US 10-year sell-off looks to be over

26 October 2023 _ News

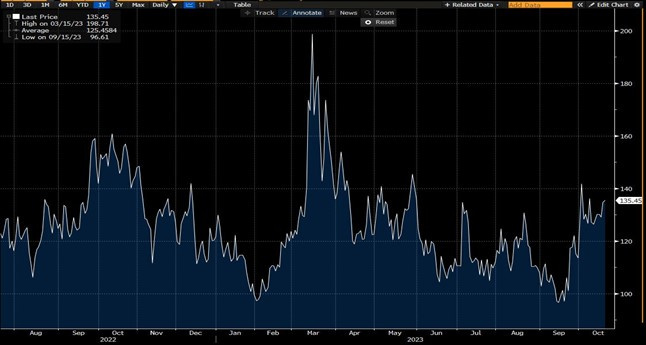

Macro data, the reporting season and central banks are the topics driving the markets around in a vicious cycle that views healthy data as negative due to monetary policy implications, especially since the ten-year rates continue to be the key variable monitored by all investors and rate volatility expressed by the MOVE index remains high.

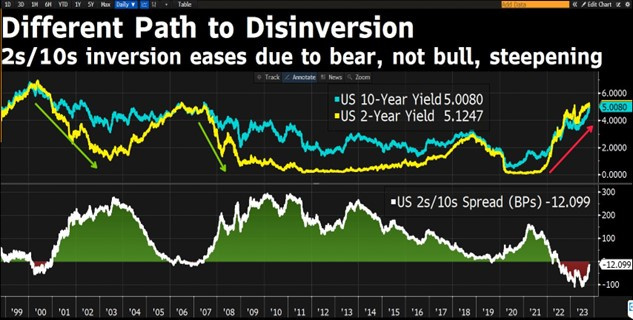

Jerome Powell should be very concerned about the rapid disinversion of the yield curve since early July, caused by bear steepening and with the 10-year yield practically at 5%. If he is, however, the Fed Chairman showed no sign of it during his speech last Thursday at the Economic Club of New York. He observed that the economy remains strong and that the monetary policy could be tightened further while also highlighting the emerging risks and thus the need to move cautiously, stating that “a range of uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little”.

Powell’s rhetoric has not changed, and so he remains steadfast in the stance of higher rates for longer, with decisions that will be made “based on the totality of the incoming data, the evolving outlook, and the balance of risks”. In other words, a flexible approach from the Fed and a message in line with previous ones, but the market reacted by bringing 10-year Treasury yields near 5%, a level not seen since 2007.

The bond markets saw genuine disaster in recent months, defined by Powell as a mere sign of tighter lending conditions rather than a more significant tightening of the monetary policy, which, according to some economists, is the equivalent of at least two, if not four, increases of 25 basis points in the federal funds rate.

The pressure on the rates is beginning to spread to the stock markets, with investors taking some risk off the table, not just because of the level reached by the 10-year, now also worrying for equities, but in light of the outbreak of war in the Middle East and its associated uncertainty, with new rises in the price of oil and the volatility index (VIX) breaking 20 to reach the highest level so far this year.

In this context, the latest macro data have been somewhat conflicting but, on average, much stronger than expected. In particular, retail sales in September were a pleasant surprise, rising to 0.7% compared to the expected 0.3%, and better data were reported by the labour market, with unemployment claims at 198,000 instead of the expected 210,000. On the other hand, in relation to the weak macro data, sales of existing homes fell below expectations, with the rate on 30-year fixed-rate mortgages reaching 8.00%, the highest since the 1990s. High rates are undoubtedly weakening demand for homes, with mortgage applications at their lowest in the last 30 years.

Bond investors would like to see weaker economic indicators before placing their trust in continued limited inflation, but the Citigroup Economic Surprise Index remains high at around 50, indicating even better macro data than expected, which are driving rates up.

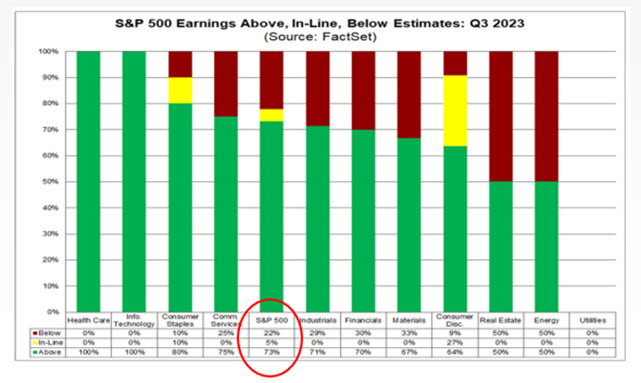

That said, equity investors are pleased to see that the earnings season has begun and rather nicely to boot. As it stands, around 20% of American companies have reported, with 73% recording pleasant surprises on their profits for around 6%.

The reported profits could not possibly be as interesting as the CEOs' comments on the evolution of business and the guidance provided by various companies. From this perspective, we have heard many words of caution from CEOs, for example in real estate, Equifax posted a 35% drop in new mortgage applications and Goldman Sachs a 50% depreciation in the value of its offices. This news is short-term buzz. As we know, the noise on the market can be deafening and its stories extremely compelling, but prices are almost always quick to change and, following the short-lived buzz, risks us getting left behind. Market prices for the real estate sector, for example, had already been trading at a 50-70% discount on the value of the assets for months before Goldman Sachs wrote down its offices. Another example is Pfizer stock, which had reached such depressing valuations that the stock rose 4% the day they announced a cut in guidance. As always, everything plays out on expectations and in a highly uncertain market context. We believe that it is fundamental to focus on stocks or sectors where expectations are very low.

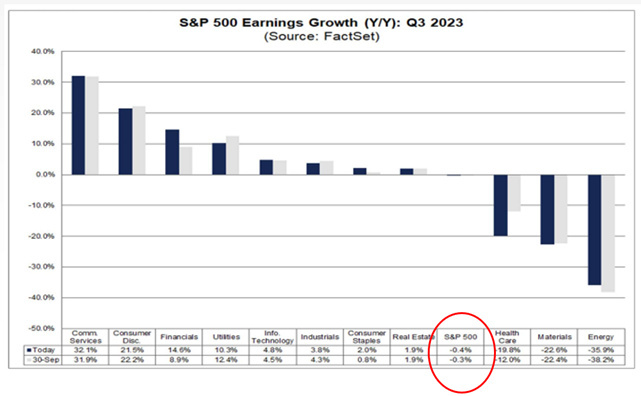

These are currently defensive sectors, utilities, consumer non-discretionaries, pharmaceutical and financial stocks, which we therefore continue to prefer. These stocks and sectors continue to suffer from continuously rising interest rates, but expectations truly seem to be brought much lower and prices have become more reasonable.

During the week, all eyes will be on the reporting season, which will be in full swing once we have the accounts of big Wall Street names. Some volatility is to be expected from the results, with this quarter’s profits forecast to be down 0.4% compared to last year.

We will also see some important macro data towards the end of the week, especially on Thursday, for the US GDP, which is expected to jump to 4.3% from the previous 2.1%, and on Friday, for the GDP deflator, i.e. the measure of inflation most monitored by the Fed. Lower inflation or weaker macro data could help the interest rates to retrace their steps by removing a dead weight from the market. Otherwise, the volatility on equities and interest rates will remain high. Signs of a possible retracing of the rate have already arrived in recent days, so we are confident that this trend will continue.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.