

From a macro perspective, the most interesting movement was seen in long-term rates. After peaking in previous weeks, yields fell, supported by weaker consumption and some less impressive labor market data, reigniting the idea of disinflation and a potentially more accommodative Fed.

Almost simultaneously, however, a stronger-than-expected labor market report dampened enthusiasm for imminent cuts. The point is that the data are not inconsistent, they are less synchronized: the economy can remain solid while some components begin to normalize. In this context, monetary policy does not follow a linear path, and the market alternates between phases in which it buys duration and phases in which it unloads it.

But the most interesting part of the week was not the macro. It was the nature of the rotation within equities. Looking at the weekly leadership, some might say it was a classic rotation toward defensives. Utilities and real estate outperformed, while parts of technology, communication services, and some financials struggled. However, interpreting this movement as a simple shift from growth to value or from cyclical to defensive would be reductive.

The real distinction that the market is introducing is not stylistic, but structural. The question driving pricing today is not “is this a growth or defensive stock?”, but rather: can this business model be replaced, compressed, or structurally eroded by artificial intelligence?

If the answer is yes, the market applies a discount. If the answer is no, or if the risk is perceived as much lower, the valuation holds up better.

This is a profound change in the way sectors are viewed. It is not a question of high or low multiples in absolute terms, but rather the defensibility of the economic model in a context where the marginal cost of many digital functions tends towards zero. Goldman Sachs recently compared several current asset-light sectors to the publishing industry in the early 2000s, models that seemed solid until technology drastically reduced barriers to entry and pricing power, effectively destroying them.

Many purely digital businesses, based on information brokerage or functions that can be replicated via software, are now viewed through the same lens. This is not a judgment on today's profits, but a reassessment of their durability.

Artificial intelligence can automate processes, reduce costs, and replicate digital functions. It can impact consulting, information flows, and activities with low physical asset content. But it cannot transform itself into an electricity grid, it cannot become a refinery, it cannot replace logistics infrastructure or physical consumer goods. And that is why the rotation we are seeing is not simply “defensive versus growth,” but “potentially destructible versus less destructible.”

The real change lies in the question that the market is asking itself. Over the last two years, the narrative has been: who will be the big winner in AI? Which platform will dominate? Today, the question has become more pressing: which model risks losing pricing power? Which product could become a commodity?

When the market shifts from seeking winners to hunting potential losers, selectivity becomes brutal. But there is a further level that amplifies the movement and is linked to the mechanics of flows.

A sector ETF is designed to simplify and diversify. With a single instrument, you buy an entire sector and reduce specific risk. However, when the flow reverses, that same structure becomes a multiplier of distortions.

An ETF does not perform fundamental analysis. It does not distinguish between those who are truly exposed to disruption and those who have solid competitive advantages. If an ETF is reduced, the entire basket is sold. It is not only the fragile model that is removed: companies with robust margins, high cash generation, significant switching costs, and defensible pricing power are also removed. It is a mechanical sale. And when quantitative strategies, risk reduction, and deleveraging are added to passive logic, repricing can become excessive.

At that point, we are no longer observing a selective adjustment of multiples based on the actual risk of disruption. We are witnessing a “basket” effect: if the sector is under pressure, the entire sector is lightened.

These are violent phases, but precisely for this reason they generate asymmetries. When selling is indiscriminate, the market temporarily ignores the differences between truly vulnerable models and models with defensible barriers—proprietary data, deep integration into customer processes, high replacement costs.

And that's where opportunities begin to emerge.

Meanwhile, the “physical” AI continues to show very solid momentum. Demand for infrastructure, data centers, energy capacity, and industrial components remains strong, with orders and backlogs confirming a structural upturn.

This is a crucial point: artificial intelligence is not just a digital or software issue, it is an industrial issue. It is redesigning entire production chains and creating winners across very different value chains. And this is precisely the most relevant information for the market as a whole. The benefits of AI are not concentrated in a few platforms, but are spreading across different sectors and industries. This broadening of the base of beneficiaries is a deeply constructive element, because it makes the story less dependent on a few names and more supportive of the entire stock market.

The conclusion of the week is clear: it doesn't take a major shock to generate volatility when expectations are high. All it takes is a change in the perception of the defensibility of business models. The market is not saying that the economy is collapsing. It is saying that, at this stage, it is not enough to be growth-oriented, and it is not enough to be defensive. We are in a more demanding environment, where resilience to disruption is required. Those who demonstrate their ability to integrate technology without being overwhelmed by it are rewarded. Those who risk being squeezed out or replaced are repriced.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.