Post-COVID, new opportunities for Biotech

16 June 2021 _ News

There are three main catalysts for the sector: the end of lockdown, the upturn in M&A activities and a full return to FDA activity. Biogen is a good example of this.

After the improved investment performance of recent months, a new window of opportunity is opening for biotechnology companies. The bounce back, or rather the resumption of the long-term bullish trend is already underway. The Nasdaq Biotechnology Index, for example, hit a low of 4,597.62 on 12 May 2021 and now (at close of business on Friday 11 June it was 5,131.27) it is approaching a year-to-date high of 5,427.13. Morgan Stanley’s broader global index (the MSCI World Pharmaceuticals, Biotechnology and Life Sciences Index) has however already reached new historical highs, closing the month of May at 387.93.

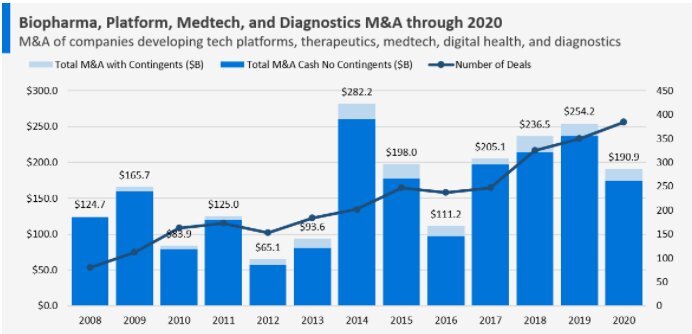

But what has put biotechnology companies back in the spotlight? There are three main catalysts for the sector. The first is the end of lockdown, or rather the easing of the coronavirus pandemic. In the last year the spread of COVID-19 has meant that the efforts of the pharmaceutical world have been focused on the virus itself and on the production of vaccines and medicines capable of containing the pandemic and curing the disease. This has led to a slowdown in FDA activity (the Food and Drug Administration is the US government body responsible for approving and regulating drugs) and a contraction in M&A operations (the graph below shows the slowdown in mergers and acquisitions).

But now the COVID crisis seems to be receding (at least to some extent) and the sector has started to unlock. This is where the other two catalysts come in – the FDA on the one hand and M&A on the other.

As well as the coronavirus pandemic, the activity of the Food and Drug Administration has been affected by the change in the US administration from Donald Trump to Joe Biden, with the consequent change of commissioner of the US government body (from Stephen Hahn to Janet Woodcock), which in the last six months has made the FDA less accommodating, reducing the potential approval rate. Now, in the second part of 2021, there could be an upturn in the drug approval rate, as witnessed by the recent green light from the FDA for the Biogen Alzheimer’s drug.

Indeed, on Monday 7 June, the Food and Drug Administration granted accelerated approval for Biogen and Eisai’s amyloid-targeting antibody aducanumab for the treatment of Alzheimer’s disease, ending a controversial and at times contentious review process. With the approval, Aduhelm, which is the drug’s brand name, becomes the first new licenced therapy for Alzheimer’s disease since 2003 and the first treatment to target the underlying pathophysiology of the disease. Researchers assessed the efficacy of Aduhelm in three different studies involving a total of 3,482 patients. The impact on the stock market was immediate, with the share price jumping 40% in a single session from 286 dollars on Friday 4 June to 396 dollars in the next session.

The final catalyst is the merger and acquisitions operations which, after the slowdown in 2020, are also showing signs of recovery. In 2019, Biotech M&A reached an equivalent value of 250 billion euros, falling to around 190 billion dollars in the following 12 months. The first part of 2021 has followed the 2020 trend, with M&A still subdued but, thanks to the easing of the coronavirus pandemic, things could start to change in the second half of the year and then accelerate in 2022.

To sum up, the biotechnology sector could be at a turning point. The pandemic and the lockdown measures have led to distortions in the market, with structural slowdowns that have created big investment opportunities. The focus is on the small and mid-cap companies that make up Medical Innovation, Pharus Sicav’s thematic sub-fund. The small and mid-cap companies are the ones that invest most in research and development and could therefore be able to produce the new drugs in the future.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.