Waiting for a rate cut to invest in bonds? History suggests not.

14 March 2024 _ News

To answer this difficult question, it is first necessary to introduce what drives the actions of central banks and how this is transferred to the bond markets. After that, it is crucial to understand what history teaches us.

How Central Banks think

The central banks' monetary policy is guided by the objectives of their mandate. Depending on which objective they are pursuing, different monetary policy manoeuvres are implemented that have different effects on bond market interest rates. In the case of the Fed, the three objectives are inflation, employment and financial stability.

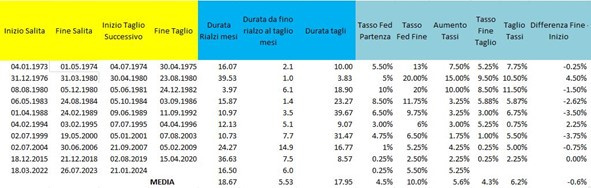

For the first objective, inflation management, the FED implements restrictive monetary policies such as raising rates. This is anticipated by the bond markets that raise rates earlier than the Central Banks. Once this is achieved, the Fed enters a transition period where it neither raises nor cuts rates. This period will lead it to shift its focus to other objectives, such as employment and financial stability. The improvements in inflation data and the words of the FED today make us realise how we are in this situation where the FED is moving from inflation management to its other objectives. History teaches us that these transitional periods last from 6 to 17 months (today we are at 8 months) and during these periods the Central Banks wait for inflation to finally come down before they can start cutting rates.

What the Central Banks are telling us today

First of all, the ECB held the benchmark interest rate steady, taking the next few months to assess the impact of rates on inflation and the economy. On the timing and magnitude of the rate cut, Lagarde said they will have a lot of data in April but even more in June, thus shifting the market's focus to the June cut. The most interesting aspect of the ECB meeting was the negative revision to economic growth and inflation expectations. Indeed, Lagarde highlighted how they expect corporate profit margins to shrink and wages to fall, and how they expect inflation to reach 2% next year.

Federal Reserve Chairman Jerome Powell also spoke on the Senate floor, pointing out that the Fed is not far from being able to cut interest rates. Quoting his words, "When we have confidence that inflation is coming down, and we're not far from it, it will be appropriate to cut" interest rates to avoid plunging the economy into a recession. This week we will have the very inflation figure that should help the Fed and rates to come down. A very interesting aspect of the speech is about natural rates, which are the rates to which the economy converges, described as 'well above neutral,' he said. "We are far from neutral now." This brings back rationality to investors who continue to think that rates will go up; in fact, the Fed is aware that keeping rates above neutral for too long has always brought problems. In support of the FED came the labour market data which showed an unemployment rate of 3.9% compared to expectations of 3.7%.

What history teaches us

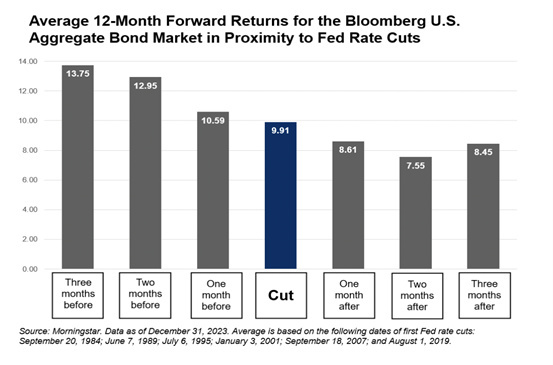

History teaches us that it is necessary to seize the opportunity on bonds during these transition periods where rates remain stalled. This is because the bond market always tends to anticipate the FED's moves and that waiting for the cut is therefore too late.

Here are three reasons to support this.

1. Historically, when the Fed cuts rates, it often does so quickly.

In the last 30+ years, only once has the Fed cut rates by less than 100 basis points in the first year of a cycle. And the only time they did not do so was in a 'soft landing' environment. Although there is no way to predict how fast the cuts will come, the Fed has historically cut rates quickly.

2. The timing of the market is difficult. Historically, investors have been rewarded for being early.

Market strategists have spent a lot of energy trying to predict exactly when the Fed will cut rates, how much it will cut, and how long the cutting cycle will last. The truth is that the Fed reacts to constantly changing data, so it is almost impossible to predict exactly what it will do. Instead of trying to time the market, investors have done well to act in advance. Historically, in the three months prior to the first cut in a cycle, the yield on 10-year Treasury bonds has fallen by an average of 90 basis points. Thus, investors were rewarded for moving away from cash-linked investments and into high-quality bonds before the first cut.

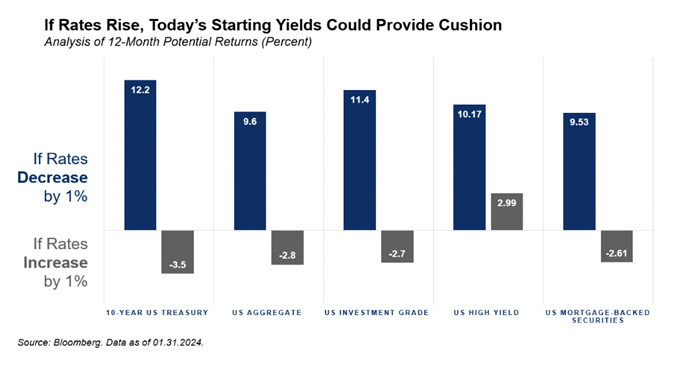

3. If the Fed defies expectations and raises rates, bond investors have protection

To sum up, investors should focus less on trying to predict the precise timing of the Fed's actions. History has shown that it is indeed better to extend duration in a stalled rate environment, and that arriving late can result in lost returns.

Although extending duration across a bond portfolio can have a positive impact on an investor's total return in a falling rate environment, what happens if unforeseen circumstances push the Fed to raise rates? If this happened, bond coupons would allow the bond portfolio to absorb part of the decline.

How equities might react to a rate cut

We cannot generalise, but we can summarise by pointing out that it depends on the valuations of the reference markets and the companies that make up those markets. To be more precise, the European market, where more traditional businesses are well represented, has very attractive valuations. The American stock market, where the tech component has a significant weighting, presents less attractive valuations with a few exceptions. Again, the sectors that are most sensitive to interest rates or generally more 'defensive'.

To find out which companies are at the biggest discount follow us on LinkedIn, Instagram and Spotify where we will continue to show you the opportunities we see in the markets.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.